In the News: Chasing Chase

- Banks

- Branch Transformation

- Consulting

- Retail

Categories:

With so much being written over the years about the demise of the branch, especially in the wake of the pandemic and the rise of digital, it’s interesting to note the recently released article from The Financial Brand relating to the retail strategy revealed by Chase.

Among the click-bait worthy headlines such as digital first darlings, FinTech disruptors and industry pundits standing on their soap box eulogizing the branch and its prominence from a by-gone era, there is a level-headedness in analyzing what Chase is doing with their branch strategy over the past several years.

At LEVEL5, we work with community banks and credit unions each day developing and executing growth strategies and inevitably, these strategy sessions always hold discussions relating to the Big Banks – BofA, Chase, Wells Fargo and Citi.

There are two sides of the coin when watching what the Big Banks are doing – they are often (way) ahead of the curve when it comes to innovation, spend, resources and strategy. This can be a blessing and a curse. On one hand, they have the financial prowess and horse power to be a first mover. On the flip side, community banks and credit unions can sit and wait to see if those strategy work or now, and can extrapolate their own strategies thereafter.

When it comes to analyzing Chase’s retail branch strategy, there are some interesting lessons to be learned, particularly of note is their effort in “expanding their branch network.”

BANKING RELATIONSHIPS BEGIN AT THE BRANCH

Chase continues to innovate and offer a wide array of products, but the branch acts as an important anchor. Not only do most new relationships stem from the branch, but the branch purpose itself is morphing away from transactional and more toward advisory. This strategy is not only stated by Chase, but also recently corroborated by BAI in their recent “From branch to engagement center” article.

IT’S NOT ABOUT BRANCH REDUCTION, IT’S ABOUT BRANCH OPTIMIZATION

But it’s not just strategic lip service – the numbers support this as well. In 2017, Chase had approximately 5,150 branches across ~25 states, serving 61% of the population.

At the close of 2021, Chase’s retail branch strategy had ~4,800 branches, but covered the entirely of the lower 48 states, serving 79% of the population.

Don’t let the fewer number of total branches fool you you here – these were not out and out closures, they were consolidations, or branch optimization plans in effect, all the while, Chase was expanding, aggressively entering 300 new markets with 500 new branches, and saturating high value markets such as Boston, Philadelphia and D.C.

WHAT CAN YOU LEARN FROM THE CHASE BRANCH STRATEGY

Your FI is never going to be Chase. You’ll never outspend them, never spend as much on innovation, and never will offer as many products and services. You shouldn’t try to be them – but you sure can learn from them.

Regarding the branch, the lesson here is this: the branch is important – as important as it ever has been. It is your living billboard, an anchor in the community, and it drives new acquisitions.

The numbers game here when it comes to your branch network is not about how many, but how many in the right trade areas. Branches acts as an anchor in a given trade area, but that serviceable trade area’s geography may be bigger than what it was five years ago. Right sizing your branch network is key, but you need to optimize your branch network for the right amount of coverage, to serve your customers or members in and around where they live and work.

If the question of your branch network and the best path to optimization comes up a little too often in your strategy meetings, it’s time you reached out to LEVEL5. Our Strategy team analyzes branch networks and expansion geographies every day for community banks and credit unions across the country.

Act On Your Branch Growth Data Plan Before It’s Too Late!

- Banks

- Branch Transformation

- Consulting

- Credit Union

Categories:

When you go to the grocery store, and you see those ripe, crisp apples at their peak of freshness, you buy a bunch with every intention to consume them over the next day or so.

You put them in a bowl, on the counter, but if they go unattended, they begin to stale, go past their peak freshness, eventually going rotten.

In the world of banking, data and apples are one in the same. When delivered they are fresh. If left alone, they begin to stale with each passing day.

If you are a banking executive looking to grow and you are given fresh data, do you intend to do something with it, or will you just watch it rot?

When you hire a firm like LEVEL5 to assess your current and potential growth markets, you are given irrefutable data points and a 10-year proforma back-tested at 96% accuracy.

When looking to de-risk decisions, you can’t really have more confidence in the black and white, binary numbers to help support your decisions. But that data has a shelf life.

Strike the iron is while it’s still hot. Otherwise, you may miss out on real growth potential because as time ticks on, your data becomes stale, all the while, your competition will likely be making their moves.

Let’s say you receive the data and you don’t act on it for 6 months…that’s 6 months you could’ve been making progress, now lost.

Can your institution really afford to be behind for so long?

To illustrate the real implications of inactivity, we’re highlighting some vital junctures where taking steps soon on your fresh credit union and community bank consulting analytics can have a huge impact on your future.

3 Ways Current & Valid Data Assist Your Overall Growth

Change is the only constant, and how you fare rests on the ability to adapt accordingly.

That goes for branch networks too, one of your major avenues for gaining and maintaining the desired clientele.

Visualize your branch network as an ever-adapting entity, acclimating to the winds of change in market viability and customer demographics. You need to play this strategy correctly and decisively to win out.

In this state of flux, accurate analysis for fruitful future steps can certainly be made, but lingering on current quality data longer and longer places your organization further and further behind in making highly effective moves for your network’s viability.

There are 3 pivotal ways to optimize your network, but acting on your current data analysis is highly time sensitive in order to reap the rewards:

1 – Opening New Branches In The Right Areas

With accurate market and demographic analysis aligned with your specific goals, you understand the logic and purpose behind opening up new branches in high-quality locations. You don’t want to let solid direction pass you by here, as you’ll be missing out on prime locations that will be building up your clientele portfolio and holdings. Worse yet, a savvy competitor may beat you to saturating a market before you can.

Watch our video on Northeast Credit Union where we helped them grow into new places with informed market analysis.

