Crystal Ball 2022 Pt. 4 | The Branch Strategy Shift from Transactional to Advisory

- Branch Transformation

Categories:

Last week, we predicted the importance and need for the branch in the year to come. This week, let’s talk about the why and how of it all.

Part 4 – The Branch Strategy Shift from Transactional to Advisory

The Shift is Happening

While it is true that the branch is indeed alive and well, it is also true that the branch we used to know and love has irreparably changed. A study done by Raddon right before the pandemic surveyed consumers on their branch preferences. The results showed that when it came to the older generations, they did prefer those traditional branch layouts with the teller lines and transactional components. It’s what they were used to and knew how to use. When it came to Millennials, however, the results told a different story. The study showed that Millennials preferred technology-oriented branches, and/or the “coffee bar” model of branch.

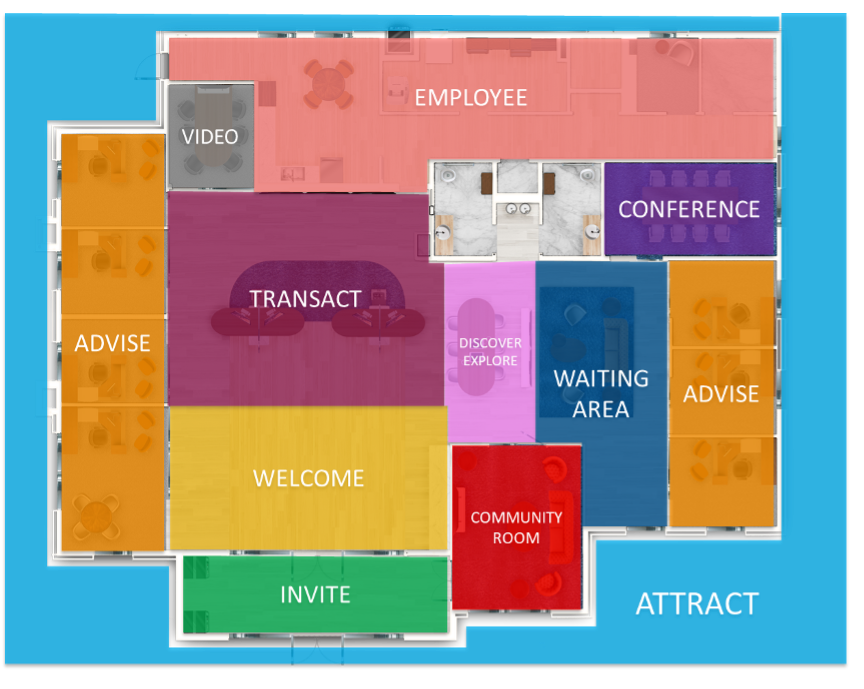

The technology focused branch is the branch that you walk into and see digital screens around, displaying local news, the weather, the stock market trends, advertisements about products that the financial institution is offering, and events in the area. It holds interactive teller machines and a tech table with tablets for consumers to use for discovery needs. The rest of the branch, then, is for advisory offices and maybe a teller pod or two.

A Cup o’ Coffee for Your Thoughts

The “coffee bar” branch is the branch with an attachment of a Starbucks, a Peet’s coffee (if you’re Capital One Café), or a local roastery. That’s the branch that you, as a consumer, can visit to enjoy a coffee and dessert while you take out a car loan or open a new account. It can be a convenient place for students to go to for financial advice or to begin the learning process for the upcoming adult responsibility of money. Then, they can stay for the coffee and snacks with peace and quiet while studying.

The existing Capital One Café is the perfect example of this. In order to be successful, these branches are conveniently located and strictly advisory.

Both branch types represent solutions to needs that mobile banking does not and cannot fill. Millennials are no longer those kids that can’t get off their phones. They are now financially independent adults with careers, families, and homes. They are now thinking about how they can move up in the world and this means investing their money, taking out car loans and mortgages, creating financial strategies, and even planning early for retirement. Properly designed advisory branches are the perfect (and only) fit for those needs.

A Strategic Plan First

Now, that’s not to say that every single traditional branch must be shut down immediately. You must root every decision in strategy. You must take a look at your branch network, target markets, and consumer demographics before making the decision of what type of branch you need in each area. The market surrounding a college campus would benefit a lot more from the “new” branch than the market surrounding a retirement community, for example.

Lucky for you, LEVEL5 has the leading Market Analysis team for Financial Institutions in the country. Our experts will evaluate the relevant data to draw conclusions and then align them with your strategies and goals. After that, we can come up with a game plan together and begin the execution.

Contact Us here to come up with a game plan to evolve your branch network into leading advisory facilities.

