Enhanced Credit Union Retail Banking: Remodel Your Branch for Optimal Member Growth

- Banks

- Branch Transformation

- Credit Union

Categories:

Embracing Evolution to remodel your credit union

Remodeling credit union branches is essential to competing in an evolving market. In the rapidly evolving landscape of credit union retail banking, adaptation to technological advancements is paramount for institutions to remain relevant and competitive.

However, embracing change should always be accompanied by a well-thought-out strategy. While the idea of creating a network of completely new modern branches might be enticing, it’s crucial to consider factors such as budget and operational capacity.

Remodeling existing credit union branches can offer a practical and efficient solution. This article delves into the significance of credit union and bank branch remodels and outlines three tiers of remodeling strategies:

- Refresh

- Redesign

- Reinvent

The Need for remodeling credit union branches

In an era where technology drives member expectations, many branches are lagging behind in terms of design and functionality. While they may serve their purpose to some extent, they lack the modern strategies that can optimize member experience.

Whether it’s an outdated floor plan or a lack of technological integration, the need for remodeling is evident. Even branches untouched since the 1960s are candidates for transformation, highlighting the universal need for change.

Three Tiers of Remodeling Strategies

1. Refresh: Surface-level Revival

The refresh strategy focuses on superficial changes to rejuvenate the branch’s appearance and drive member engagement. This involves minor fixes that cover up wear and tear accumulated over the years. A fresh coat of paint or wall graphics, repairing damaged surfaces, and replacing worn-out carpets are examples of these quick fixes. As a relatively simple process, refresh remodeling has minimal impact on branch operations. It’s a cost-effective way to enhance aesthetics and maintain a presentable environment.

2. Redesign: Modernization and Efficiency Enhancement

Moving up the remodeling ladder, the redesign strategy aims to address outdated elements and inefficiencies within the branch. This approach doesn’t entail a complete overhaul, but instead employs a targeted strategy to improve functionality.

For instance, replacing traditional teller lines with teller pods, incorporating Interactive Teller Machines (ITMs), or introducing tech tables with iPads can enhance member engagement and convenience. Even incorporating things like a coffee lounge, or a fireplace work wonders to create an inviting and comfortable experience.

Watch our video on Colorado Credit Union’s Branch Remodel, where our team refreshed an existing space into a new branch with new teller pod layouts, a community room, and more!

View our video on 4 Remodels for Wasatch Peaks Credit Union in Utah, we helped create a modern, refreshed and uniform look, a complete overhaul from their older traditional spaces from the 90’s.

Included in the remodels were:

- Teller Pods

- Glass walls for an open-air environment

- New Floor Plan layouts optimizing operations and members’ journeys

- Cash Recyclers

- Coin Machines

3. Reinvent: Complete Transformation for Maximum Impact

The reinvent strategy marks the most comprehensive and impactful form of branch remodeling. This approach involves a radical transformation, falling just short of entirely new branch construction. It encompasses elements from both refreshing and redesigning strategies while introducing more profound changes.

Knocking down walls to create an open, flowing layout can greatly enhance member experience. This level of remodeling also presents an opportunity to reimagine brand execution within the physical space. Incorporating technology for a superior member journey, employing member consultation rooms, and manipulating lighting for ambiance all contribute to an immersive and modern banking environment.

Adapting to Survive: The Necessity of Change

In the current landscape, embracing change is not just important; it’s essential for survival. With consumer expectations evolving rapidly, credit unions and banks must keep pace to remain competitive. Remodeling offers a tangible way to meet these demands, allowing financial institutions to offer modern, efficient, and engaging services to members.

As financial services technology continues to shape the industry, remodeling becomes a means to not only survive, but to thrive.

Taking the Step Towards Transformation

The evolution of credit union retail banking demands a proactive approach to change. While the idea of building entirely new branches may seem tempting, it’s also vital to assess the most suitable strategy based on budget, operational capacity, and member needs.

Remodeling existing branches offers a practical and efficient solution. Whether through a surface-level refresh, a targeted redesign, or a comprehensive reinvention, branch design remodeling allows financial institutions to adapt, transform, and create a banking experience that aligns with the expectations of today’s tech-savvy consumers.

If you’re ready to embark on the journey of branch transformation, contact LEVEL5 to assess your branch needs and develop a tailored strategy for a modern and member-centric banking environment. Together, we can shape the future of your retail banking and growth through strategic remodeling.

Technology and the Branch of the Future

- Banks

- Branch Transformation

- Credit Union

- Data

Categories:

Leveraging Critical Credit Union Data Components for Smart Geographic Expansion

In the ever-evolving landscape of data collection in the credit union and financial service industries, the race to capture new markets and enhance member experience has intensified. Basically, you have to keep up.