2 – Closing Underperforming Branches

Branches that are repeatedly in the negative need to be closed and waiting too long means they’ll keep pulling valuable resources from your organization, resources that could be reutilized for growth.

Don’t worry, closing a branch is not the end of the world, in fact, it’s just par for the course. Similar to retail environments, this is just part of the evolution. Their absence can be made up for in spades with your new locations that are prime for future performance.

Do you act soon and save resources based on your valid data? Or do you wait to see what happens while running a real risk of detriment to your institution?

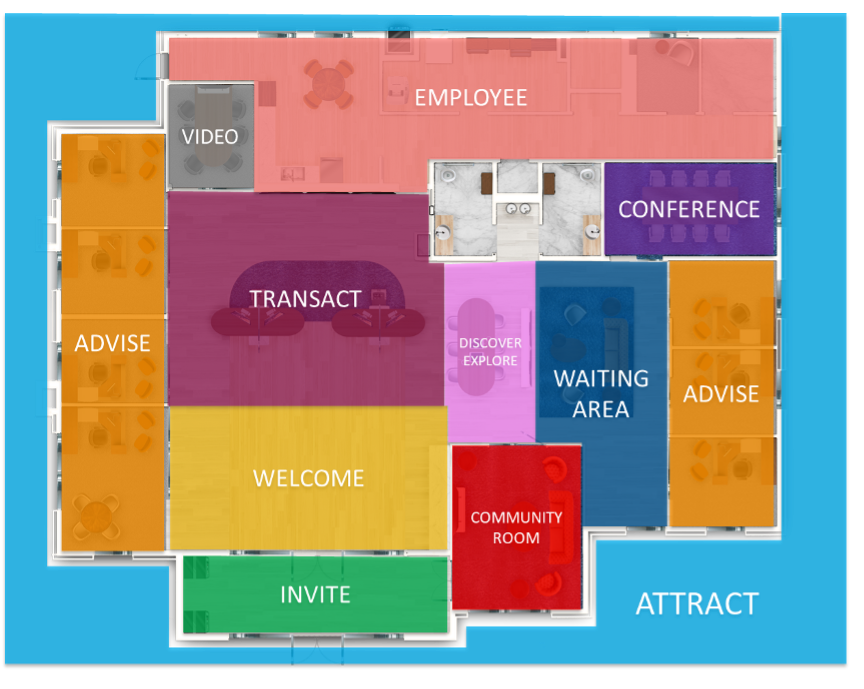

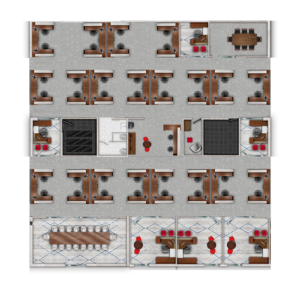

3 – Crafting Your New Branch Prototype

Your prototype works on so many levels to drive your institution into the future and holding back in its implementation sets you back even further.

A world-class prototype design accounts for everything needed to make a success including, but not limited to:

- A floor plan to facilitate employee and member interaction

- A modern appearance that solidifies you as a leader in your market

- Branding consistent with your culture and values

- An easily repeatable and malleable design for effective, rapid deployment

When you meticulously create a new branch prototype, you’re laying the foundation for attracting new members and offering excellent quality experiences for years to come. This design is carefully crafted and tailored meet the needs of your clientele’s unique demographics as well as to accommodate for the future of financial institution needs.

Consider the following if you’re hesitant to put your prototype into action:

Why go through all that upfront work creating the next generation of your institution, just to never use it?

What optimal land in the market will you place your new state-of-the-art branch prototype on if it’s already been gobbled up by your competitor?

It’s undeniably important to start rolling out the new face and space of your institution before it becomes just an idea lost to time. Both your clientele and stakeholders will greatly value the exciting new look, feel, and functionality of your newly-built or updated branches.

Don’t Let Success Pass By Your Organization

You’re truly doing yourself a disservice by waiting too long to act on quality data, plain and simple.

LEVEL5 visualizes Actionable Data as one of our 5 Elements of a Branch Transformation Playbook and we dissect your data to purposefully point you in the right direction for meaningful, lasting expansion through branch optimization.

Contact our team today for a 10-year pro-forma based on your performance metrics so you can make the most of your institution’s time.

The clock is ticking…

The Network Effect

- Banks

- Branch Transformation

- Consulting

- Credit Union

- Data

- Retail

Categories:

Have you ever visited a new city and find yourself needing a pick-me-up that only a good cup of coffee will satisfy? As tempting as a local cafe can be, they are an unknown and you don’t want to take a chance and risk a good cup of coffee on a bad mom and pop shop. Luckily, you know they’ll be a Starbucks nearby. Heck, there’s likely several of them nearby. Even if it’s not your favorite cup of coffee, it’s a familiar place and you know exactly what you’ll be getting.

Familiarity and consistency may be at the heart of why franchises exist, but there’s more to the story – especially when considering the economic factors of a high concentration of locations for a specific business.

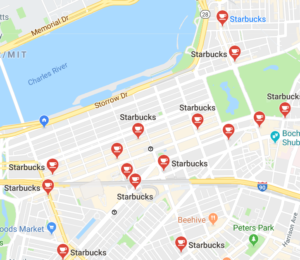

The reason you’re seeing so many Starbucks around town, and sometimes even across the street from one another, is not because they are doing you a favor and having so many locations for your convenience. Those stores are making money. And making even MORE money by the sheer fact that there are so many concentrated within a geographic region.

According to Investopedia, the “Network Effect” is “a phenomenon whereby increased numbers of people or participants improve the value of a good or service.” Translating this into retail locations, there is an increase in overall store performance by the sheer fact that there are other stores nearby.

To put this in simple economic terms, if a specific trade area has 4 Starbucks each earning $800,000 per year. The fifth location in this Trade Area will not only likely earn that $800,000 average, but because of the concentration of locations (the Network Effect), all five Starbucks locations can expect a X% lift across the board.