Crystal Ball 2022 Pt. 3 | The Branch Lives

- Branch Transformation

Categories:

If you’ve missed the previous Parts, you can access them here: Part 1 or Part 2

Part 3 – The Branch Lives

Gone are the days of industry commentators preaching “the branch is dead!” and gone are the talks of moving to solely digital platforms (we hope, we think, but probably not).

Long live the branch!

Let me explain:

The Surprising Aftermath of an ongoing Pandemic

Long ago, in the ancient days of 2018 and 2019, the percentage of people using branches was declining. In 2010, 83% of people surveyed said that they visited bank or credit union branches at least once a month. That number steadily declined to 70% and 69% as mobile and online banking steadily increased.

Everything changed when the pandemic hit. For a brief time, branch use obviously hit an all time low as the whole world shut down. Then, the strangest thing happened. As the world hesitantly began to open back up, as stimulus checks were sent out, as FDA-approved vaccines rolled out, people stepped back out into the sunlight. People not only started visiting branches again, but they started visiting them even MORE than before. In 2020, it was reported by the Fiserv company, Raddon, that 77% of consumers went to a branch at least once during the pandemic.

Despite the health risks of going in public, despite business shutting down, and despite the convenience and rise of mobile and online banking on top of all of that, the branch prevailed. People WANTED to leave the house and go interact with other people. People craved that human interaction.

The New Branch

Now, don’t get me wrong, digital banking is still rising and will continue to rise. But the rise of digital does not have to mean the death of the branch. They are not mutually exclusive. In fact, for either of them to work to their fullest potential, they must support each other. While mobile banking rises, brick and mortar will also rise. It might not be the traditional physical building that you’re used to, but it’s a physical building nonetheless. There’s a new branch in town.

Your branch locations must be used to fill the gaps that mobile leaves. This means the human element to branching is imperative. When a modern-day consumer walks in the branch, their first touchpoint should be a human one inquiring about their needs. After that, they can move either to the transactional zones of the branch or the advisory.

We’re finding more and more that people are coming in less for the teller lines and more to sit down in a private office to talk to someone about their finances. Now, they want to walk in the branch, tell an advisor about their financial goals, and plan a strategy to meet those goals. They want to learn about the different types of credit card programs you offer and discuss which one would best fit their needs. They want to learn about your high-yield savings account and how to properly invest their money. Some of them are buying houses and want to know about their mortgage options.

Even if they do want a transactional process done, many times, they’ll head straight to the ATM’s or ITM’s. As popular as mobile has and will continue to become, you’ll never be able to withdraw cash from your phone. At a tech table, a consumer might want to use a tablet to go through the steps of opening an account. You might ask yourself, “Why would they do this at a branch when they could go through the same steps on their phones?” Well, it might seem the same, but again, that lacks the human component. if they wanted to open an account quickly on a tablet inside the branch, they would also be able to ask questions to the nearest teller about the different types of accounts and which of them best suits their needs.

Your consumers cannot have the same level of security in informed decision making from their couches.

Whatever reason the modern consumer has for needing brick and mortar branches, there’s no denying the existence of that need. The people have spoken and the branch is here to stay.

If you’d like to learn more about the new branch and how to adapt, Contact Us today to talk to our experts.

Crystal Ball 2022 Pt. 2 | Supply Chains & Trades Issues

- Banks

- Branch Transformation

- Brand Deployment

- Credit Union

Categories:

Welcome back, if you missed Part 1, you can access here.

Part 2 – Supply Chains & Trades Issues

While the pandemic seems to be drifting away, at least in its economic impacts, construction materials supply chain problems and availability of Subcontractors will continue to remain a challenge to credit unions and community banks looking to open a new branch in 2022 or 2023.

A critical component to executing a Branch plan is to have the right partner on your side.

Advance Planning, Advance Savings

During the past 2 years, more and more of LEVEL5’s clients have been opting for advance design and planning of multi-year, multi-branch rollout strategies for their prototype branches. We believe this is happening largely because the antidote to such an unpredictable construction landscape is predictability that translates into advanced planning with the benefit of cost savings.

So how does working with our team help you plan for the future and reduce your spending?

Establishing a supply chain means that you have a defined product to execute upon. Let’s use a branch prototype as example. Once you’ve worked with LEVEL5 to design and finalize your prototype, this means that you’ve already specified materials needed for the majority of your branches. At this point, our team can work proactively with different manufacturers, subcontractors, suppliers for furniture, equipment, fixtures and so forth.

This advanced heads-up will give our sourcing partners an upfront and predictable way of understanding allocation needs. It will in turn helps to bring down prices for you.

The Design-Build construction method allows you to make material selections based on current availabilities. We factor this in with you in the design process.

Conversely, in the Design-Bid-Build process, a stand-alone architect designer may not be as privy to current materials costs in the design stages. Not being able to account for fluctuations here can result in unexpected costs once bids are turned in.