Furthermore, with the growing influence of technology, interwoven with strategy consulting, site selection, branch design, and building, this bevy of tools has become vital for financial institutions to stay competitive and thrive and meet members’ needs properly.

In this post, we will explore six crucial data components that inform the branch pro forma; as well as and aid in the geographic expansion plans of credit unions, enabling them to build the branch fit for the growth of the future.

1. Loans and Deposits Forecasting: Unearthing the Elbow Room

Understanding Market Viability

When considering expansion geographies and specific trade areas, it is essential to assess the availability of loans and deposits in that market before making a final decision on branch real estate site selection.

This crucial data component helps credit unions determine the “elbow room” or growth potential in a given area, identifying if there are still untapped opportunities or if the market is already saturated and unsuitable for expansion.

2. Competitive Analysis: Identifying Opportunities Amidst Competition

Beyond the Elbow Room

When entering a new retail banking market requires a thorough competitive analysis.

Accordingly, financial institutions must gauge the opportunities for a new entrant and assess how well they can compete against existing players. This involves understanding whether competitors dominate or outspend potential newcomers, ultimately determining if the market is viable for a new branch.

3. Consumer Overlays: Tapping into Existing Consumer Bases

Building on Existing Clientele

Another critical factor in successful geographic expansion is identifying how many existing consumers reside in the expansion geography.

A pre-built consumer base can significantly impact the success of a new branch, providing a strong foundation for growth and member engagement.

4. Demographic Tapestry Profiles: Recognizing Shifting Consumer Demographics

Mapping Consumer Demographics

Even if credit unions know their target consumers, they must ensure that these consumers reside in the expansion area.

Demographic tapestry profiles allow you to understand the overlays of the existing consumer base in potential expansion geographies. Consequently, this helps to avoid potential mismatches between target demographics and location.

5. Market Potential Indices: Measuring Consumer Behavior

Predicting Consumer Behaviors

Market Potential Indices (MPI) provide valuable insights into the likelihood of adults in a specific geographic area exhibiting purchase behaviors aligned with the banking products and services offered by the credit union.

This data component aids in assessing the market’s demand for the institution’s offerings or those they plan to introduce.

6. 4 Square Quadrant: Mapping Branch Performance and Market Potential

Visualizing Success

The 4 Square Quadrant, a critical component of the LEVEL5 Branch Market Analysis engine, provides a comprehensive reading of proposed branches in a given trade area.

By scatter-plotting the branches based on performance and market potential, financial institutions can effectively gauge which locations are likely to thrive and which ones may under-perform.

Paving the Way for the Credit Union Branch of Tomorrow

In the dynamic world of financial institutions, leveraging technology to analyze critical data components is paramount for making informed decisions regarding geographic expansion and long-term growth.

Credit Union strategy consulting, site selection, and branch design and building can be significantly enhanced with the insights drawn from loans and deposits forecasting, competitive analysis, consumer overlays, demographic tapestry profiles, market potential indices, and the 4 Square Quadrant. Armed with these data-driven tools, financial institutions can confidently build the branch of the future, positioning themselves for success in a competitive landscape.

For expert guidance and assistance in harnessing the power of these data components for your institution’s growth and expansion plans, do not hesitate to contact LEVEL5, the industry leader in strategy consulting, site selection, design, and construction for credit unions and banks.

Let us help you create the branch of tomorrow that sets new standards and meets your members needs.

Designing Your Branch Prototype: Creating a Future-Proof Banking Space

- Banks

- Branch Transformation

- Credit Union

Categories:

A space says more than a thousand words, and your credit union branch prototype says a lot. In the ever-evolving landscape of credit union retail banking, your branch serves as the physical embodiment of your institution’s identity. A well-designed branch not only attracts new members but also nurtures existing relationships. It’s a space where face-to-face interactions occur, complex transactions are handled, and solutions are provided.

In this digital age, the branch remains a critical avenue for delivering the human touch that digital channels simply cannot replicate. As you consider reinventing your brand and enhancing your member experience, one vital strategy is the creation of a new branch prototype.

The Role of a Credit Union Branch Prototype in Modern Banking

Your branch isn’t just a building; it’s a strategic asset that showcases your brand, culture, and commitment to member service. A well-executed prototype branch serves as the foundation for your entire network, ensuring consistency and efficiency across all locations.

At LEVEL5, as leaders in credit union branch design for over 20 years, we emphasize the significance of a new branch prototype. The majority of our projects center around this concept.

Identifying the Need for a Branch Prototype in a credit union

The decision to develop a retail branch prototype arises when you seek a comprehensive and uniform approach to optimizing your branch network. This extends beyond new market entries, encompassing your existing branches in need of rejuvenation.

Often, established credit unions and community banks find themselves with multiple locations that lack engagement and alignment with their brand. A prototype offers a solution, breathing new life into tired spaces and setting the stage for future growth.