You can easily translate this retail strategy to your Branch Network.

If you have a good saturation of branches around a city, you are not only providing retail location conveniences to those living in that market, you will be gaining market share, share of wallet, and pinching your competitors.

Doing this even more so by accurately saturating a market with locations not only accomplishes the above, but your overall revenues and profits across the board will benefit from the Network Effect.

Now, this all sounds well and good when you talk about it in theory. The key here, however, will be execution. If you scatter branches arbitrarily around a market in efforts to achieve The Network Effect, you might not like the results. It is imperative that you do your data homework before executing this plan, or, better yet, work with a partner who specializes in interpreting data to produce the most effective strategy.

Once you’ve gathered the data, interpreted it, and created a strategy for your branch network, it’s time to execute. Not executed hesitantly, one branch at a time, to test the waters. The Network Effect can’t take place unless the network (concentration) is there. Entering one market strong with a few branches will yield better results and more loans and deposits than entering a couple different markets with individual branches.

Contact LEVEL5 today to learn more about our Strategy and Market Analysis work, which can help you find the right location, and determine the right amount of branches in a market to help you achieve the Network Effect.

Hub & Spoke model

Any branch optimization and expansion strategy should have a well-laid out plan regarding Hub & Spoke.

A classic and well-known strategy within the retail sector, implementing a Hub & Spoke model has a play within your branch strategy as well.

The foundation of a Hub & Spoke strategy is born in the Market Analysis phase, where geographic assessments are analyzed and overlaid with branch types that are a fit for that market. They are then perfected in the Design phase where a branch prototype is completed, along with accompanying Kit of Part components for scalability across different branch types and markets.

Here, we’ll break down the key sequential steps to planning and executing a well-planned Hub & Spoke strategy.

Step 1 – Strategic Market Segmentation Analysis

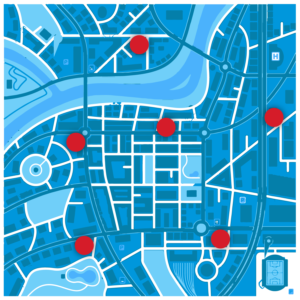

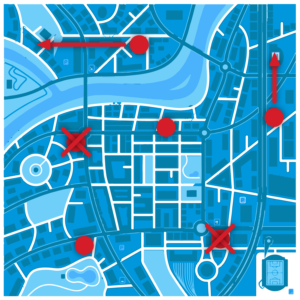

In looking at the broader Market Segmentation Analysis, this geographic assessment is your “50,000 foot” view of expansion areas, which could be at the state or county level, or both. Within this, there will be multiple Trade Areas deemed as viable expansion opportunities.

When working with LEVEL5, the key point of differentiation between other “Real Estate Consultants” is that we only make recommendations in specific Trade Areas where viable sites are available.

The sites of consideration are then ranked in order.

If you’re looking to build multiple branches in multiple geographies over the course of a 5-year aggressive growth plan, LEVEL5 will help you plot your Trade Areas based on different and varying priorities such as growth markets, demographies, loans, deposit, build-out costs, etc.

Step 2 – Branch Type Mix

Once multiple Trade Areas have been identified across a large Market Segment, you need to start thinking about which branch types fit in which Trade Areas, while also considering adjacent trade areas and their branch types.

Choosing the right branch type in a given market can be daunting, and the wrong decision can result in an underperforming branch leaving loans and deposits unclaimed in that Trade Area.

The key branch types of consideration in a Hub & Spoke model are:

- Flagship Branch – Your primary, free-standing branch, likely offering the most services, best experience and boastful brand deployment components

- Satellite Branch – A full-service, free-standing branch, just not to the level of your Flagship

- Headquarters Branch – A full-service branch, embedded in your Headquarters location

- Storefront Branch – A full-service branch embedded in a shopping center

- Micro Branch – A smaller footprint, not offering as many services/functions, but still delivers the transactional needs of your consumers

- Branch with Regional Office – A full-service branch, located far from your headquarters, thus the need for “back office” facilitates to support that “remote” geography

Step 3 – Staffing Models

When a branch type is considered for a specific location, layering a Staffing Model is the next step.

Based on the branch type, total volume of employees can be calculated based on square footage, assumptive traffic patterns, as well as product and service mix.

Staffing specialties to consider are Universal Tellers, as well as Mortgage, Investments, etc. based on the needs of the customer/member in that area.

Step 4 – Technology Models

The final component of a Hub & Spoke model involves the technology and equipment needed to fully execute a branch type. Considerations here are ATM’s, ITM’s, Cash Recyclers, Digital Signage, among others.

Developing your Hub & spoke model

While the four steps outlined above are presented sequentially, their considerations actually should be viewed more as a variable matrix.

Knowing how all the elements intertwine is one thing, but understanding how to execute a Hub & Spoke model, specifically when the disparate parts make up a proforma to aid decisions, is an entirely different task.

Lucky for you, LEVEL5’s Strategy and Site Selection departments do this every day.

If your Bank or Credit Union is in need of a full branch assessment and right-sizing for a fully formed, well-executed Hub & Spoke retail branch model, you deserve to contact LEVEL5 today.

Entering a new market

- Banks

- Branch Transformation

- Consulting

- Credit Union

- Data

- Services

Categories:

When assessing growth plans, and following the methodologies outlined in our recent Branch Playbook, you should have a clear understanding of how important data is when making market expansion decisions.

A proper Branch Playbook dives deeper into the geographic components that make up Market Analysis.

Data de-risks growth decisions, and is a critical element of expanding into a new market.

Enacting growth strategies by opening branches in a new market is not as simple as pointing to a map and building a branch. The days of building a new branch in a “busy” area of town just doesn’t cut it.