Think of the saying “knowledge is power.” In this context, we’re talking about the knowledge of future needs. It is a power that keeps costs down for your financial institution.

As you can see, advanced design and planning of rollouts can certainly drive down cost.

Knowing Costs Now Helps You Make Better Business Planning Decisions

To your advantage, you have an annual business planning cycle that needs to be built on sturdy information.

Once your professional credit union and bank consulting is complete, you’ve decided on the prototype and strategy. Then, we supply you with an accurate price estimate on your new branch or branches.

Having an accurate estimate now takes a huge unknown out of your organization’s plans, giving you more assurance and a realistic scope of your budget. It also allows you to make effective projections and preparations for changes in personnel at varying locations.

Secure Necessary Subcontractors Amid Shortage & Strain

Subcontractor labor shortages have been an issue even before the pandemic. Think all the way back to the great recession in 2008. But now, it’s become even more strained due to the aftermath (or continued impact) of COVID-19.

Because of these circumstances, the ability of your General Contractor to secure the right kind of Subcontractors for your project will only become more difficult the longer you wait to get things started. Less time to plan ahead and communicate properly with Subcontractors on their availability can cause obvious hurdles for your goals.

This goes for both singular branch builds and multi-branch rollouts. However, we want to note that Subcontractors will be more aggressive sometimes. For example, bidding and staffing for projects that are part of an integrated/multi-location rollout will be aggressive. A one-off branch project will be much less so.

Regardless of the branch rollout volume, you can see how moving forward with long-term action now will put you in a preferable spot. It will minimize unknowns in both project staffing and pricing.

Don’t linger too long when making growth decisions – it could cost you greatly in finances, stress, and timeline goals for your bank or credit union.

Contact us now for help avoiding unnecessary expenditures and longer–than–necessary lead times. Our 20+ years of growth consulting for banks and credit unions, coupled with our nationwide relationships with manufacturers and subcontractors, Is the added muscle you need to get a well-executed project off and running.

Crystal Ball 2022 Pt. 1 | Costs Continue to Rise

- Branch Transformation

Categories:

It’s a new year, which can only mean one thing: a new Crystal Ball series.

Part 1 – Costs Continue to Rise

While indicators seem to be pointing to a “recovery” from the pandemic, such as employment rates, and even total cases per day/month, one of the lagging hangover effects that has not begun to ease are construction costs.

One of the impacts of the pandemic, foreseen or not, was the spike in construction across the board, both residential and commercial.

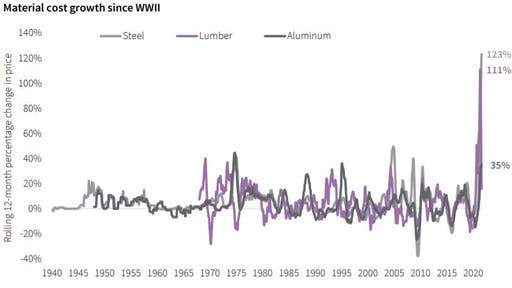

As seen with the below graph from the U.S. Bureau of Labor Statistics, costs of materials have not only spiked, but are also the highest since World War II.

Regardless of prices, this has not translated into construction projects being put on ice – quite the opposite.

Cranes are flying over downtown skylines, and residential neighborhoods are replete with both new homes, remodels and extensions.

So what does this all mean for a Bank or Credit Union who is looking to grow, and looking at the branch as a main driver of this growth?

It comes down to a matter of investment.

While it may cost “more” to build a branch compared to pre-pandemic cost structures, if it’s growth you seek, and it can only/mostly be done via new members bringing in new Loans and Deposits via a new branch in a new Trade Area, you have to ask yourself if it’s worth the investment.

Wayne Gretzky famously said, “You miss 100% of the shots you don’t take.”

In banking growth terms, this quote can be translated into the simple economic situation of needing to invest to grow, or, “you have to spend money to make money.”

Material costs are predicted to rise, or stabilize at least through the first half of 2022, but what is the trade off of NOT doing anything? How can you value being stagnant, and how do you justify to the board to sit and wait for an unknown “cost” future?

The reality is, for a Bank or Credit Union looking to grow, you act now.

So, how do you counterbalance higher material costs for optimal margins?

Economies of Scale

Typically, when LEVEL5 begins a client engagement, the discussion of a branch is never singular, it typically involves 2 or more branches, even if the schedules for the builds is over a 12-36 month period.

If the plan is to indeed design and build more than one branch, buying the raw materials in advance will yield savings, and aid the overall margin.

Labor Discounts

Deals on labor can be had when multiple projects are happening either concurrently, or successively.

