The Branch and Its Zones

- Banks

- Branch Transformation

- Brand Deployment

- Credit Union

Categories:

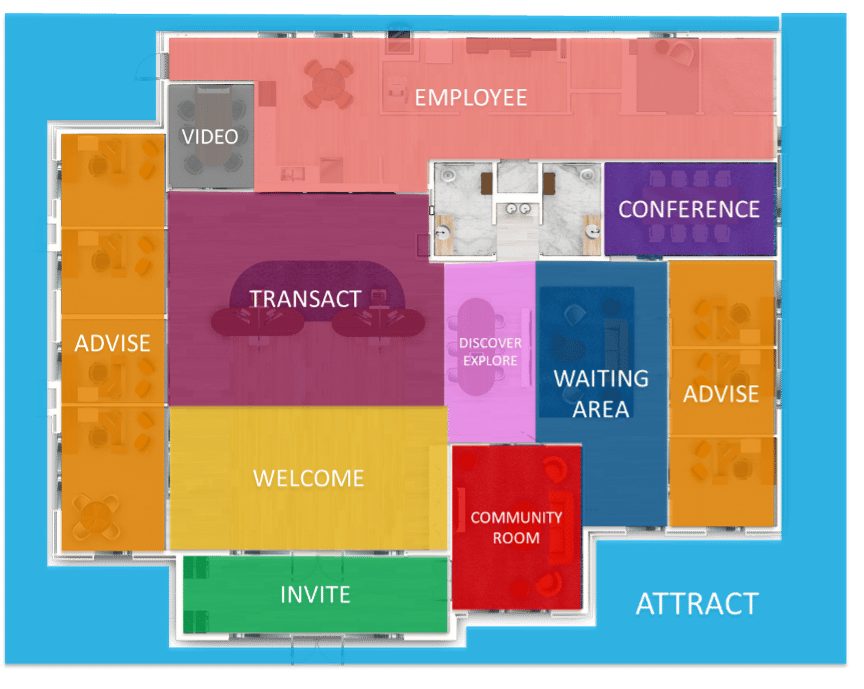

In order to ensure that your branch runs as efficiently and effectively as possible while also meeting your members’ expectations, you must consider the Branch Zones and how your floorplan is built strategically to support those zones.

This will make or break the Member Experience in your branch.

The branch zones determine the function of each section of the branch, beginning from a warm entrance, to advising, transacting, and even providing places to rest and reenergize. Every single part of the branch should be built purposefully with strategy behind the design and elements in each area. Not only that, but they should also be built to optimize member and employee directional flow according to their placement next to each other.

A correctly-zoned credit union or bank branch prototype design is vital for a positive overall Member Journey as it fosters seamless and logical progression from one space to the next.

This strategy provides your members with a nearly effortless and intuitive visit into and throughout your branch, making it easier for them to achieve their financial purposes and goals with your team and more enjoyable for them to return again and again!

Use the graphic above to reference as you read more about each zone and its purpose.

ATTRACT ZONE

This first zone is the exterior of your branch. It not only includes the building façade, but the entire property as well, which will likely include road signage, drive-thru, directional signage, and landscaping. This zone should work for you 24/7, day and night.

Key Elements:

- Road Signage

- Building Signage

- Nighttime Illumination

- Iconic Design Elements

- Entry/Exit Points

- Directional Signage

- Drive-Thru

INVITE ZONE

This zone is the first entry point of the branch, also referred to as the vestibule. This zone may include double entry doors, 24-hour ATM/ITM’s and be well-lighted for nighttime use.

Key Elements:

- Card Entry

- Lighting

- 24-hour ATM/ITM

- Branding

- Marketing Signage

- Branch Hours

- Music

WELCOME ZONE

The Welcome Zone is the first zone of the main branch. It should have key lines of site to employees and other, easily accessible zone through the branch. This is also a key point for visitors to be welcomed and directed to their needs.

Key Elements:

- Well-lighted

- Cleanliness

- Visibility/Good Lines of Sight

- Digital Signage

- Branded graphics

- Iconic feature

- Universal Banker/Greeter/Concierge

TRANSACT ZONE

Likely the anchor point of your branch, if not the traditional purpose of a customer or member’s visit. Can be the central design element, or off-set based on strategic intent.

Key Elements:

- Teller Pods

- Traditional Teller Lines

- Drive-Through Screens/Tubes

- Cash Recyclers

- ATMs

- ITMs

- Assisted Self Service

DISCOVER/EXPLORE ZONE

This is a multi-purpose zone meant for self-discovery of products and services, while also acting as an informal location for onboarding and semi-private advisory sessions.