The Development Process

Creating a successful branch prototype involves a meticulous development process that caters to your institution’s unique needs, goals, and brand identity. The journey begins with an in-depth Programming and Visioning phase, where you collaborate closely with key stakeholders. During this phase, you uncover critical insights into your institution’s requirements, retail strategies, influences, and brand elements.

Once this foundational knowledge is gathered, the next step is synthesis. Our skilled designers work to weave these elements into a cohesive and functional design. The resulting prototype branch includes:

- Structural outlines and preferred technology

- Thoughtfully curated design choices

- Integration of banking equipment and brand deployments

- Incorporation of iconic elements

- Attention to details like furniture style, tile selection, and carpet color

This comprehensive approach ensures that every aspect of your prototype branch aligns seamlessly with your institution’s vision.

Flexibility And Adaptability

One of the remarkable benefits of a well-designed branch prototype is its adaptability. The prototype serves as a template that can be tailored to various needs, which saves time and costs on re-designing from scratch. This adaptability extends beyond replicating the prototype in new locations. You can seamlessly translate the standard-sized floor plan into:

- Micro branches

- Standalone kiosks in smaller towns

- Adaptation for regional offices and operational centers

This flexibility ensures that your branch design components and member experiences remain aligned with your strategic goals no matter where you are meeting your members at.

Embrace the Future with Your Branch Prototype

In an ever-changing banking landscape, where technology and member expectations evolve rapidly, having a modern branch prototype ready for deployment is a forward-thinking strategy. It’s a blueprint that accommodates growth, adapts to changing market dynamics, and ensures your branch network remains a relevant and vibrant growth asset.

Embark on Your Branch Transformation Journey

The role of the branch cannot be underestimated as you contemplate your credit union or bank’s future. It’s not just a physical space; it’s a strategic touch point that connects your institution with its members. Embracing a branch prototype approach, backed by a team experienced in design and implementation, can reshape your institution’s identity, enhance member experiences, and set the stage for sustained success in the dynamic world of banking.

Don’t hesitate to reach out to our team to discuss how a new branch prototype could transform your institution. With decades of experience in implementing effective and visually stunning branch design templates, we’re ready to guide you on this exciting journey toward branch innovation and excellence.

How to Choose the Perfect Location for Your Credit Union or Bank Branch

- Banks

- Branch Transformation

- Consulting

- Credit Union

- Data

Categories:

a data-driven branch strategy approach

Selecting the ideal site for your credit union’s or bank’s next branch is a critical decision that can significantly impact your institution’s long-term success. Gone are the days of relying on intuition alone; today, financial institutions need to use data-driven strategies to make informed choices.

At LEVEL5, we understand the importance of coupling data with our Branch Site Selection services to provide well-informed, actionable recommendations. In this article, we’ll explore why it’s crucial to let the data dictate the right location in your trade area and how partnering with a developer-minded firm like LEVEL5 can lead to the best results.

Data-Informed Branch Site Selection: More Than Drawing a Circle on a Map

Simply drawing a circle around a location on a map based on gut feelings won’t guarantee the best site for your next credit union or bank branch. Accurately assessing growth markets requires a comprehensive analysis of multiple data points that leads to a quantifiable recommendation.

However, while having data pointing to a specific site is essential, it doesn’t guarantee the availability of suitable locations in that area. That’s why LEVEL5 synthesizes our data strategy with our vast real estate acquisition experience and capabilities.

Aligning Strategy with Actionable Branch Site Recommendations

Data without a clear strategy is meaningless. Paying for data analysis is only valuable if it leads to actionable insights. We combine our Site Selection services with the data obtained during our Branch Market Analysis Strategy sessions so that we only recommend prime sites which can be acquired.

This integration ensures that the locations we recommend not only meet the data criteria but also align with your defined business strategy. By fusing data and strategy, we present you with workable options that truly support your long-term growth goals.

The Benefits of a Developer-Minded Branch Network Partner

Choosing a site is about understanding how the chosen location fits into your long-term plan. That’s why we think of ourselves as developers with your overarching plans as the goal, not mere brokers. Our approach involves a thorough assessment of the geographies and available options within a given trade area.

Moreover, we overlay the Credit Union or Bank Branch Design types that best suit the specific location, directly aligning with your 10-Year Branch Pro forma developed during the Strategy phase. This approach ensures that the site chosen will indeed support your long-term objectives.

Location, Location, Data-Driven Action: Partner with LEVEL5 for the Perfect Credit Union or Bank Branch Site

Selecting the right site for your branch or headquarters is a critical process that requires more than just intuition or simple mapping. A data-driven approach, coupled with a clear strategy, is essential to making informed and actionable decisions to grow your branch network.