The right data not only informs these decisions, but gets you beyond generalities and into the specifics you and your Board need to greenlight projects and get you on the right growth path.

When it comes to data, LEVEL5 calculates and delivers an in-depth proforma that reviews variable data points across a 10-year horizon.

Below is a rundown of the critical data components that inform the proforma and aid your geographic expansion plans:

- Loans and Deposits Forecasting – Likely the most important component when assessing the Data Outputs, when assessing expansion geographies and specific Trade Areas, you need to understand the “elbow room” in that market, i.e. are there still Loans and Deposits to be had, or is a given Trade Area saturated, and thus not viable

- Competitive Analysis – Speaking of “elbow room” – is there an opportunity for you as a new retail banking entrant into a given market or not? Going beyond the elbow room, do the competitors in that given market dominate and/or outspend you, or will your entry be well received?

- Consumer Overlays – A critical factor in geographic expansion is answering the question of how many of your existing consumers live in this expansion geography. Having a pre-built consumer base is often an important component

- Demographic Tapestry Profiles – You may know exactly who your consumers are, but do those consumers live in the next town over. Consumer demographics can shift greatly within only several miles, so understand the overlays of your existing base in expansion geographies

- Market Potential Indices – The MPI measures the likelihood of adults in a given geographic area to exhibit purchase behaviors based on certain banking products and services that align to your offerings (or those you plan to introduce)

- 4 Square Quadrant – The final component of the LEVEL5 Market Analysis engine is the delivery of a 4 Square Quadrant reading of a host of proposed branches in a given Trade Area by scatter-plotting them based on the branch performing well or poorly, and cross sectioned with the market potential being good or poor

To learn more about LEVEL5’s Strategy division and our unparalleled Market Analysis, contact us today so we can begin the assessments needed to help you grow the right way.

4 Critical Things We Learned in 2021

- Announcements

- Banks

- Branch Transformation

- Consulting

- Credit Union

- Data

- Retail

Categories:

2021 was the much-anticipated light at the end of the seemingly endless tunnel of 2020. It wasn’t an easy year, as we were all still dealing with the tribulations of the pandemic, but it was laced with hope.

Before we begin to look ahead to 2022 (our annual Crystal Ball series is close), let’s revisit this year as we highlight 4 critical things and discuss what we learned.

The Branch is Not Dead

Let’s be honest here… if anything were to have killed the branch, it would have been COVID-19. A global pandemic preventing people from gathering in groups, touching surfaces, attending events in-person, or entering closed spaces without masking up first? And all of that on TOP of the already rapid rise in digital as an alternate to in-person banking?

If that didn’t get rid of all bank and credit union branches in the country, nothing will. Brick and mortar in the banking industry is simply not going to go away – it’s just time to optimize.

According to a recent study completed by Raddon/Fiserv, 77% of consumers said they went to a branch at least once a month during pandemic. Pre-pandemic, only 69-70% of consumers said they went to a branch at least once a month. Although mobile usage is steadily rising, branch usage is now rising for different reasons. People like to interact with people, especially when it is regarding the things most important to them.

The branch is not dead, but the old way of banking is. In order to continue to thrive and grow, it is imperative to reevaluate and optimize your branch network. The first step in this process is to take a good look at which branches are underperforming and why, and then remove or relocate them. Then, take a look at which branches are performing well and make sure they are well-equipped to provide consumers with personalized experiences. Once your branch network is operating at the maximum efficiency, you can begin to expand.

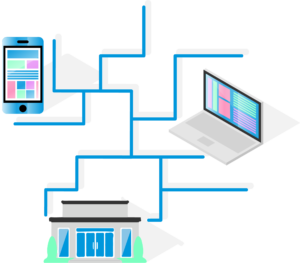

OmniChannel

Although the branch is not dead, mobile banking saw big gains during the pandemic and will only become more widespread. The rapid increase and reliance on mobile banking does not mean the end of branches, however. Caroline Vahrenkamp, a Senior Research Analyst for Raddon/Fiserv, says “People like to see other people. People like to interact with other people. The challenge is they also like to do things on mobile banking. So they like to use their phones for some things, they like to use their computers for some things, and they like to do some things face to face. And there’s a pretty clear idea of what each individual person wants to do in each of those methods.

Although it’s not consistent it’s not like everyone wants to do the same thing in each of those ways, everyone has a blend. But everyone has a blend.”

The statistics of the uptick in branch usage during the pandemic is clear proof of this.

It’s not enough to use brick and mortar, online, and mobile banking arbitrarily. Those three avenues must work seamlessly together and compliment each other. The channels working separately and under different departments forces them to work against each other instead of together. Mobile and online banking should not be the enemies of brick and mortar banking. Mobile and online banking fit the average consumer’s simple, daily needs. Your branches must fill in the gaps that mobile and online banking leave. They can provide human interaction, advisory services, and various other capabilities that require thought and trust. Something not provided by the apps.

Return to the Office

as predicted, the inevitable happened and the great migration back to the office began for much of the country this year. As the vaccines rolled out, companies slowly started opening their doors back up. While some decided that remote work was the best fit for their operations, many other institutions opted for “flex” type schedules. Others decided to go back in full-swing, pre-pandemic style.

Companies that decided on any type of in-person work had to put measures in place for the safety and comfort of people. Workplaces are now equipped with hand sanitizer stations, plexiglass dividers, and spread-out environments to accommodate those coming back to the office. Those on flex schedules go in to the office every other day and work from home the other days. They perhaps even share workspaces or common areas with others working in-office on opposite days.

LEVEL5 worked tirelessly throughout 2021 to equip our clients with the knowledge and resources they need for a safe and comfortable return to the office. We used our (Re)FI Design program to re-envision the workspace according to COVID-19 restrictions. We looked into workspace designs that allow for social distancing as well as minimizing touch points to stop the spread of germs and various other ways to allow for a safe branch.