Key Elements:

- Touchscreens (Large Format and/or Tablets)

- Digital Signage

- Tech Bar

- Consulting/Engagement Fixtures

- Marketing Collateral (Traditional or Digital)

ADVISE ZONE

A critical branch differentiator when compared to digital channels, the Advise Zone affords opportunity for in-person dialogue, counseling and advice and acts as an important component in account openings, cross-selling and thus share of wallet.

Key Elements:

- Consulting/Engagement Fixtures

- Offices

- Computers/Touchscreens

- Digital Signage

- Traditional Signage

COMMUNITY/CONFERENCE ZONE

Whether combined for smaller footprint branches, or as separate zones/rooms for larger square-foot branches, this zone acts as an opportunity for employees to huddle and meet, whether they be branch staff, or those from corporate using the rooms for miscellaneous meetings. Additionally, the room can be offered to the community as a gathering place, which can be booked independently, with it also having an “off hours” entry point for non-employees.

Key Elements:

- Digital Signage

- Two-Way Video

- Table and Chairs

- Community/Branded Wall

VIDEO ZONE

A smaller room suited for a customer or member to communicate with a “remote expert” via 2-way video.

Key Elements:

- 2-way video (camera & screen)

- Remote Expert at secondary location

- Room for several customers & Employee

- Can act as secondary office

EMPLOYEE ZONE

Also considered “back of the house” for employees, this zone will likely the critical elements for an employee’s need before and after work, as well as during lunch breaks.

Key Elements:

- Tables

- Lockers

- Quiet Room

- Refrigerator

- Kitchenette

- Tablets/Computers (personal use)

Contact LEVEL5 to enhance your Credit Union or banking member experience!

A seamless, interactive journey throughout the branch is imperative to take care of your members’ needs. They want to be comfortable with their financial institution, knowing that they can trust that their finances are in good hands, and the first step to building trust is creating a high quality, unparalleled in-person branch user experience.

Here at LEVEL5, we understand the importance of the Member Journey. It is an undeniably important concept to consider when we design and build credit union and bank branches for our clients. We have the years of experience needed to execute this strategy, enhancing your branch in your network with a modern, effective floorplan zone that speaks to your members’ needs.

Contact us today and find out how we can help you!

The LEVEL5 Construction Warranty Process Explained

- Banks

- Branch Transformation

- Brand Deployment

- Consulting

- Credit Union

Categories:

When you embark on your next credit union or bank branch construction project, you’re making an investment in your growth for years to come. That’s why you want to know that all aspects are completed correctly during the build process, so your facilities will work properly to meet your goals.

Here, we want to break down our One Year Warranty process that’s offered on new branch Design-Build projects so you can better understand how your investment receives an extra layer of protection. Remember, each individual contract is different, but here we provide a general overview.

Let’s jump in.

When Does The Warranty Begin?

Warranty start date can be determined by one or a combination of the following scenarios:

A. When the building is occupied and used by the Owner for its intended purpose. Sometimes, owners move in before the final punch list is completed, but when this occurs, the owner gets Beneficial Occupancy and is utilizing the building systems.

And/Or

B. When the final punch list is generated and then subsequently addressed and completed by the General Contractor and then when the Architect Officially Issues the Certificate of Substantial Completion (this is contingent upon the punch list being completed satisfactorily.)

If you’re unaware of what a punch list is, it’s a document created towards the completion of a project, which identifies work that has not met specifications of the contract. It is generated by a site walk-through with the LEVEL5 Superintendent, Project Manager, the Owner (You), and the Architect.

Before a final payment is issued, the General Contractor must successfully resolve all outlined tasks.

The key to warranty is when the project is substantially complete and contracts vary as to the definition of Substantial Completion. Every contract can be different. From our perspective, the key is the definition of Substantial Completion.

What Does The Warranty Cover

Speaking in the turnkey context, a warranty will essentially cover all aspects of the building’s structural quality, appearance, and function including, but not limited to:

- Design flaws by the Architect

- Mistakes made by any Contractors

- Damage to items or spaces

- Incorrect installation of equipment/malfunctioning equipment

- Promised elements that were not delivered

When orchestrating a project, we create subcontracts with Subcontractors.

Subcontractors are often referred to as Trades and are managed and directed by a General Contractor to complete specific aspects of your project. Some examples of common Subcontractors include the Electrician, Roofer, Landscaper, Window Installer, Brick Mason, etc… These subcontracts have a One Year Warranty, which runs concurrently with LEVEL5‘s overarching general contract.

The General Contractor will typically dictate to Subcontractors when their One Year Warranty on work begins. Our contracts with them allow us to require that they solve any issues resulting from their work on the project.

In addition to the One Year Warranty period, there are multiple separate Manufacturers’ Warranties running congruently from your project.

For example, the manufacturer of the roofing products, flooring materials, plumbing fixtures, HVAC systems, etc., usually provides a warranty on those materials. The warranty timeframe varies depending on the product, but works to cover factory defects if they occur.