At LEVEL5, we bring you the expertise of a developer, not a broker, as we assess geographies, identify suitable options, and align them with your long-term goals.

Let the data guide you to an optimal site and work with a partner who understands your unique needs. Contact LEVEL5 today to ensure that your financial institution makes the best location choices for sustainable growth and success.

A Modern Playbook: Leveraging Big Data for Decision Making in Financial Institution Growth and Branch Design and Construction

- Banks

- Consulting

- Credit Union

- Data

- Services

Categories:

With LEVEL5’s 20 years of experience, we have developed a modern growth playbook that relies on big data rather than old-school intuition, providing quantifiable insights that have consistently achieved business success.

In this article, we will explore the significance of data in expanding financial institutions long-term, the limitations of intuition, and how LEVEL5’s data-driven approach can help your institution make strategic decisions with unparalleled precision.

The Power of Data

Data vs. Information

Data is the foundation, but it is the interpretation of that data that turns it into actionable information. Think of an alarm clock displaying the time—it’s data. The actionable information is that it’s time to wake up. Similarly, financial institutions need actionable information—what to do and when to do it—derived from data in order to make informed decisions.

Using Data for Strategic Branch Network Decisions

LEVEL5’s Strategic Consulting Group has a finely honed analytical process, utilizing both private and public data points. We have developed custom algorithms that provide fool-proof, data-driven facts to guide strategic decision-making. This approach ensures that expansion market decisions are not based solely on intuition, but rooted in concrete data.

Market Analysis for Credit Union & Bank Growth

When assessing new expansion markets, relying on intuition is no longer sufficient.

For example, when considering a new branch location, perhaps a specific idyllic area in the community first comes to your mind.

You might “feel” this is a prime spot for growth, but how far does this “feeling” really get you?

Sure, it may be a well-trafficked area, perhaps near a hub of retailers, but what if there are even more optimal locations in your town unbeknownst to you, spaces with even more traffic, even more of your member demographics, and with even more potential for future growth?

It pays to know!

That’s why each market decision must be backed up with careful, in-depth analysis that helps you minimize unknowns and maximize potential.

LEVEL5 has been assisting clients with market analysis for two decades. Our comprehensive approach examines state, county, metro, and trade areas to determine growth trajectories that make sense both in the present and for the next 5-10 years. The resulting reports provide clients with a 10-year branch pro forma, offering accurate visibility into how a branch will perform on a specific street corner.

By analyzing data at various levels, including state, county, metro, and trade areas, we provide actionable insights that enable informed decision-making.

De-risking Growth Decisions with Unbiased Data

The Role of Data in De-risking Decisions

Data provides clarity and reduces uncertainty when making growth decisions. It allows financial institutions to understand their “elbow room” in a given market and forecast performance accurately.

By running multiple pro formas that consider branch types, personnel, and technology fit, LEVEL5 ensures decisions are based on reliable data rather than subjective intuition.

Data Points the Way

The Power of Data-Driven Decision Making: Insight Beats Intuition

Data-driven decision making is not new. Industries such as e-commerce and sports have long embraced the power of data to enhance their strategies. Financial institutions can also harness this power to inform their branch playbook and make well-informed decisions.

By basing your decision-making on quantifiable insights rather than intuition, you set your financial institution—whether a community-owned bank or credit union—on a path toward sustainable, long-term growth.

LEVEL5’s Holistic Approach

LEVEL5’s approach to strategy and market analysis goes beyond traditional consulting engagements. We combine market analysis with site selection, ensuring that the quantifiable insights provided are actionable. Our comprehensive process involves two main components: critical inputs and outputs.

Critical Inputs:

The critical inputs for LEVEL5’s market analysis are derived from a range of data sources. These include proprietary data points exclusive to LEVEL5, as well as data points specific to the financial institution itself.

Staffing interviews provide qualitative and quantitative insights, while market segmentation analysis and trade area analysis contribute to a comprehensive understanding of the market.

Outputs:

The outputs of LEVEL5’s market analysis process provide clients with actionable information.

A 10-year pro forma offers visibility into a branch’s performance, including key factors such as loans, deposits, and return on investment.

Branch type models allow for flexibility in considering different branch types, while the staffing model helps evaluate the impact of personnel on performance.

Additionally, technology-needs assessment ensures that capital costs related to technology are considered in growth decisions.

Grow Your Financial Institution with Confidence Through a Data-Driven Strategy

In the dynamic world of financial institutions, and especially in a tough business environment like the one we’re facing today, relying solely on old-school intuition is no longer enough to stay competitive. By embracing big data and adopting a data-driven approach, financial institutions can make informed decisions and build with confidence.

LEVEL5’s expertise in utilizing data and providing actionable insights has made us a trusted partner for financial institutions looking to design and build successful branches.