Labor and Supply Chain

A couple of major disruptions throughout the last year that were caused by COVID-19 were the massive labor shortage and the extreme stress put on the supply chain. Although there were issues with it to begin with, the supply chain took a major hit with factories shutting down and workers losing jobs. Even when recovery seemed to be in the works, the Delta variant took some more punches – and who knows just what impact Omicron will have.

For what seemed like an eternity, the supply chain disruption happened in conjunction to a heavy decrease in demand. Factories closed and cut production while many lost jobs and couldn’t afford to spend money on anything other than the bare necessities. But not in the fun, carefree way that Baloo sings about. No one could forget about their worries and strife.

Then, as financial assistance was provided, vaccines were produced, and people returned to work, the demand grew back rapidly. This, however, put the supply chain under immense pressure. The pressure continues now as materials and resources are low along with a shortage of essential workers. In addition, the countries of the world “opening back up” is not happening in parallel. The US, for example, is opening at a much faster pace than some other countries, leaving an imbalance in the flow. The supply chain continues on the path of recovery, though. It’s making a comeback.

Although the pandemic permanently altered society, the changes that happened in banking were going to happen regardless of COVID-19. It merely kicked the evolution into overdrive. We have been preaching about the transition of branches from transactional to advisory for years now, but 2021 proved what we’ve been saying since the beginning.

Now, 2022, we’re ready for you. Bring it on.

If you’d like to know more about how you can help your bank or credit union grow in 2022, CONTACT US.

5 Key 2022 Planning Strategies

- Banks

- Branch Transformation

- Consulting

- Credit Union

- Data

- Leadership

- Training

Categories:

As the calendar has now rolled into October, you undoubtedly have been called into the first of several meetings to discuss your strategies and goals for next year.

It’s planning and budget season.

How will you gain more members/customers and grow relationships with existing ones next year? Well, now’s the time to answer these questions.

Growth-minded credit union and community bank leaders need to make vital decisions to propel business growth in 2022 and an effective plan takes into account the changing nature of banking.

Our team, here at LEVEL5, lives and breathes financial institution growth every day, so we’re sharing our 5 key 2022 planning strategies for credit unions and community banks.

#1 Analyze Your Branch Network

Before you can begin to think about organic growth with net new customers in net new areas, you need to ensure the current branches and the customers they serve are performing.

Initially, you must to take a holistic assessment of your entire branch network.

Do you have a current and accurate understanding of loan and deposit performances per branch?

Which demographics make up your clientele at each branch and have they changed?

Do you have the right number of branches within a certain market to benefit from the network effect?

And most importantly, which branches are performing at forecast, and which ones are not?

Knowing what you’re working with is the foundation for making correct growth decisions for next year. In order to know, your finger needs to be on the heartbeat of the entire organization.

#2 Optimize Your Branch Network

Once you’ve captured a clear picture of your network, it’s time for action.

While some branches may be thriving, others may not be performing. In order to optimize, it may be crucial to consider closing or relocating them before they can take more toll on your financial health than they already have.

It’s best to get ahead of loss by data-driven analysis to determine what needs to be done. Once a non-performing branch is closed, you can move those resources into a new branch that will turn positive numbers within a healthier market.

Identify geographic markets where your optimal demographic is growing. With the right branch in the right place, you’re armed to expand your network in an impactful way. Informed consulting services tell you which branches to close, keep, remodel, and/or relocate.

#3 Boost the Retail Experience

Branches are still at the forefront of customer engagement and retention, but due in part to digital channels, their role has become less transactional and more about onboarding and advisory sessions.

The Financial Brand publication notes that bolstering a credit union or local bank standing as a trusted advisory community institution helps to keep them competitive against mega retail banks. From our experience, we couldn’t agree more.

Therefore, the branch should be where new customers come to open accounts and clientele visit to seek advice from a real person, making the functional experience of your spaces paramount. After all, the effort you put into your environment speaks to the effort you’ll put into your banking relationships.

All great branches should include at a minimum:

- An inviting entrance, opening into a welcoming space that facilitates trust with staff

- High quality branding, amenities, and materials in line with your organization’s culture

- Informal advisory areas

- Private advisory areas

- Comfortable furniture

- Well-lighted spaces

Our ReFi program helps you assess clientele experience in your current branches with actionable ways to remodel, re-inventing an inviting and engaging branch experience.

#4 Secure Your Budget

Planning is key, but it’s all backed up by the ability to properly secure funds for future projects.

Make sure to properly communicate all future fund needs to all stakeholders and decision-makers. In addition, make them aware of the purpose behind each project so proper decisions can be made now and no surprises pop-up later on.

A well-defined plan, with actionable and attainable goals will be the projects awarded the proper funds for execution.

#5 Prepare An Employee Training Plan

Ensure your tellers and bankers on the ground are up-to-speed on the ultimate purpose of the branch. They need to know that they’re on the front lines of fostering relationships and growth.

While critical functions such as onboarding, executing transactions and product cross-selling are key to any in-branch function, there is always a gap in the training where a newly built (or remodeled) branch and its core strategic function are lost on the staff that occupy it.

Ensure that your branch staff not only know how to perform the duties defined in their job descriptions, but also how to do it in the space you’ve planned and built.

To learn more about the 5 key strategies outlined above and how LEVEL5 can assist you with your strategic assessments and branch build projects, Contact Us today. We’re ready to help you meet your 2022 goals.

Forbes: 4 Retail Trends and What They Mean for Branches

- Banks

- Branch Transformation

- Consulting

- Retail

Categories:

While some semblance of normalcy is incoming, the impact of the pandemic is still very much a reality.