It’s crucial to note that warranties normally don’t cover problems that are a result of neglecting prescribed maintenance. Maintenance requirements are usually specified in close– out documents at the end of a project.

The Final Step of The One Year Warranty

The final step is to ensure all final warranty items are accounted for and solved for by the 12-month mark.

This final walk-through is made 30 days before the One Year period ends and is typically attended by the Owner and our Project Manager.

If there are outstanding warranty items requiring a solution, our team quickly takes action to ensure that the proper party responsible resolves the issues as soon as possible.

Contact us to learn more details on our extensive warranty. We work meticulously so that your final building is up to world-class standards, ready to meet the needs of your institution.

Why FI Leaders Should Think Like a Developer

Just like the leader of a credit union or community bank, land developers always have growth in their sights and there are many strategies that a financial institution could benefit from to expand in an intelligent and financially advantageous way. Here’s how.

Let’s look at the big picture first; you know that your growth depends on increased loan and deposits, and a major factor of those numbers is your ability for new members to open new accounts. Branches are major avenues for creating and retaining new clients.

Having well-placed brick and mortar branches is a necessity by geo-locating the right branch near those targeted new members/customers, so you might as well do it in a way that benefits you the most, from varying angles, just like a savvy developer.

3 Ways to Optimize You real estate efforts

1. Develop a Multi-Tenant Plaza, Occupy and Fill

If you build it, they will come.

When you’re searching for a new prime piece of land, task one is to ensure it’s right for your organization’s needs. Beyond that, you can drive even more foot traffic into your place by making convenient shopping experiences surrounding it. Convenience is valued and appreciated ever more in our modern-day culture. Here’s how you can leverage that.

Small retail outlets, coffee shops, restaurants, an urgent care, nail or hair salon, you name it. You’re creating a place of value for the local community and your branch is included in this hotspot.

Prospect clientele may be drawn in by your new development, peruse shops, and realize that their banking needs can be met there as well. Another thing they can check off their “shopping” list.

This can enhance relationships with existing clients in this market as well. They may have more incentive to drop into your branch on their shopping or errand trips, opening up the floor for more discussion, deepening relationships. Perhaps after their coffee next door, they’ll remember about that new account they’ve been meaning to open.

If the idea of a plaza seems overwhelming, sublet just one part of your building to a boutique business like one of our clients did with a soda shop in Utah!

2. Extra Land Extra Value

Secure a parcel of land that’s larger than your immediate needs require. This doesn’t necessarily mean go all out and grab 20 acres more than you need, but this can be done with a purposeful and lean strategy. Remember, the developer is always thinking ahead, just as you are.

One LEVEL5 client benefitted greatly with this strategy by purchasing a 2 acre plot, then built their new, best-in-class branch on 1 of them. The property value of the empty acre then rose due to the modern branch’s proximity.

The grand finale? This client ended up selling the empty acre for more than what they had bought both acres for.

Now that’s a return on investment for the record books.

When considering site selection, always work with a team who has ample experience and resources in locating the right credit union or bank branch real estate for your needs.

3. Repurpose Your Existing Space & Scale Up Simultaneously

Developers understand the need for new space, but they also know the value of strategically making the most out of an existing space, too.

Use your goals as guideposts, then take due action.

Consider the example story of our client Hoosier Heartland State Bank’s branch transformation and operations center needs in Indiana. They desired to breathe new life into their main branch to better meet the needs of their modern, expanding customer base while also developing a new operations center to support an increase in employees.

This all needed to be done in a way that differentiated the bank as a leader in their community.

They partnered with LEVEL5, who knows bank construction inside and out, and thinks like a developer.

Their branch got an update with a new floor plan, diverging away from traditional teller lines, into a more open retail environment, giving staff a more effective way to interact with members and forge deeper relationships.

Their operations center now fits their long-term staffing needs, and the new exteriors reflected their forward-thinking culture.

Hoosier Bank’s President, Brad Monts added, “We chose LEVEL5 as our partner because of the value they bring to the complete design-build process. Few firms in the country can study markets, address headcount, procure real estate, design and construct facilities like their team.”

Furthermore, their HQ is part of a larger renovated complex, where they have sub-leased space to small business owners that not only benefit their employees, but also help revitalize their home town.

Contact us today for assistance locating the right land or updating an existing branch for your needs. We have experience helping partners get the most value and return from their property.

Hub & Spoke model

Any branch optimization and expansion strategy should have a well-laid out plan regarding Hub & Spoke.

A classic and well-known strategy within the retail sector, implementing a Hub & Spoke model has a play within your branch strategy as well.

The foundation of a Hub & Spoke strategy is born in the Market Analysis phase, where geographic assessments are analyzed and overlaid with branch types that are a fit for that market. They are then perfected in the Design phase where a branch prototype is completed, along with accompanying Kit of Part components for scalability across different branch types and markets.