By leveraging the power of data, LEVEL5 helps financial institutions navigate the evolving landscape with assurance, backed by accurate insights and strategic decision-making.

Contact LEVEL5 today to learn more about our proprietary data-driven approach and unlock the growth potential of your financial institution.

3 Reasons to LAUNCH: Alignment

- Announcements

- Banks

- Branch Transformation

- Credit Union

- Leadership

- Retail

Categories:

We Have Liftoff

LEVEL5 has officially launched our LAUNCH Program.

This program has been specifically designed for the Credit Union and Bank executive who has a clear vision for the next 3-5 years, but is struggling to execute to these goals.

In this article, we discuss the second phase of our LAUNCH Program.

Phase II: Alignment

Phase I was the Discover phase, where we got to know each other, but most importantly, discussed current and future states, with goals and objectives laid out, but also discussing what’s been getting in the way of successfully executing to these goals.

In Phase II, we discuss the Alignment of your goals to our services. You did most of the talking in Phase I, now it’s our turn.

We will take the information we discussed, and add insights. We’ll present initial data to add value to our conversations, while also laying down a firm roadmap on how to break through the roadblocks and initiate plans to help you achieve your goals.

Based on relevancy of the need, we’ll recommend paths forward relating to Market Analysis as part of our Strategy service, as well as Site Selection to ensure geographic analysis aligns with available land and buildings in your desired Trade Areas.

Technology is a key strategic component in the branch. We’ll discuss options relating to the right “Tech Fit” across your current and/or future locations.

And finally, we’ll walk you through the Design and Build phases, speaking to budgets and timelines.

When relevant, we’ll also discuss previous efforts in the form of Case Studies, or share insights into current jobs that have relevance to your scenario.

Why LAUNCH At All?

The LEVEL5 LAUNCH Program follows a methodical, yet casual approach to uncovering the critical needs of your Financial Institution. Through a series of easy discussions, our team will be able to capture your goals, but also understand what is getting in the way of you achieving them.

From there, we’ll be able to make actionable recommendations on how to execute to these goals.

To learn more about our LAUNCH Program, and to schedule your first Discover call, Contact Us today to get going.

3 Reasons to LAUNCH: Discover

- Announcements

- Banks

- Branch Transformation

- Consulting

- Credit Union

- Leadership

- Retail

- Services

Categories:

We Have Liftoff

LEVEL5 is excited to help your FI with your growth initiatives in 2023 and beyond with our LAUNCH Program.

We’ve built this phased approach to assessing and launching your growth strategy around the methodical steps aimed at uncovering the challenges getting in the way of your Credit Union or Bank achieving its objectives and goals.

Phase I: Discover

The first phase in. our LAUNCH Program is called “Discover” – when our relationship will begin with a casual conversation, no more than 30-minutes, where we simply have a chat.

In this discussion, we’ll go over our services and background – but this phase is frankly about you. We’ll want to know about your FI’s history, your place and positioning in the communities you serve, and most importantly, current state versus desired state.

Your “Current State” is where you are today – number of branches, trade areas, assets, branch type mix, and of course, your member/customer base.

Your “Desired State” is where you want to be – expansion plans, asset goals over the next 3-5 years, thoughts on branch types, hub & spoke models, as well as any M&A’s that may be in play.

From here we’ll start to discuss next steps. Most importantly, we’ll need to uncover what is getting in the way of you executing and achieving your goals. That bridge from here to there is typically full of roadblocks, but that’s where LEVEL5 comes in.

Why LAUNCH At All?

The LEVEL5 LAUNCH Program follows a methodical, yet casual approach to uncovering the critical needs of your Financial Institution. Through a series of easy discussions, our team will be able to capture your goals, but also understand what is getting in the way of you achieving them.

From there, we’ll be able to move into the other phases of the LAUNCH Program and make actionable recommendations on how to execute to these goals.

To learn more about our LAUNCH Program, and to schedule your first “Discover” call, contact us today to get going.

The Branch and Its Zones

- Banks

- Branch Transformation

- Brand Deployment

- Credit Union

Categories:

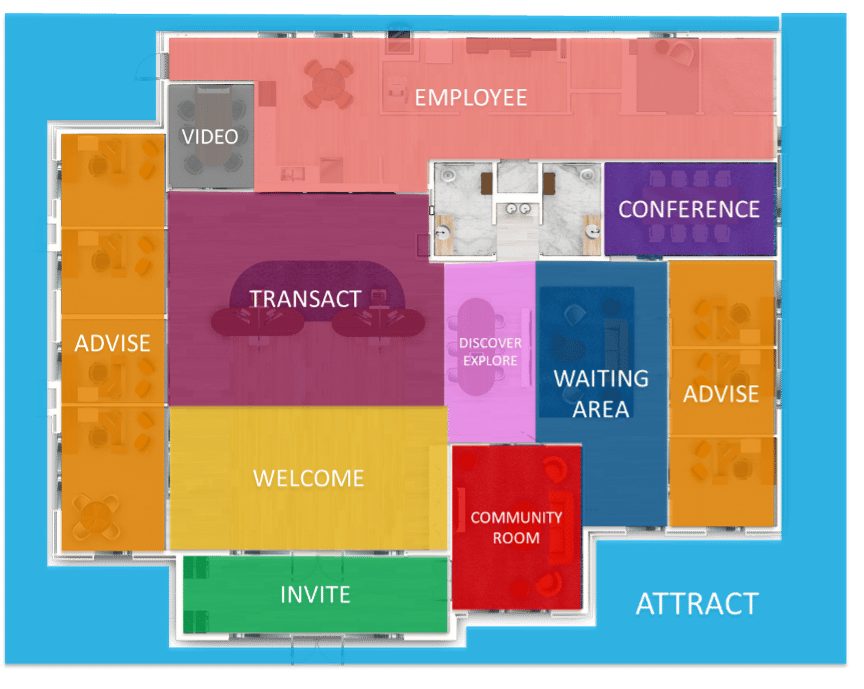

In order to ensure that your branch runs as efficiently and effectively as possible while also meeting your members’ expectations, you must consider the Branch Zones and how your floorplan is built strategically to support those zones.

This will make or break the Member Experience in your branch.

The branch zones determine the function of each section of the branch, beginning from a warm entrance, to advising, transacting, and even providing places to rest and reenergize. Every single part of the branch should be built purposefully with strategy behind the design and elements in each area. Not only that, but they should also be built to optimize member and employee directional flow according to their placement next to each other.

A correctly-zoned credit union or bank branch prototype design is vital for a positive overall Member Journey as it fosters seamless and logical progression from one space to the next.

This strategy provides your members with a nearly effortless and intuitive visit into and throughout your branch, making it easier for them to achieve their financial purposes and goals with your team and more enjoyable for them to return again and again!

Use the graphic above to reference as you read more about each zone and its purpose.

ATTRACT ZONE

This first zone is the exterior of your branch. It not only includes the building façade, but the entire property as well, which will likely include road signage, drive-thru, directional signage, and landscaping. This zone should work for you 24/7, day and night.

Key Elements:

- Road Signage

- Building Signage

- Nighttime Illumination

- Iconic Design Elements

- Entry/Exit Points

- Directional Signage

- Drive-Thru

INVITE ZONE

This zone is the first entry point of the branch, also referred to as the vestibule. This zone may include double entry doors, 24-hour ATM/ITM’s and be well-lighted for nighttime use.

Key Elements:

- Card Entry

- Lighting

- 24-hour ATM/ITM

- Branding

- Marketing Signage

- Branch Hours

- Music

WELCOME ZONE

The Welcome Zone is the first zone of the main branch. It should have key lines of site to employees and other, easily accessible zone through the branch. This is also a key point for visitors to be welcomed and directed to their needs.

Key Elements:

- Well-lighted

- Cleanliness

- Visibility/Good Lines of Sight

- Digital Signage

- Branded graphics

- Iconic feature

- Universal Banker/Greeter/Concierge

TRANSACT ZONE

Likely the anchor point of your branch, if not the traditional purpose of a customer or member’s visit. Can be the central design element, or off-set based on strategic intent.

Key Elements:

- Teller Pods

- Traditional Teller Lines

- Drive-Through Screens/Tubes

- Cash Recyclers

- ATMs

- ITMs

- Assisted Self Service

DISCOVER/EXPLORE ZONE

This is a multi-purpose zone meant for self-discovery of products and services, while also acting as an informal location for onboarding and semi-private advisory sessions.

Key Elements:

- Touchscreens (Large Format and/or Tablets)

- Digital Signage

- Tech Bar

- Consulting/Engagement Fixtures

- Marketing Collateral (Traditional or Digital)

ADVISE ZONE

A critical branch differentiator when compared to digital channels, the Advise Zone affords opportunity for in-person dialogue, counseling and advice and acts as an important component in account openings, cross-selling and thus share of wallet.

Key Elements:

- Consulting/Engagement Fixtures

- Offices

- Computers/Touchscreens

- Digital Signage

- Traditional Signage

COMMUNITY/CONFERENCE ZONE

Whether combined for smaller footprint branches, or as separate zones/rooms for larger square-foot branches, this zone acts as an opportunity for employees to huddle and meet, whether they be branch staff, or those from corporate using the rooms for miscellaneous meetings. Additionally, the room can be offered to the community as a gathering place, which can be booked independently, with it also having an “off hours” entry point for non-employees.