As it relates to retail branching, the early days of the pandemic seemed to have three primary predictions:

1) The Branch is Dead

2) The Branch Will Come Back Stronger

3) The Branch Will Change

Like most things in life, level-headedness has prevailed. With a good bit of recent history now behind us, the right answer here seems to be point #3. The branch will change due to the pandemic. Let’s be honest, though, the branch was already changing and will continue to do so regardless.

Forbes, who does a great job of keeping the finger on the pulse of so many topics, recently published an article called “Four Trends Reshaping The Future of Retail.” They talk evolving trends greatly impacted by the pandemic. Here, we will highlight those four trends, but look at it through the lens of retail banking and what it means for your organization.

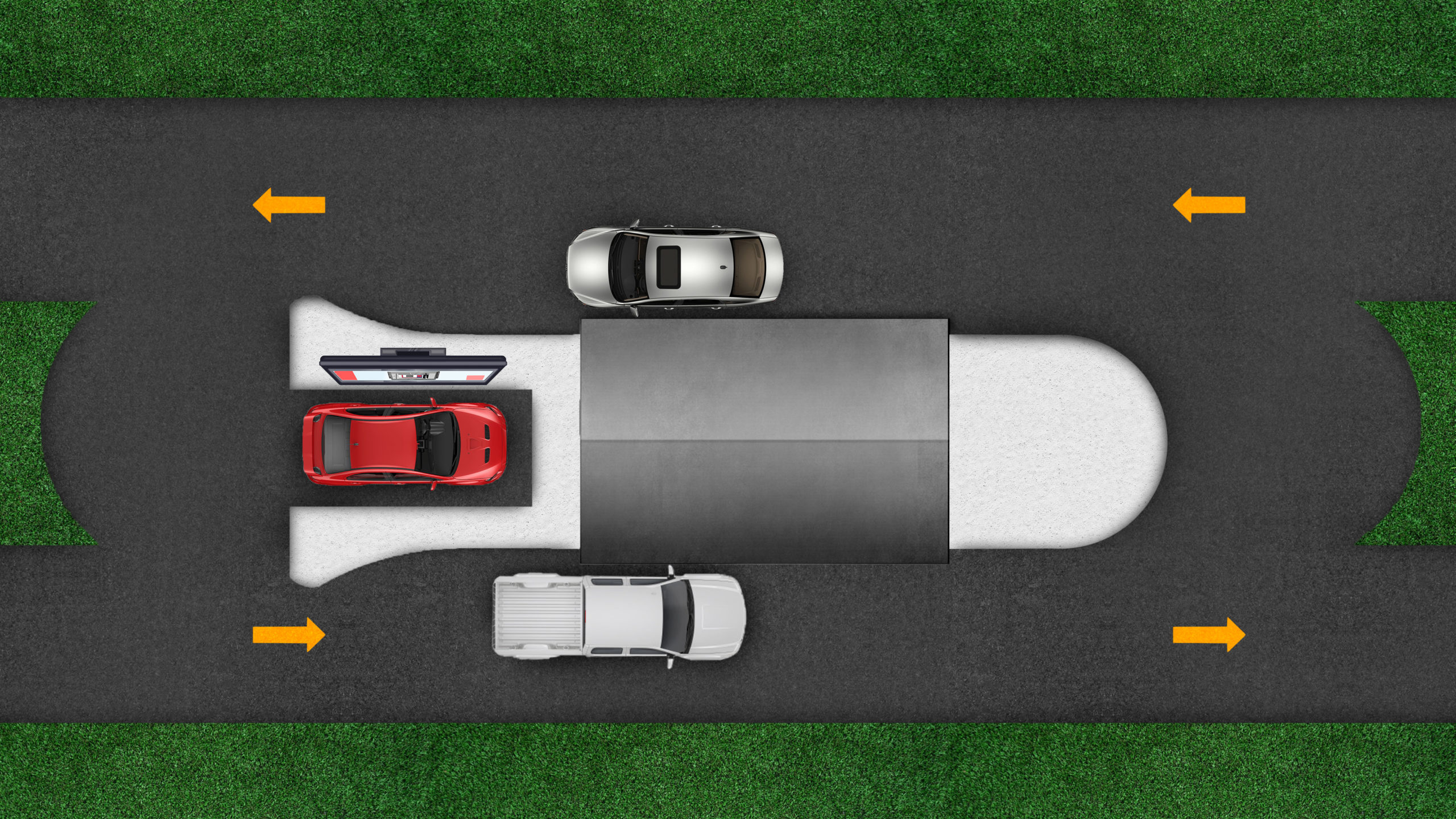

#1 – Buy Online, Pick Up In-Store & Curbside Pickup Remain Popular

In General Retail Terms – The main takeaway here from the Forbes article is the concept of “Omni-channel.” What you can begin with online has either a hand-off or direct correlation to what happens in-store (or vice-versa). This still has great relevance to any Bank or Credit Union. These services were available to most retailers prior to the pandemic, but really came into their own when many stores were closed and while customers eased their way back to “normal.”

In Retail Branching Terms – Omni-channel servicing is not a new concept to retail banking. For an industry that is hard to change its ways, however, looking at product and services in a seamless, intertwined fashion between the online and offline must become part of any strategy going forward. We predicted long ago the rise of “curbside banking” and have now seen a post-pandemic bump in the drive-through. The branch is becoming less transaction and more advisory. Blending what can be learned or discovered online, then delivered and/or advised upon in-branch is key.

#2 – Retail Stores Have Become Fulfillment Centers

In General Retail Terms – Some retail stores had to reinvent themselves as fulfillment or distribution centers when doors were shut and/or foot traffic tailed off. This is a direct result of point #1 above, especially as it relates to in-store pickup and/or curbside.