Here, we’ll break down the key sequential steps to planning and executing a well-planned Hub & Spoke strategy.

Step 1 – Strategic Market Segmentation Analysis

In looking at the broader Market Segmentation Analysis, this geographic assessment is your “50,000 foot” view of expansion areas, which could be at the state or county level, or both. Within this, there will be multiple Trade Areas deemed as viable expansion opportunities.

When working with LEVEL5, the key point of differentiation between other “Real Estate Consultants” is that we only make recommendations in specific Trade Areas where viable sites are available.

The sites of consideration are then ranked in order.

If you’re looking to build multiple branches in multiple geographies over the course of a 5-year aggressive growth plan, LEVEL5 will help you plot your Trade Areas based on different and varying priorities such as growth markets, demographies, loans, deposit, build-out costs, etc.

Step 2 – Branch Type Mix

Once multiple Trade Areas have been identified across a large Market Segment, you need to start thinking about which branch types fit in which Trade Areas, while also considering adjacent trade areas and their branch types.

Choosing the right branch type in a given market can be daunting, and the wrong decision can result in an underperforming branch leaving loans and deposits unclaimed in that Trade Area.

The key branch types of consideration in a Hub & Spoke model are:

- Flagship Branch – Your primary, free-standing branch, likely offering the most services, best experience and boastful brand deployment components

- Satellite Branch – A full-service, free-standing branch, just not to the level of your Flagship

- Headquarters Branch – A full-service branch, embedded in your Headquarters location

- Storefront Branch – A full-service branch embedded in a shopping center

- Micro Branch – A smaller footprint, not offering as many services/functions, but still delivers the transactional needs of your consumers

- Branch with Regional Office – A full-service branch, located far from your headquarters, thus the need for “back office” facilitates to support that “remote” geography

Step 3 – Staffing Models

When a branch type is considered for a specific location, layering a Staffing Model is the next step.

Based on the branch type, total volume of employees can be calculated based on square footage, assumptive traffic patterns, as well as product and service mix.

Staffing specialties to consider are Universal Tellers, as well as Mortgage, Investments, etc. based on the needs of the customer/member in that area.

Step 4 – Technology Models

The final component of a Hub & Spoke model involves the technology and equipment needed to fully execute a branch type. Considerations here are ATM’s, ITM’s, Cash Recyclers, Digital Signage, among others.

Developing your Hub & spoke model

While the four steps outlined above are presented sequentially, their considerations actually should be viewed more as a variable matrix.

Knowing how all the elements intertwine is one thing, but understanding how to execute a Hub & Spoke model, specifically when the disparate parts make up a proforma to aid decisions, is an entirely different task.

Lucky for you, LEVEL5’s Strategy and Site Selection departments do this every day.

If your Bank or Credit Union is in need of a full branch assessment and right-sizing for a fully formed, well-executed Hub & Spoke retail branch model, you deserve to contact LEVEL5 today.

Crystal Ball 2022 Pt. 2 | Supply Chains & Trades Issues

- Banks

- Branch Transformation

- Brand Deployment

- Credit Union

Categories:

Welcome back, if you missed Part 1, you can access here.

Part 2 – Supply Chains & Trades Issues

While the pandemic seems to be drifting away, at least in its economic impacts, construction materials supply chain problems and availability of Subcontractors will continue to remain a challenge to credit unions and community banks looking to open a new branch in 2022 or 2023.

A critical component to executing a Branch plan is to have the right partner on your side.

Advance Planning, Advance Savings

During the past 2 years, more and more of LEVEL5’s clients have been opting for advance design and planning of multi-year, multi-branch rollout strategies for their prototype branches. We believe this is happening largely because the antidote to such an unpredictable construction landscape is predictability that translates into advanced planning with the benefit of cost savings.

So how does working with our team help you plan for the future and reduce your spending?

Establishing a supply chain means that you have a defined product to execute upon. Let’s use a branch prototype as example. Once you’ve worked with LEVEL5 to design and finalize your prototype, this means that you’ve already specified materials needed for the majority of your branches. At this point, our team can work proactively with different manufacturers, subcontractors, suppliers for furniture, equipment, fixtures and so forth.

This advanced heads-up will give our sourcing partners an upfront and predictable way of understanding allocation needs. It will in turn helps to bring down prices for you.

The Design-Build construction method allows you to make material selections based on current availabilities. We factor this in with you in the design process.

Conversely, in the Design-Bid-Build process, a stand-alone architect designer may not be as privy to current materials costs in the design stages. Not being able to account for fluctuations here can result in unexpected costs once bids are turned in.

Think of the saying “knowledge is power.” In this context, we’re talking about the knowledge of future needs. It is a power that keeps costs down for your financial institution.

As you can see, advanced design and planning of rollouts can certainly drive down cost.