Key Elements:

- Digital Signage

- Two-Way Video

- Table and Chairs

- Community/Branded Wall

VIDEO ZONE

A smaller room suited for a customer or member to communicate with a “remote expert” via 2-way video.

Key Elements:

- 2-way video (camera & screen)

- Remote Expert at secondary location

- Room for several customers & Employee

- Can act as secondary office

EMPLOYEE ZONE

Also considered “back of the house” for employees, this zone will likely the critical elements for an employee’s need before and after work, as well as during lunch breaks.

Key Elements:

- Tables

- Lockers

- Quiet Room

- Refrigerator

- Kitchenette

- Tablets/Computers (personal use)

Contact LEVEL5 to enhance your Credit Union or banking member experience!

A seamless, interactive journey throughout the branch is imperative to take care of your members’ needs. They want to be comfortable with their financial institution, knowing that they can trust that their finances are in good hands, and the first step to building trust is creating a high quality, unparalleled in-person branch user experience.

Here at LEVEL5, we understand the importance of the Member Journey. It is an undeniably important concept to consider when we design and build credit union and bank branches for our clients. We have the years of experience needed to execute this strategy, enhancing your branch in your network with a modern, effective floorplan zone that speaks to your members’ needs.

Contact us today and find out how we can help you!

The LEVEL5 Construction Warranty Process Explained

- Banks

- Branch Transformation

- Brand Deployment

- Consulting

- Credit Union

Categories:

When you embark on your next credit union or bank branch construction project, you’re making an investment in your growth for years to come. That’s why you want to know that all aspects are completed correctly during the build process, so your facilities will work properly to meet your goals.

Here, we want to break down our One Year Warranty process that’s offered on new branch Design-Build projects so you can better understand how your investment receives an extra layer of protection. Remember, each individual contract is different, but here we provide a general overview.

Let’s jump in.

When Does The Warranty Begin?

Warranty start date can be determined by one or a combination of the following scenarios:

A. When the building is occupied and used by the Owner for its intended purpose. Sometimes, owners move in before the final punch list is completed, but when this occurs, the owner gets Beneficial Occupancy and is utilizing the building systems.

And/Or

B. When the final punch list is generated and then subsequently addressed and completed by the General Contractor and then when the Architect Officially Issues the Certificate of Substantial Completion (this is contingent upon the punch list being completed satisfactorily.)

If you’re unaware of what a punch list is, it’s a document created towards the completion of a project, which identifies work that has not met specifications of the contract. It is generated by a site walk-through with the LEVEL5 Superintendent, Project Manager, the Owner (You), and the Architect.

Before a final payment is issued, the General Contractor must successfully resolve all outlined tasks.

The key to warranty is when the project is substantially complete and contracts vary as to the definition of Substantial Completion. Every contract can be different. From our perspective, the key is the definition of Substantial Completion.

What Does The Warranty Cover

Speaking in the turnkey context, a warranty will essentially cover all aspects of the building’s structural quality, appearance, and function including, but not limited to:

- Design flaws by the Architect

- Mistakes made by any Contractors

- Damage to items or spaces

- Incorrect installation of equipment/malfunctioning equipment

- Promised elements that were not delivered

When orchestrating a project, we create subcontracts with Subcontractors.

Subcontractors are often referred to as Trades and are managed and directed by a General Contractor to complete specific aspects of your project. Some examples of common Subcontractors include the Electrician, Roofer, Landscaper, Window Installer, Brick Mason, etc… These subcontracts have a One Year Warranty, which runs concurrently with LEVEL5‘s overarching general contract.

The General Contractor will typically dictate to Subcontractors when their One Year Warranty on work begins. Our contracts with them allow us to require that they solve any issues resulting from their work on the project.

In addition to the One Year Warranty period, there are multiple separate Manufacturers’ Warranties running congruently from your project.

For example, the manufacturer of the roofing products, flooring materials, plumbing fixtures, HVAC systems, etc., usually provides a warranty on those materials. The warranty timeframe varies depending on the product, but works to cover factory defects if they occur.

It’s crucial to note that warranties normally don’t cover problems that are a result of neglecting prescribed maintenance. Maintenance requirements are usually specified in close– out documents at the end of a project.

The Final Step of The One Year Warranty

The final step is to ensure all final warranty items are accounted for and solved for by the 12-month mark.

This final walk-through is made 30 days before the One Year period ends and is typically attended by the Owner and our Project Manager.

If there are outstanding warranty items requiring a solution, our team quickly takes action to ensure that the proper party responsible resolves the issues as soon as possible.

Contact us to learn more details on our extensive warranty. We work meticulously so that your final building is up to world-class standards, ready to meet the needs of your institution.

national vs local general contractors

- Banks

- Branch Transformation

- Credit Union

- Retail

- Services

Categories:

When you’re a community based credit union or bank, and you’re looking ahead to your next branch construction project, the question of whether to hire a national or local general contractor is a worthwhile topic.