In Retail Branching Terms – The translation here for retail banks and credit unions is not so much as “fulfillment centers” to sell your widgets. You must understand that the majority of folks who come into the branch to open an account very likely began their “shopping” experience for your products and services online. They probably looked into your credit card offerings and got an understanding of the different flavors and narrowed down the choices. They might have even determined the winner. When it came time to open, though, they decided to come into the branch to open the winner. They wanted that personal touch.

#3 – Free-Standing Stores Continue to Proliferate

In General Retail Terms – Free-standing stores, compared to their mall or shopping center based brethren have seen better store-over-store sales. The reason for this is directly related to the pandemic, with consumers choosing the larger overall footprint of these given stores, and not having to deal with the confines of a crowded shopping complex.

In Retail Branching Terms – At LEVEL5, we have a robust Market Analysis division, that has a very strong reputation for running 10-year proformas on different branch types. Without fail, our models always show better sales and faster ROI with a freestanding branch. Regardless of our models, the other primary takeaway here is that you should think of your Branch Strategy in the terms of Branch Optimization. Make sure any individual branch of yours is giving you the best return. The upside to a freestanding branch will nearly always outweigh any storefront branch.

#4 – In-Store Health and Safety Measures Remain Paramount

In General Retail Terms – Retailers, through and through, want you back in the store. Health and safety are paramount. This is marketed widely, both through advertising media, but also in-store. Retailers are glad you’re back and want you to feel safe while shopping.

In Retail Branching Terms – Welcoming customers or members back to the branch is no different than any other shopper type. Branches across the country have gone through great lengths to put up plastic guards, hand sanitization stations, social distances markers, alternating chairs, and more. While masks are becoming a thing of the past, a bottle of Purell only goes so far. LEVEL5 has created the Re-FI Design Program, which was developed to specifically help Bank and Credit Unions address the issues related to the pandemic beyond simple triage measures.

So much press in our industry trades was given to Digital Transformation and Branch related obituaries. Let’s be honest, though, most are click-bait. There are kernels of truth sprinkled about, but it leaves us to sift through the noise to find the relevancy.

Yes, Digital Transformation is a real thing. If your digital platforms are at least not on par, you have some catching up to do.

No, the branch is not dead. It simply needs to continue to evolve.

The main takeaway here is Omni-Channel. The digital world and retail world can have mutually exclusive strategies. If there aren’t cross-over and intertwined components, you’ll be left behind your competition. More importantly, you won’t be delivering a modern experience for your customers or members.

2021 Crystal Ball: Boldly Predicting the Year to Come Pt. 2

- Banks

- Consulting

- Credit Union

- Main Office

- Retail

Categories:

In last week’s post, we gazed longingly into the Crystal Ball to look ahead at the year. Here, we’ll gaze into the future one last time, discussing a range of topics surely relevant to the way you conduct and run your business.

The Great Migration (Back to Work)

Just as giant herds of wildebeest seek greener pastures, your employees too will return from whence they came.

While the pandemic continues to steal headlines and as I continue to write this article, cases are as high as ever. Branches hours are changing daily, but there is light at the end of the tunnel. Whether it’s due to warmer temperatures, vaccination roll outs, or herd immunity, many believe the pandemic’s peak is upon us. The downward curve is fast approaching and health and business experts alike agree that the post-pandemic world is within reach.

While the pandemic continues to steal headlines and as I continue to write this article, cases are as high as ever. Branches hours are changing daily, but there is light at the end of the tunnel. Whether it’s due to warmer temperatures, vaccination roll outs, or herd immunity, many believe the pandemic’s peak is upon us. The downward curve is fast approaching and health and business experts alike agree that the post-pandemic world is within reach.

Your employees, who are still working in their home offices, kitchen tables, or closets under the stairs, will have to physically return to their places of employment. It could be on a flex schedule or full-time basis. No matter what, though, they are returning and you and your organization must be prepared for them.

Aside from some bottles of sanitizer, chances are that your corporate offices are not prepared for a proper return. Do your current offices need to be renovated accordingly? Are you looking into the future for an entirely different office building? If so, we have created the “L5 HQ” program, which is meant to assess your corporate office needs.

The Cost of Things

The cost of doing business, specifically in the Design-Build world, has been greatly impacted by the pandemic. As we look ahead to 2021, there will be carryover from 2020 along the following fronts:

Labor

One of the ironic impacts from the pandemic has been the boom to the construction industry. If you have not done something to your home, the chances are, your neighbor has. Ever since the first wave of lockdowns commenced back in March, there was a massive rise in DIY projects. All of a sudden, desires arose to landscape yards, update kitchens, overhaul master baths, finish unfinished basements (guilty), and build out those home offices.

While on the surface, this all sounds residential and not commercial, an impact on labor is seen across sectors. You see, the crew doing your home project may also be the sub-contractor at the complex up the road.

Thus, we have a national labor shortage, with states like New York, Florida, California and Texas particularly feeling the pinch.

This is where planning ahead and having the right General Contractor for your branch or headquarters project really count.

The right GC has existing relationships with the local sub-contractors who pour the concrete, set the framing, and manage all the other elements that make up your building. Subs tend to allow themselves to be hired out by those they trust, and those who feed them continued work. A local General Contractor typically does not have the pull and project load compared to a national outfit.

Materials

So, if there is a labor shortage, that must mean that there are many projects abound and materials are in short supply. When supply is short, costs go up. Timber in particular has struggled to keep up with demand. While our projects continue to stay on budget, we are aware of the national timber shortage and have seen it impacting jobs across the country.

So, if there is a labor shortage, that must mean that there are many projects abound and materials are in short supply. When supply is short, costs go up. Timber in particular has struggled to keep up with demand. While our projects continue to stay on budget, we are aware of the national timber shortage and have seen it impacting jobs across the country.