Knowing Costs Now Helps You Make Better Business Planning Decisions

To your advantage, you have an annual business planning cycle that needs to be built on sturdy information.

Once your professional credit union and bank consulting is complete, you’ve decided on the prototype and strategy. Then, we supply you with an accurate price estimate on your new branch or branches.

Having an accurate estimate now takes a huge unknown out of your organization’s plans, giving you more assurance and a realistic scope of your budget. It also allows you to make effective projections and preparations for changes in personnel at varying locations.

Secure Necessary Subcontractors Amid Shortage & Strain

Subcontractor labor shortages have been an issue even before the pandemic. Think all the way back to the great recession in 2008. But now, it’s become even more strained due to the aftermath (or continued impact) of COVID-19.

Because of these circumstances, the ability of your General Contractor to secure the right kind of Subcontractors for your project will only become more difficult the longer you wait to get things started. Less time to plan ahead and communicate properly with Subcontractors on their availability can cause obvious hurdles for your goals.

This goes for both singular branch builds and multi-branch rollouts. However, we want to note that Subcontractors will be more aggressive sometimes. For example, bidding and staffing for projects that are part of an integrated/multi-location rollout will be aggressive. A one-off branch project will be much less so.

Regardless of the branch rollout volume, you can see how moving forward with long-term action now will put you in a preferable spot. It will minimize unknowns in both project staffing and pricing.

Don’t linger too long when making growth decisions – it could cost you greatly in finances, stress, and timeline goals for your bank or credit union.

Contact us now for help avoiding unnecessary expenditures and longer–than–necessary lead times. Our 20+ years of growth consulting for banks and credit unions, coupled with our nationwide relationships with manufacturers and subcontractors, Is the added muscle you need to get a well-executed project off and running.

2020 Crystal Ball: Costs Will Rise

- Branch Transformation

- Brand Deployment

- Retail

Categories:

[fusion_builder_container hundred_percent=”no” equal_height_columns=”no” menu_anchor=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=”” background_color=”” background_image=”” background_position=”center center” background_repeat=”no-repeat” fade=”no” background_parallax=”none” parallax_speed=”0.3″ video_mp4=”” video_webm=”” video_ogv=”” video_url=”” video_aspect_ratio=”16:9″ video_loop=”yes” video_mute=”yes” overlay_color=”” video_preview_image=”” border_size=”” border_color=”” border_style=”solid” padding_top=”” padding_bottom=”” padding_left=”” padding_right=””][fusion_builder_row][fusion_builder_column type=”1_1″ layout=”1_1″ background_position=”left top” background_color=”” border_size=”” border_color=”” border_style=”solid” border_position=”all” spacing=”yes” background_image=”” background_repeat=”no-repeat” padding_top=”” padding_right=”” padding_bottom=”” padding_left=”” margin_top=”0px” margin_bottom=”0px” class=”” id=”” animation_type=”” animation_speed=”0.3″ animation_direction=”left” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” center_content=”no” last=”no” min_height=”” hover_type=”none” link=””][fusion_text columns=”” column_min_width=”” column_spacing=”” rule_style=”default” rule_size=”” rule_color=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=”” animation_type=”” animation_direction=”left” animation_speed=”0.3″ animation_offset=””]

As the sun rises on a new year, so will the costs of doing business. While this is a broad statement and can cover nearly every element of your business, from staffing to operations, we’ll focus on the Design-Build aspect of things, that is, the idea of growing your Branch Network and standing up a new Main Office or Facility Building.

2020 Cost Challenges

The economy continues to be strong, though the winds of change are swirling, with many experts divided on actual direction. Regardless, interest rates are down and consumer confidence is up.

Architecture firms and Construction firms are citing steady business and forecasting growth in 2020. With this comes increases in costs. While material costs are not nearly as impacted as they were 2 years ago with tariffs on raw materials like lumber, steel and aluminum, costs are still forecasted to rise, ironically, because the industry is busy. According to Producer Price Indexes (Bureau of the Labor Statistics by the AGC), a 12-month run of 0.0% increase in material costs ended in September 2019 due to newly implemented tariffs from China.

And, when businesses are growing and forecasting growth, contractors and subcontractors also stay busy. With jobs being plentiful, bids are inching higher than industry averages, according to ConstructionDive. With skilled labor being tied to a steady flow of jobs, the unskilled labor force and shortage of a skilled labor force causes price increases due to competition and even an extension of completion times.

How Does a Retail Banker Manage Costs

Despite some cost headwinds, there are strategies that a Retail Banker can plan for and implement to manage costs across a single or multiple projects.

Prototype Design

Once an overall design is chosen for a prototypical branch, the right planning and foresight will allow this design to scale in square footage size and type. If the branch design and purpose is to remain the same across different locations, but these locations vary in total square footage, think of a balloon expanding or contrasting. The basic elements grow or shrink accordingly.