In one regard, you want to keep dollars local – after all, you pride yourself on being a “local” financial institution.

On the other hand, you want to keep costs down, and want a GC who can save you money, while also managing budgets and schedules.

Can you have it both ways?

In short – yes.

In this article, we’ll take a full look into the advantages of partnering with an experienced national Design-Build firm while also utilizing expert local Subcontractor talent within your institution’s local markets.

A National Design-Build Contractor Brings National strength and scale

More Experience

A national General Contractor has most likely completed a higher volume of projects, on a larger scale, compared to a local General Contractor. This means a national General Contractor has seen more and done more overall, bringing a broader range of expertise and can offer inputs from a larger team to advise on your success.

But just because a national GC may have their HQ in a different state, doesn’t mean there is not local representation. LEVEL5 always places a full-time, seasoned superintendent on each project, dedicated to working with Subcontractors and seeing it through to completion.

More Buying Power & STRONGER Relationships

A local General Contractor certainly won’t have the national buying power and broader relationships that allow a national General Contractor to pass on substantial cost savings to their client.

Because LEVEL5 has multiple projects at one time across the nation, we are able to consolidate purchases for materials, whether it be lumber, steel, even furniture.

And to be clear, LEVEL5 always works with as many local Subcontractors as possible. We have a robust national database of contractors across all trades in nearly every market. We’re also glad to work with your preferred local Subcontractors.

Due to our licensing and work history in all 48 contiguous states, we’re able to pull from a preferred list of competitive and trustworthy local Subcontractors within your area.

However, when there’s an opportunity to benefit our client with more savings and optimized delivery, our national frame allows us to tap into partners from other parts of the country accordingly.

For example, we always ensure that Subcontractors will actually have the availability to work on your project.

Sometimes the provider right in your own city may not have capacity and are unable to allocate resources a few miles down the road. With our network, we can resolve this issue ahead of time, sometimes securing an available sub who may not be local, but who is definitely experienced and available.

This sometimes translates into cost savings for you, too! In some cases, we may know a sub elsewhere who can work on your project for a substantially lower price than similar local Subcontractors are offering.

Specialized In Your Vertical

Many local General Contractors serve a wide array of industries…this isn’t inherently bad, but pertinent to note that they likely don’t have a comprehensive understanding of success for your particular vertical’s needs. They may be good at construction, but they are not EXPERTS in building a branch.

In LEVEL5‘s case, we have specifically provided our services to financial institutions nationwide for nearly 20 years.

With a committed team who has managed over $1 Billion in successful construction of branches, operations centers, and call centers, holistic, practical know-how in building for credit unions and community banks comes with the territory.

Keeping Your Subcontractor Dollars Local Has Huge Benefits

Reduce Your Costs

First off, you’re likely going to keep your costs lower by utilizing local Subcontractors.

Subcontractors near your construction site area are closer to the end of the supply chain for needed materials, equipment, and parts.

That generally means (but not always) lower prices for sourcing to your project if you were to compare against sourcing from Subcontractors who are further away from you.

Think of the costs needed for mobilizing a large backhoe, it’s going to be far cheaper moving it 10 miles down the road when compared to moving it from Florida to Texas.

LEVEL5 realizes this cost value that local Subcontractors bring, which is why as mentioned earlier, we try to hire them locally as much as possible, unless we see an opportunity where a non-local Subcontractor can benefit you more!

Be a True, Known Community Player

Beyond reducing your spending, keeping a majority of labor dollars local is a great Public Relations spotlight. You’re investing right back into your community, with the same folks who may even me your clientele.

Local workers on the job will spread the news of your soon-to-be branch. Families, friends, neighbors, word travels fast and when the general community realizes you’re hiring local Subcontractor businesses, it will only help solidify your standing as an organization truly dedicated to its people. Community members will take this to heart and it may even push them to consider opening an account with you.

Closer By, Quicker Response

If needed, local subcontractors can return quickly to your project site to resolve any issues or to coordinate and communicate with other Subcontractors since they’re right in the area nearby.

This would present obvious logistical problems if you were working with a sub from out of state or across the country.

For all our projects, we utilize only local Electrical, HVAC, and Plumbing Subcontractors specifically for this reason.

Imagine your branch’s heating system failing during mid-winter in Wisconsin…you’re going to want the familiar team within arm’s reach so that repairs can be made ASAP and operations can return to normal.

National + Local = A Win For Your Project

With the expansive reach, experience, and oversight delivered by a national General Contractor working in tandem with the local network of skilled, responsive Subcontractors, your project is set up to be completed with total success.

Contact us for your next project and get the best of both worlds.