As the General Contractor, LEVEL5 has existing relationships with different Trades (sub-contractors) across the country, and have had success in booking these Trades for multiple jobs. This aid the sub-contractor, who can keep their workers engaged for longer.

Real Estate/Site Selection Transactions

LEVEL5 has been acquiring land and buildings for clients for over 20 years. In doing so, we veil your identity during the negotiation phase. The reason this is important is because in doing so, we have more negotiation power, and often save our clients up to 18% on the transaction price – helping your bottom line.

Time is Money

The other benefit of working with LEVEL5 when it comes to overall cost is the savings you’ll get from working with a proven national General Contractor. In today’s economic climate, the supply chain is compromised and there are labor shortages – both of these typically mean that a standard construction job inevitably is going over on schedule – and added time is added money.

We have been successful in queuing up work well in advance, which is why we subscribe to the “Design-Build” philosophy, not Design-Bid-Build.

Design-Build forecasts materials and labor during the planning stage. When things are known and predicted up front, plans can be made, and money can be saved.

If you’d like to discuss build costs and its impact to your growth plans, Contact Us today to get the conversation started.

4 Critical Things We Learned in 2021

- Announcements

- Banks

- Branch Transformation

- Consulting

- Credit Union

- Data

- Retail

Categories:

2021 was the much-anticipated light at the end of the seemingly endless tunnel of 2020. It wasn’t an easy year, as we were all still dealing with the tribulations of the pandemic, but it was laced with hope.

Before we begin to look ahead to 2022 (our annual Crystal Ball series is close), let’s revisit this year as we highlight 4 critical things and discuss what we learned.

The Branch is Not Dead

Let’s be honest here… if anything were to have killed the branch, it would have been COVID-19. A global pandemic preventing people from gathering in groups, touching surfaces, attending events in-person, or entering closed spaces without masking up first? And all of that on TOP of the already rapid rise in digital as an alternate to in-person banking?

If that didn’t get rid of all bank and credit union branches in the country, nothing will. Brick and mortar in the banking industry is simply not going to go away – it’s just time to optimize.

According to a recent study completed by Raddon/Fiserv, 77% of consumers said they went to a branch at least once a month during pandemic. Pre-pandemic, only 69-70% of consumers said they went to a branch at least once a month. Although mobile usage is steadily rising, branch usage is now rising for different reasons. People like to interact with people, especially when it is regarding the things most important to them.

The branch is not dead, but the old way of banking is. In order to continue to thrive and grow, it is imperative to reevaluate and optimize your branch network. The first step in this process is to take a good look at which branches are underperforming and why, and then remove or relocate them. Then, take a look at which branches are performing well and make sure they are well-equipped to provide consumers with personalized experiences. Once your branch network is operating at the maximum efficiency, you can begin to expand.

OmniChannel

Although the branch is not dead, mobile banking saw big gains during the pandemic and will only become more widespread. The rapid increase and reliance on mobile banking does not mean the end of branches, however. Caroline Vahrenkamp, a Senior Research Analyst for Raddon/Fiserv, says “People like to see other people. People like to interact with other people. The challenge is they also like to do things on mobile banking. So they like to use their phones for some things, they like to use their computers for some things, and they like to do some things face to face. And there’s a pretty clear idea of what each individual person wants to do in each of those methods.

Although it’s not consistent it’s not like everyone wants to do the same thing in each of those ways, everyone has a blend. But everyone has a blend.”

The statistics of the uptick in branch usage during the pandemic is clear proof of this.

It’s not enough to use brick and mortar, online, and mobile banking arbitrarily. Those three avenues must work seamlessly together and compliment each other. The channels working separately and under different departments forces them to work against each other instead of together. Mobile and online banking should not be the enemies of brick and mortar banking. Mobile and online banking fit the average consumer’s simple, daily needs. Your branches must fill in the gaps that mobile and online banking leave. They can provide human interaction, advisory services, and various other capabilities that require thought and trust. Something not provided by the apps.

Return to the Office

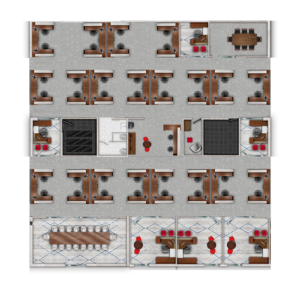

as predicted, the inevitable happened and the great migration back to the office began for much of the country this year. As the vaccines rolled out, companies slowly started opening their doors back up. While some decided that remote work was the best fit for their operations, many other institutions opted for “flex” type schedules. Others decided to go back in full-swing, pre-pandemic style.

Companies that decided on any type of in-person work had to put measures in place for the safety and comfort of people. Workplaces are now equipped with hand sanitizer stations, plexiglass dividers, and spread-out environments to accommodate those coming back to the office. Those on flex schedules go in to the office every other day and work from home the other days. They perhaps even share workspaces or common areas with others working in-office on opposite days.