If you aim to deploy different types of branches (Hub, Spoke, Specialty, etc.), a kit of parts strategy can be implemented to lay the foundational purpose of the branch elements within, so they can then be chosen in a plug-and-play manner across different locations.

Modular Design

As an added element, design specs across multiple locations can be pre-built, with one module fitting alongside an already existing module, either for present or future use.

This strategy is particularly useful for larger spaces that are not entirely needed now, but will be ready to be built in a near-term state.

Supply Chain Management

As noted above, raw materials are expected to rise, if they already haven’t begun to do so. If your Branch Transformation strategy involves multiple sites across a protracted timeline, it may very well be beneficial to procure the raw materials all at once, to take advantage of current costs and bulk pricing.

Even if you’re only ready to break ground on one site, the additional materials can be warehoused for future use. The short term storage costs will pale in comparison to the long term cost of buying raw materials in waves over months or years.

If you’re ready to begin discussions on your Branch Transformation and/or Main Office project and price is a concern, there’s no better time than now to begin speaking with the experts.

Contact Us today today to learn more about cost savings efforts on your new branch plans.

[/fusion_text][/fusion_builder_column][/fusion_builder_row][/fusion_builder_container]

2020 Crystal Ball: The Branch Will Change

- Branch Transformation

- Brand Deployment

- Retail

Categories:

[fusion_builder_container hundred_percent=”no” equal_height_columns=”no” menu_anchor=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=”” background_color=”” background_image=”” background_position=”center center” background_repeat=”no-repeat” fade=”no” background_parallax=”none” parallax_speed=”0.3″ video_mp4=”” video_webm=”” video_ogv=”” video_url=”” video_aspect_ratio=”16:9″ video_loop=”yes” video_mute=”yes” overlay_color=”” video_preview_image=”” border_size=”” border_color=”” border_style=”solid” padding_top=”” padding_bottom=”” padding_left=”” padding_right=””][fusion_builder_row][fusion_builder_column type=”1_1″ layout=”1_1″ background_position=”left top” background_color=”” border_size=”” border_color=”” border_style=”solid” border_position=”all” spacing=”yes” background_image=”” background_repeat=”no-repeat” padding_top=”” padding_right=”” padding_bottom=”” padding_left=”” margin_top=”0px” margin_bottom=”0px” class=”” id=”” animation_type=”” animation_speed=”0.3″ animation_direction=”left” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” center_content=”no” last=”true” min_height=”” hover_type=”none” link=”” first=”true”][fusion_text columns=”” column_min_width=”” column_spacing=”” rule_style=”default” rule_size=”” rule_color=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=”” animation_type=”” animation_direction=”left” animation_speed=”0.3″ animation_offset=””]

The branch is changing. You’ve noticed, but the bigger question is, have you done anything about it. Whether it be the Big Boys who dominate the headlines or the buzz-worthy smaller retail Banks or Credit Unions who are finding new, refreshing ways to utilize their existing branch network, it’s not a matter of if you change, but when.

Transactional

The traditional purpose of the branch was to provide convenience for a transactional minded customer with a need to do something. While transactions still likely provide the main reason for the branch to exist and why customers stop by in the first place, transactions have moved into more convenient spaces such as online and mobile, so as a result, some industry leading institutions have played around with and are proving that the branch can be more than just a transaction house.

Advisory

The branch represents a tremendous opportunity to simply speak and advise your customers. Regardless of the why, there surely must be an opportunity to engage, speak and counsel (not sell) customers about the right product mix, depending on their stage in life.

Customers who are considered “banked” and have several products still need counsel. They may need more products and they may very well need to swap products based on their life-stage. Customers change, go through ups, downs and different phases, each with different needs. Let the branch be that gathering place to foster these discussions.

Format Fluid

Your branch and your overall network is not McDonald’s. A foundational principle of any fast food chain is to be exactly the same, across the board, across the country. Customers expect to walk in and be presented with the same basic layout, the same decor and absolutely the same menu whether they are in Baltimore or Bar Harbor.

- Mixed Use – While not new and maybe not for everybody, Capital One has gotten a lot of attention for their Capital One Cafe’s. While perhaps more buzz-worthy than practical, it has garnered a lot of attention and is at least attempting to answer the question of how to evolve the branch.

- Hub and Spoke – A known branch model utilized to great effect by retailers across the board. In banking, you would look to operate a hub (or a flagship) branch that is the epitome of who you want to be, from branding elements, technology and particularly an array of services. The spoke model will be smaller scaled satellite branches. They will still be very much your branches, but offer less services with different staffing models. Those customers seeking services not offered at a spoke location would be advised to visit other full-service hub branches, or better yet, be offered the ability to speak with a remote expert.

