Data Points the Way

- Branch Transformation

- Credit Union

- Data

- Retail

Categories:

Using data to make informed decisions is nothing new. We’ve seen (or at least heard) the stories of mega e-commerce platforms that know what and precisely when to deliver us ads on things we didn’t even know we needed. Sports leagues use data to determine the value and output of a player beyond what a scout can see with the naked eye and thirty years of industry experience.

When it comes to informing your Branch Playbook (download here), and determining the right methodologies and decision, you need to have the right access to data (and likely the right partner).

LEVEL5’s approach to Strategy and Market Analysis goes beyond the traditional “consulting” engagement of other firms. Firstly, Market Analysis and the data does not live unto itself, we pair it with Site Selection.

While traditional firms will tell you a market area is viable, we take the data and hand it off to our Site Selection department to determine actionable properties. What good is data pointing to a broad section of a map if there is nothing actionable.

To further understand how LEVEL5 does Market Analysis, we have broken out the data components into two broad categories, with four sub-sets in each.

The first four components of our Market Analysis represent the critical INPUTS that fuel our proprietary algorithms.

- Data Points – We begin by feeding the data engine with proprietary data points exclusive to LEVEL5, as well as data points exclusive to you, the Financial Institution

- Staffing Interviews – Our Strategy team conducts a series of staff interviews, both qualitative and quantitative, which are then gathered and computed into the overall input engine

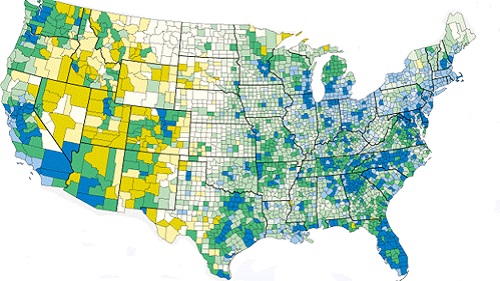

- Market Segmentation Analysis – Geographic assessments are conducted over a defined area to include currently existing footprints and growth areas, which include competitive analysis, current consumer overlays, population densities and growth trajectories, demographics and product propensities

- Trade Area Analysis – The final layer is a further drill-down at the geographic level, determining a several square block radii with viable, actionable properties

The second phase of a data-rooted Market Analysis effort is the OUTPUTS.

- 10 Year Proforma – LEVEL5 delivers a 10-year proforma on a specific branch’s performance over a 10 year period with several variable factors, giving you visibility into the break-even point, loans, deposits, and Return on Investment (ROI)

- Branch Type Model – One of the key variables to the 10 Year Proforma is branch type, with the modeling allowing for plug and play entries for free standing, storefront, and micro branch types, among others

- 10 Year Staffing Model – Staffing, and their inherent costs greatly impact the model of a branch’s performance, with entries allowed for number of staff and staff types (salaries/costs)

- Technology Needs Assessment – Technology, whether it be banking equipment and/or digital signage are an important capital cost consideration into your overall branch growth decisions

If you’d like to learn more about how LEVEL5 approaches data differently, and can give you the visibility into your growth potential and help you de-risk decisions, Contact Us today.