LEVEL5 worked tirelessly throughout 2021 to equip our clients with the knowledge and resources they need for a safe and comfortable return to the office. We used our (Re)FI Design program to re-envision the workspace according to COVID-19 restrictions. We looked into workspace designs that allow for social distancing as well as minimizing touch points to stop the spread of germs and various other ways to allow for a safe branch.

Labor and Supply Chain

A couple of major disruptions throughout the last year that were caused by COVID-19 were the massive labor shortage and the extreme stress put on the supply chain. Although there were issues with it to begin with, the supply chain took a major hit with factories shutting down and workers losing jobs. Even when recovery seemed to be in the works, the Delta variant took some more punches – and who knows just what impact Omicron will have.

For what seemed like an eternity, the supply chain disruption happened in conjunction to a heavy decrease in demand. Factories closed and cut production while many lost jobs and couldn’t afford to spend money on anything other than the bare necessities. But not in the fun, carefree way that Baloo sings about. No one could forget about their worries and strife.

Then, as financial assistance was provided, vaccines were produced, and people returned to work, the demand grew back rapidly. This, however, put the supply chain under immense pressure. The pressure continues now as materials and resources are low along with a shortage of essential workers. In addition, the countries of the world “opening back up” is not happening in parallel. The US, for example, is opening at a much faster pace than some other countries, leaving an imbalance in the flow. The supply chain continues on the path of recovery, though. It’s making a comeback.

Although the pandemic permanently altered society, the changes that happened in banking were going to happen regardless of COVID-19. It merely kicked the evolution into overdrive. We have been preaching about the transition of branches from transactional to advisory for years now, but 2021 proved what we’ve been saying since the beginning.

Now, 2022, we’re ready for you. Bring it on.

If you’d like to know more about how you can help your bank or credit union grow in 2022, CONTACT US.

Tales of a Frankenbranch

- Branch Transformation

- Credit Union

- Portfolio

- Retail

Categories:

Nestled in a quaint, mist covered valley, far from the maddening crowd of the easterly metropolis, there was a branch.

It was the first branch. It was the flagship branch.

Then, it was an old branch, built and built again, cobbled together from disparate parts across several decades.

It was a Frankenbranch.

A stitch work job, it had different styles from different decades. It resembled a branch, but was something horrifyingly different.

It started off as the main branch in a proud paper mill town in the 1980’s. The branch’s street level floor carried much of the transactional load, while a small upstairs space acted as a meeting room. Eventually, it gave way to a series of expansions. While the expansion efforts successfully achieved the goal of expanding the overall square footage, they never took into consideration previous design elements. And don’t even start on the construction engineering side of the story…

One crew set out to do the job without any knowledge of the mechanics of the previous construction.

It wasn’t even really their fault. Plans were lost. People changed. Memories fade. Guesses were made. Lots of band-aids and looking the other way.

But what didn’t fade, or rather, what became increasingly obvious as the years turned to decades, was a patched together branch. It was undoubtedly historic, but also unabashedly stitched together to create a monster of a branch in which “good customer service” was a scary proposition.

It just wasn’t working anymore.

So…

Who you gonna call?

Enter the Branchbusters at LEVEL5, the nation’s leading Design-Build firm. They turn the country’s Frankenbranches into beautifully designed, expertly built revenue driving beacons on the hill that often times act as the prototype for high growth financial institutions.

Working with the existing infrastructure and maintaining the historical integrity of the building, the LEVEL5 design team crafted a modern branch that echoed the brand.

The construction crews never closed the branch to its members. Behind the scenes, however, on nights and weekends, they worked. They ripped out walls, re-established load bearing walls, refined the footprint for a better consumer experience, and reinvented a branch from the studs. The result delivered was a new, highly functioning branch. It was as if it had been built from the ground up.

5 Key 2022 Planning Strategies

- Banks

- Branch Transformation

- Consulting

- Credit Union

- Data

- Leadership

- Training

Categories:

As the calendar has now rolled into October, you undoubtedly have been called into the first of several meetings to discuss your strategies and goals for next year.

It’s planning and budget season.

How will you gain more members/customers and grow relationships with existing ones next year? Well, now’s the time to answer these questions.

Growth-minded credit union and community bank leaders need to make vital decisions to propel business growth in 2022 and an effective plan takes into account the changing nature of banking.

Our team, here at LEVEL5, lives and breathes financial institution growth every day, so we’re sharing our 5 key 2022 planning strategies for credit unions and community banks.

#1 Analyze Your Branch Network

Before you can begin to think about organic growth with net new customers in net new areas, you need to ensure the current branches and the customers they serve are performing.