- Specialty Sites – As an off-shoot of the Hub and Spoke model, a Specialty Site would be a standalone site focussing on one exclusive function. Think a location outfitted only with Mortgage Specialists or Financial Advisors.

Universal Banker

The Universal Banker ushered in an era where the traditional Teller and traditional Personal Banker morphed into one full-service associate. Gone are the days of a branch having an abundance of staff who or are really good at one thing. The Universal Banker model accounts for the overall personnel contraction in a typically transaction-oriented branch, making way for someone who can do a lot of things, maybe just not as well as the specialist.

Regardless, the dawn of the Universal Banker 2.0 is upon us. With in-branch transactions continuing to decline and the branch’s purpose beginning to morph into a more experiential center, the new Universal Banker will now also have to wear an “Advisory” hat. Ironically, it is the Millennials (Generation Y) and the new Generation Z customers, while incredibly proficient with online and mobile tools, being the ones who need the most financial advice, even something as seemingly simple as opening a new Savings Account will prove to be a critical reason for the branch.

If you’d like to learn more about branch trends in the industry and how you can begin to lay the right future foundation, Contact Us today to speak to a specialist.

[/fusion_text][/fusion_builder_column][/fusion_builder_row][/fusion_builder_container]

Video: NECU Hooked On New Branch Concept

- Branch Transformation

- Brand Deployment

- Credit Union

- Portfolio

Categories:

CEO Tim Collia Shares NECU’s Hooksett, NH Branch Story

What Retail Bankers Can Learn From The Recent Target News

- Branch Transformation

- Brand Deployment

- Retail

- Training

Categories:

Target’s “Modernization” is Basically “Branch Transformation” for Big Box

In news that broke last week (https://www.insider.com/targets-modernization-plan-has-backfired-workers-say-2019-10), it seems that many Target employees have not been happy about the new “Modernization” effort that the Big Box retailer has been implementing.

This is newsworthy for Retail Bankers who are struggling through or at least considering a Branch Transformation effort of their own. Nobody ever said that transformation is easy, but it’s often the right thing. And doing the right thing can be challenging, to say the least.

You see, Target’s “Modernization” effort is really a Big Box version of retail banking’s “Branch Transformation” efforts with two main anchor points: 1) a new design model, which, 2) allows for a better environment in which employees are better suited to sell (or at least consult).

If you’ve spoken to us lately, or attended our recent speaking engagements, LEVEL5 has been actively discussing Target’s revitalization – an effort to bring better shopping experiences to their customers. While the Business Insider article primarily talks about employee complaints regarding backrooms and stocking procedures, the takeaways here for Retail Bankers should be this:

Change Is Disruptive

People just don’t like change. You can only move someone’s cheese so much before they revolt. If you read between the lines and understand what Target is trying to do, it actually makes sense. Trader Joes, for example, has utilized their store staff as both stockers and sellers for a long time. It has been well documented how these “universal associates” are omni-present, not only making sure the shelves are full of product and aesthetically pleasing, but also making sure to answer any questions shoppers may have.

Training Guides Only Get You Halfway There

It does make sense to have a training guide, documenting the reasoning, end goal, and tactical elements to get Target through “Modernization.” But training guides are just that – guides. It’s black ink on white paper and undoubtedly some pretty pictures. At the time of this article, LEVEL5 has not seen the guide, but we know a thing or two about transforming branches and have developed our fair share of guides, but they are meant to be a visual aid to the real transitioning element – training.

People Training Completes the Mission

If you were given the definitive guide to Fly Fishing, had the best gear in the world and put in the middle of the the most productive stream running through Yellowstone, but you were not trained on casting, tying knots, or setting the hook, how many trout do you think you’d catch?

Being shown how to do something in a real world setting is key. Not only does it allow the tips to be put in action, but you can iron out the wrinkles with “practice makes perfect,” and allay any fears about the unknown.

We have executed countless training sessions with our PLACES! program, that not only speak to a Branch Transformation project including Universal Tellers, but also teach a branch staff how to effectively and accurately utilize new cash equipment, even the likes of Digital Signage.

I have no doubt that in the coming months, Target will figure this out. The new “Modernization” will be spoken of highly with better sales and happier employees (and customers) a part of it.

But change is tough and it needs to be handled delicately. If you’d like to learn more about the LEVEL5 PLACES! training program, contact us today.

3 Retail Stores That Began As Online Only Companies

- Branch Transformation

- Brand Deployment

- Retail

Categories:

What Retail Bankers Can Learn from Warby Parker, Casper and Apple.

As a follow up to last week’s blog article entitled “The Branch is Dead, Long Live the Branch!” we thought we would flip the script here and look at three companies who started as an online only company, but subsequently took retail by storm and opened up not only successful brick and mortar locations, but played a large part in reinventing retail for the modern age.

These are great companies and their retail strategy has one thing in common – a great customer experience.