Regardless, post-pandemic prices have not dipped, but are instead rising slightly. There will likely be a leveling off by mid-summer. Projects in the construction industry have stayed steady, however.

Q&A RE M&A

I sat down with our lead consultant, John Hyche. His reputation as a thought leader in the industry has continued throughout his nearly 30-year career. John is no stranger to Mergers and Acquisitions, having been involved in heading many consulting engagements with clients over the years.

I asked John his thoughts regarding Mergers and Acquisitions and the below is a summary of his thoughts:

Mergers and Acquisitions will continue to be a trend within the industry. While the pandemic and post-pandemic world has its influence, the trends and reasonings behind the topic are consistent.

They can be broken down into 3 broad categories.

The first we’ll call “The Smaller Players.” These community based FI’s are typically operating a small handful of branches in their comfortable corner of a given market, with assets in the single digit millions to low double digits. They are surrounded by larger players, both in asset size, branch network and most importantly, efficiencies. The smaller players may ultimately find themselves at a precipice, where the cannot grow. Conversely, they may fill a niche for a local larger player, and so a M&A play commences.

The second scenario we’ll call “Merger of Equals.” This is when two like FI’s see complimentary components with one another. They may be similar, but also are seen as filling in gaps to one another. Whether it be geography (east side of town vs. west side), innovations, product offerings, customer base, etc. A merger of these “equals” is seen as a much faster growth route than doing it organically. This makes a lot of sense, but a critical component to the post-merger success is the personnel, with many organizations struggling to right-size their staff after the fact.

The third broad scenario we’ll call “The De Novo.” This is a new FI, from scratch. The advantage that a De Novo bank or credit union has is they can build whatever type of FI they want. They are not burdened by being branch first, tech first, on an old core system, or operating in the wrong trade areas. While De Novo FI’s may begin existence by filling a void in the market, ultimately, they may cause enough of a fuss for the bigger players in the market to begin to entertain an acquisition play. In fact, this may very well be the de novo strategy all along.

So there you have it, our Crystal Ball for 2021.

If you’d like to learn more, need to discuss your corporate office, or interested in our M&A Consulting Packages, Contact Us today.

2020 Crystal Ball: Big Data Will Get Bigger (and Smarter)

- Consulting

- Data

Categories:

[fusion_builder_container hundred_percent=”no” equal_height_columns=”no” menu_anchor=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=”” background_color=”” background_image=”” background_position=”center center” background_repeat=”no-repeat” fade=”no” background_parallax=”none” parallax_speed=”0.3″ video_mp4=”” video_webm=”” video_ogv=”” video_url=”” video_aspect_ratio=”16:9″ video_loop=”yes” video_mute=”yes” overlay_color=”” video_preview_image=”” border_size=”” border_color=”” border_style=”solid” padding_top=”” padding_bottom=”” padding_left=”” padding_right=””][fusion_builder_row][fusion_builder_column type=”1_1″ layout=”1_1″ background_position=”left top” background_color=”” border_size=”” border_color=”” border_style=”solid” border_position=”all” spacing=”yes” background_image=”” background_repeat=”no-repeat” padding_top=”” padding_right=”” padding_bottom=”” padding_left=”” margin_top=”0px” margin_bottom=”0px” class=”” id=”” animation_type=”” animation_speed=”0.3″ animation_direction=”left” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” center_content=”no” last=”no” min_height=”” hover_type=”none” link=””][fusion_text]Big Data will continue to grow in size and usefulness. With the rise of AI and Machine Learning, it’s your decision whether to find it intimidating or useful. But let’s face it, it’s probably both.

Big Data, Big Intimidation

Think of it this way. Big Data is a seismic, confusing and useful asset. No different than the thoughts around the water cooler back when the Internet dawned and later, online banking, then mobile banking. It was daunting, scary and intimidating with the only way to conquer it was to just begin to tackle it. Now, these critical pieces are just second nature and the fears they presented seem silly in retrospect.

Now just when you thought you had a grasp of Big Data and thought it was safe to go back in the ocean, here comes AI and Machine Learning to get you confused all over again.

Rise of the Machines

The introduction of AI and Machine Learning is the next evolutionary step with Big Data. Before, where there was huge swaths of data, somebody had to interpret it. But it was not only the interpretation, it was actually really more about what to do with it. These Data Scientists would crunch, tabulate, then make recommendation based on the results.

Now, Artificial Intelligence and Machine Learning take the human element out of the equation (to a degree), making way for tabulation and particularly recommendations, in real-time. You are likely familiar with this in your personal life in the likes of LinkedIn making job recommendations and Facebook making friend recommendations. These systems are not guessing here. There are algorithms at work based on many data sets to ultimately deliver you that recommendation.

Help Wanted

So here’s the good news: you don’t need to master Big Data, AI or Machine Learning. You just need to master the art of a partnership, and work with a company who lives and breathes this stuff everyday so it can help you grow, not stall you with indecision.

These elements need to be run, managed and interpreted by those who know what they’re doing. You have a bank to run. You don’t necessarily need to know how, but you should know who. We at LEVEL5 have a team of Data Scientists/Statisticians who have been using a multitude of data points to deliver actionable results for many years, we just didn’t call it “Big Data” until that became a thing.

In fact, Big Data in the hands of the right Retail Banking Consultants can help you get out of the vicious “analysis paralysis” phase, interpret the data and give you the actionable results you so desperately seek.

The likes of making a decision on where to put your next branch or main office is daunting. For many community bank and credit union C-level folks, the right decision will make a career. The wrong decision will stop a career in its tracks.

So embrace Big Data. Or, at least embrace a partner who embraces Big Data.

If you’d like to learn more about how LEVEL5 uses Big Data to deliver actionable results, Contact Us today.[/fusion_text][/fusion_builder_column][/fusion_builder_row][/fusion_builder_container]