Initially, you must to take a holistic assessment of your entire branch network.

Do you have a current and accurate understanding of loan and deposit performances per branch?

Which demographics make up your clientele at each branch and have they changed?

Do you have the right number of branches within a certain market to benefit from the network effect?

And most importantly, which branches are performing at forecast, and which ones are not?

Knowing what you’re working with is the foundation for making correct growth decisions for next year. In order to know, your finger needs to be on the heartbeat of the entire organization.

#2 Optimize Your Branch Network

Once you’ve captured a clear picture of your network, it’s time for action.

While some branches may be thriving, others may not be performing. In order to optimize, it may be crucial to consider closing or relocating them before they can take more toll on your financial health than they already have.

It’s best to get ahead of loss by data-driven analysis to determine what needs to be done. Once a non-performing branch is closed, you can move those resources into a new branch that will turn positive numbers within a healthier market.

Identify geographic markets where your optimal demographic is growing. With the right branch in the right place, you’re armed to expand your network in an impactful way. Informed consulting services tell you which branches to close, keep, remodel, and/or relocate.

#3 Boost the Retail Experience

Branches are still at the forefront of customer engagement and retention, but due in part to digital channels, their role has become less transactional and more about onboarding and advisory sessions.

The Financial Brand publication notes that bolstering a credit union or local bank standing as a trusted advisory community institution helps to keep them competitive against mega retail banks. From our experience, we couldn’t agree more.

Therefore, the branch should be where new customers come to open accounts and clientele visit to seek advice from a real person, making the functional experience of your spaces paramount. After all, the effort you put into your environment speaks to the effort you’ll put into your banking relationships.

All great branches should include at a minimum:

- An inviting entrance, opening into a welcoming space that facilitates trust with staff

- High quality branding, amenities, and materials in line with your organization’s culture

- Informal advisory areas

- Private advisory areas

- Comfortable furniture

- Well-lighted spaces

Our ReFi program helps you assess clientele experience in your current branches with actionable ways to remodel, re-inventing an inviting and engaging branch experience.

#4 Secure Your Budget

Planning is key, but it’s all backed up by the ability to properly secure funds for future projects.

Make sure to properly communicate all future fund needs to all stakeholders and decision-makers. In addition, make them aware of the purpose behind each project so proper decisions can be made now and no surprises pop-up later on.

A well-defined plan, with actionable and attainable goals will be the projects awarded the proper funds for execution.

#5 Prepare An Employee Training Plan

Ensure your tellers and bankers on the ground are up-to-speed on the ultimate purpose of the branch. They need to know that they’re on the front lines of fostering relationships and growth.

While critical functions such as onboarding, executing transactions and product cross-selling are key to any in-branch function, there is always a gap in the training where a newly built (or remodeled) branch and its core strategic function are lost on the staff that occupy it.

Ensure that your branch staff not only know how to perform the duties defined in their job descriptions, but also how to do it in the space you’ve planned and built.

To learn more about the 5 key strategies outlined above and how LEVEL5 can assist you with your strategic assessments and branch build projects, Contact Us today. We’re ready to help you meet your 2022 goals.

Close That Branch Already

- Branch Transformation

Categories:

If there is a silver lining in the wake of all that has transpired over the past many months, it’s an opportunity to revisit strategies, tactics, and decisions that seemed like a good idea in early 2020, but now may be a bit “dated.”

When looking across the business, and specifically the retailer landscape, bankruptcy seems to be declared every day. The optics of the word are bad, but the reality is, most companies declaring bankruptcy are not closing for good and liquidating (Chapter 7). They are rather looking to restructure, move debt off their books, and use a Chapter 11 filing as a way to aggressively restructure.

Without jumping ahead to doom and gloom scenarios, perhaps the time is right to make aggressive moves.

And if there ever was a time to make aggressive decisions, the time is now.

When thinking of a plan to optimize your branch network, there are 3 definitive steps. The first, is to close those branches that are simply not performing anymore. That is the focus of this article. After that, the next two steps are developing your new branch prototype and growing your branch network.

So this brings us to your branches, more specifically, those branches that are draining profits and sitting on your books as a black eye in an otherwise healthy branch network.

You know which ones those are.

And you know what to do.

It’s time to close those branches.

You shouldn’t perceive branch closures as any different than branch openings – as they are part of running a branch network. Any organization with growth plans needs to understand that what was once a great branch may no longer be so and decisions need to be made.

The silver lining in closing a branch is that you can likely dedicate resources and expenses to a new branch. Swap an old branch in a declining Trade Area for a newer branch, in a growing market.

But it doesn’t need to be a guessing game.

LEVEL5 offers varying Consulting packages to assess current branch performance, with definitive recommendations on which branch to keep, relocate, or close.