Founded in 2010, out of the Wharton School of the University of Pennsylvania, Warby Parker took the idea (and challenge) of selling fashionable eyewear at reasonable prices directly to consumers via a company-owned website.

The online model proved successful as they allowed customers to “try before you buy” – a classic brick and mortar strategy, by allowing customers to pick up to five styles, which are then shipped directly for trying on in the comfort of their own home.

Migration to Retail

Within three years, Warby Parker began opening up “showrooms” as a compliment to their online presence. Customers could now walk through their stores and browse through the displays, fashioned after library stacks, that carry multitudes of frames for men, women and children in both eyeglass and sunglass styles.

The Lesson For Retail Bankers

While born online, the company quickly realized that the retail worlds of online versus brick and mortar were not mutually exclusive, but rather complimentary. This is called omni-channel; where these two entities work together, seamlessly. In banking, Omni-Channel is a three-pronged entity, with Mobile Banking, Online Banking and Brick and Mortar Retail Banking ideally working in unison.

Additionally, the customer experience is paramount. Just as Warby Parker developed the “try before you buy” for online purchases; they continued this type of anchor strategy in the brick and mortar sites. The retail design, however, doesn’t feel sterile like a LensCrafters or traditional optical store. It is very much a retail-first design.

The staff are trendy. They wear the product and encourage browsing. You can spend all the time you want, and even take advantage of their photo booth, to not only take a photo of yourself with a frame of choice, but of course to take that photo and post it to social media (because of course).

Founded five years ago and likely the most well-known of the new breed of online mattress retailers, Casper sells foam mattresses and promises the best sleep of your life. The crux of their online selling process was a “100-day return policy” – basically a “try before you buy” variation of traditional retail. This no-risk strategy proved successful, especially for a product that traditionally sold through brick and mortar where prospective patrons jump from bed to bed and pretend to sleep in 30-second increments.

Migration to Retail

After a wild online ride, the company began experimenting with pop-up stores before rolling out permanent locations in major U.S. markets. The pop-up stores was a very interesting strategy, almost their own version of “try before you buy,” but in this case, they were “trying” out the market before “buying” in on an expansive and expensive retail rollout.

The Lesson for Retail Bankers

In retail, the traditional “try before you buy” has returned and is likely the experience anchor for those looking for a better night sleep. The company, however, didn’t just launch locations to operate like traditional mattress stores. Products are sold in low-pressure environments (the opposite of traditional mattress stores) and offer customers the opportunity to discover how these modern mattresses are made. This is not only enhancing the experiential side of the store, but it also goes a long way to for building the brand and solidifying the mystique of the product.

This little fruit company out of Silicon Valley, believe it or not, used to sell its products exclusively online. Back when the Apple Computer was more of a boutique product for the “artistic” crowd and Apple vs. Microsoft was the new Cold War, CEO Steve Jobs was looking for a way to expand its customer touch points and grow the brand – and sales along with it.

Migration to Retail

In 2001, the first Apple stores opened after experimenting for years with “shop in shop” concepts that ultimately did not prove fruitful. Most analysts believed the concept would fail, but they were immediately successful. Now, within the retail worlds, Apple Stores are the gold standard in not only sales per square foot, but in how to execute retail when online sales have dominated to the point where entire malls are closing.

The Lesson for Retail Bankers

There are many reasons and tons of articles written as to why the Apple Stores do so well. When looking at this through a Banker’s lens, we’ll focus on three factors.

Discover Products – It’s hard to imagine, but back in 2001, there were no iPhones, iPads, or Apple Watches. The stores acted as showcase vehicles for the Macintosh and the software therein. The open space and clean product displays allowed no-pressure browsing with staff their to answer questions when needed.

Demystify Products – For those who did not grow up with the original Apple Computers and/or early Mac computers, they were intimidating. 2001 was a PC (Microsoft) dominated world where it was just difficult to convince people to make the switch. While ad campaigns spoke about how seamless and easy to use Apple products were, it still did not translate into sales.

Enter the Apple Store and let’s “try before you buy.” The stores gave wary customers the opportunity to see how easy it was to plug in a camera and unload pictures, how quickly printers were added (no searching for drivers), and ultimately, how intuitive the computer’s operating system truly was.

Genius Bar – The kicker for the Apple Store was the concept of the Genius Bar. These “Universal” employees are not only there to act as technical support, but first and foremost are there to help onboard you as a new Apple customer, or at least as a new product user. They do this by offering classes or individual guidance on how to best use the product and take advantage of the key features that you, as the customer, need to know.

As a Retail Banker, of course it’s important to pay attention to the industry in which we operate, but there are valuable lessons to be learned and case studies to study for retail in general.

If you’d like to learn more about industry trends and how critical retail strategies can be adopted into your Branch Transformation strategy, the experts at LEVEL5 are here to help.