Any retail executive would tell you a foundational strategy of a company’s growth plan is to open stores aggressively, knowing that some of them will not work out. Regardless, markets change, neighborhoods flip, with key demographics and product proclivities ebb and flow with time – and that branch on that corner in that town may simply not be cutting it any more.

The only thing that should be constant in your branch network is change.

Let the Consulting Group at LEVEL5 assess your current branch network. We’ll identify performance metrics and be able to develop 10 year pro-formas.

The facts will speak for themselves.

The question is: What will you do about it?

Forbes: 4 Retail Trends and What They Mean for Branches

- Banks

- Branch Transformation

- Consulting

- Retail

Categories:

While some semblance of normalcy is incoming, the impact of the pandemic is still very much a reality.

As it relates to retail branching, the early days of the pandemic seemed to have three primary predictions:

1) The Branch is Dead

2) The Branch Will Come Back Stronger

3) The Branch Will Change

Like most things in life, level-headedness has prevailed. With a good bit of recent history now behind us, the right answer here seems to be point #3. The branch will change due to the pandemic. Let’s be honest, though, the branch was already changing and will continue to do so regardless.

Forbes, who does a great job of keeping the finger on the pulse of so many topics, recently published an article called “Four Trends Reshaping The Future of Retail.” They talk evolving trends greatly impacted by the pandemic. Here, we will highlight those four trends, but look at it through the lens of retail banking and what it means for your organization.

#1 – Buy Online, Pick Up In-Store & Curbside Pickup Remain Popular

In General Retail Terms – The main takeaway here from the Forbes article is the concept of “Omni-channel.” What you can begin with online has either a hand-off or direct correlation to what happens in-store (or vice-versa). This still has great relevance to any Bank or Credit Union. These services were available to most retailers prior to the pandemic, but really came into their own when many stores were closed and while customers eased their way back to “normal.”

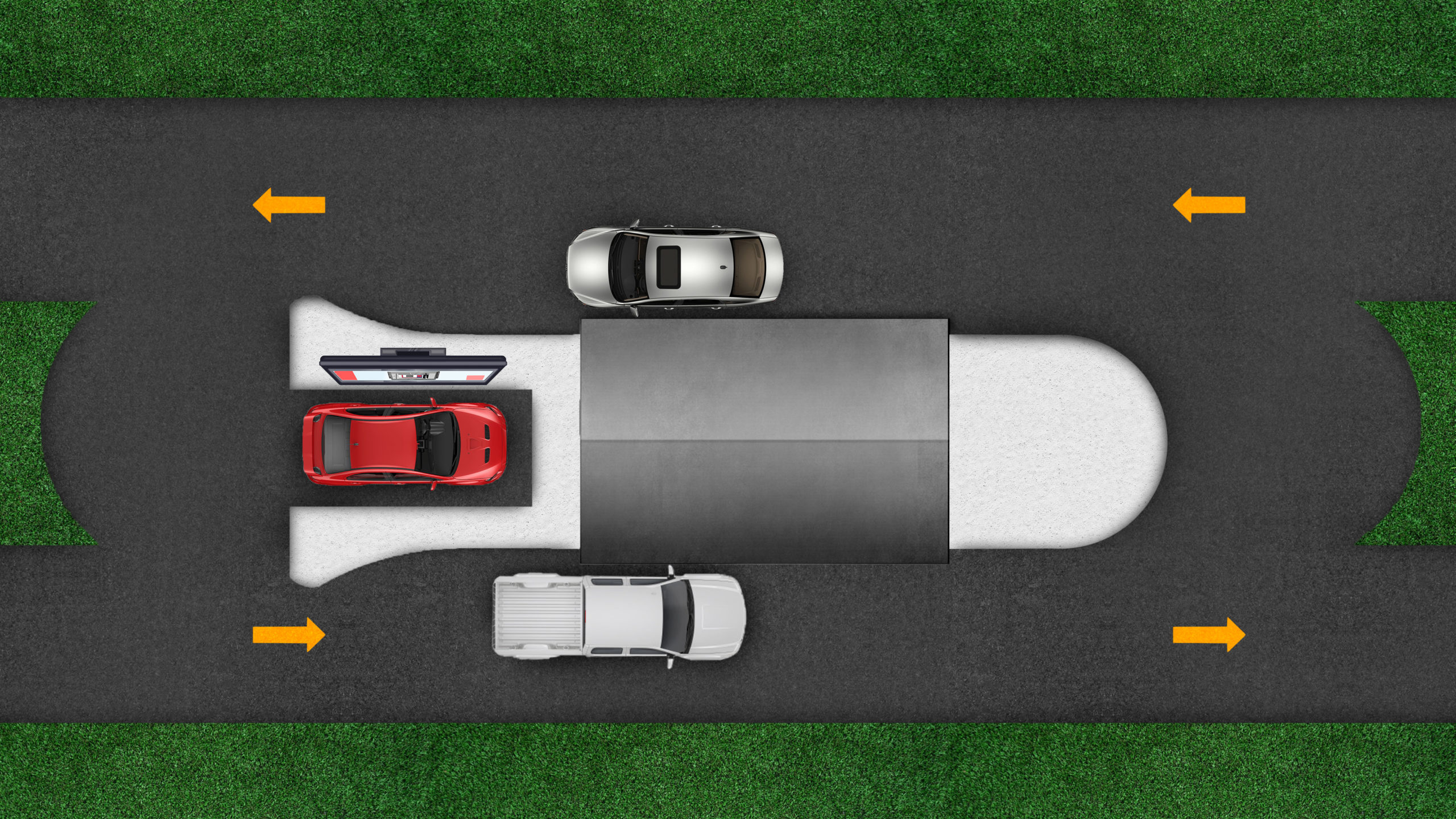

In Retail Branching Terms – Omni-channel servicing is not a new concept to retail banking. For an industry that is hard to change its ways, however, looking at product and services in a seamless, intertwined fashion between the online and offline must become part of any strategy going forward. We predicted long ago the rise of “curbside banking” and have now seen a post-pandemic bump in the drive-through. The branch is becoming less transaction and more advisory. Blending what can be learned or discovered online, then delivered and/or advised upon in-branch is key.

#2 – Retail Stores Have Become Fulfillment Centers

In General Retail Terms – Some retail stores had to reinvent themselves as fulfillment or distribution centers when doors were shut and/or foot traffic tailed off. This is a direct result of point #1 above, especially as it relates to in-store pickup and/or curbside.

In Retail Branching Terms – The translation here for retail banks and credit unions is not so much as “fulfillment centers” to sell your widgets. You must understand that the majority of folks who come into the branch to open an account very likely began their “shopping” experience for your products and services online. They probably looked into your credit card offerings and got an understanding of the different flavors and narrowed down the choices. They might have even determined the winner. When it came time to open, though, they decided to come into the branch to open the winner. They wanted that personal touch.

#3 – Free-Standing Stores Continue to Proliferate

In General Retail Terms – Free-standing stores, compared to their mall or shopping center based brethren have seen better store-over-store sales. The reason for this is directly related to the pandemic, with consumers choosing the larger overall footprint of these given stores, and not having to deal with the confines of a crowded shopping complex.

In Retail Branching Terms – At LEVEL5, we have a robust Market Analysis division, that has a very strong reputation for running 10-year proformas on different branch types. Without fail, our models always show better sales and faster ROI with a freestanding branch. Regardless of our models, the other primary takeaway here is that you should think of your Branch Strategy in the terms of Branch Optimization. Make sure any individual branch of yours is giving you the best return. The upside to a freestanding branch will nearly always outweigh any storefront branch.

#4 – In-Store Health and Safety Measures Remain Paramount

In General Retail Terms – Retailers, through and through, want you back in the store. Health and safety are paramount. This is marketed widely, both through advertising media, but also in-store. Retailers are glad you’re back and want you to feel safe while shopping.

In Retail Branching Terms – Welcoming customers or members back to the branch is no different than any other shopper type. Branches across the country have gone through great lengths to put up plastic guards, hand sanitization stations, social distances markers, alternating chairs, and more. While masks are becoming a thing of the past, a bottle of Purell only goes so far. LEVEL5 has created the Re-FI Design Program, which was developed to specifically help Bank and Credit Unions address the issues related to the pandemic beyond simple triage measures.

So much press in our industry trades was given to Digital Transformation and Branch related obituaries. Let’s be honest, though, most are click-bait. There are kernels of truth sprinkled about, but it leaves us to sift through the noise to find the relevancy.

Yes, Digital Transformation is a real thing. If your digital platforms are at least not on par, you have some catching up to do.

No, the branch is not dead. It simply needs to continue to evolve.

The main takeaway here is Omni-Channel. The digital world and retail world can have mutually exclusive strategies. If there aren’t cross-over and intertwined components, you’ll be left behind your competition. More importantly, you won’t be delivering a modern experience for your customers or members.

Edwards FCU Flies Ahead With New Flagship Branch

- Branch Transformation

- Credit Union

- Main Office

- Retail

Categories:

With the project just completed, and the moving boxes being emptied, Edwards FCU are now the proud occupants of a new Flagship Branch and Headquarters Building.

So impressive is this project, the CUToday wrote an article and added some great photos, so we’ll let them do the bragging for us.

To learn more about this project, and to discuss your next branch or headquarters building, Contact Us today.