Three Common Mistakes Credit Unions Make When Looking to Grow Core Deposits

- Consulting

- Credit Union

- Data

- Leadership

Categories:

This article was first posted on CUInsight.com.

How are we going to grow core deposits?

This is the question many credit union executives have recently been wrestling with. With zero percent interest rates a thing of the past, the only real option credit unions have is to expand their reach—attracting new members who make new deposits. How can you avoid mistakes credit unions make to grow core deposits?

The unfortunate reality is that many executive teams had been lulled into an uneasy sleep over the last 15 years, thinking that the low interest rate environment would never end. Now, finally facing the fact that we won’t be going back to that any time soon, they’re scrambling for a silver bullet to find new members, open new accounts, and bring in those new deposits.

In that scramble, we’re seeing credit union executives oftentimes making three big mistakes. If you want to cultivate a growth strategy that yields consistent, predictable long-term growth, you’ll need to avoid all three.

MISTAKE #1: Putting all your eggs in the digital basket.

Do you need a good solution for online banking? Of course. Are you going to create an online banking experience that differentiates you in your market to the degree that it will be your primary growth engine? Probably not.

Community based credit unions will almost always struggle to compete on a digital solution alone when compared with enormous banks that can invest tens of millions into their online tools. You need digital banking solutions that work, yes, but you’ll never grow solely based on your app or your online bill pay.

To compete and win the online banking battle will take more than you will ever be able to spend. If you’re putting all your hopes for growing core deposits into attracting new members through your slick mobile app, think again. The online experience is one factor—and not even the most important one—for people (no matter their age) who are evaluating banking options.

Digital alone won’t grow your core deposits.

MISTAKE #2: Believing the “branching is dead” myth.

Branching as a growth strategy is far from dead. If you’ve been paying attention lately, both PNC and JP Morgan Chase recently announced enormous investments in their branches.

They’re planning to open new branches, close under-performing branches, and remodel existing branches, investing billions of dollars in making sure that they’ve got up-to-date locations in the communities where their potential customers live and work.

At LEVEL5, we’ve seen insight-based branching strategies predictably grow core deposits no matter the economic landscape. Digital transactions don’t build trust. And trust is what ultimately drives where people put their money.

When you’re on a road trip, you’ve got to decide which gas station and convenience store you’ll use. How do you decide? You look for indicators of the other businesses nearby, if the exterior looks clean and well-maintained, and the ease of access to get in and get out.

If you consider all those factors when you’re going to spend 10 minutes there to fill up your car and get a snack, how much more important are those factors when people are considering where to put their money? Branching is still the best strategy to build trust and attract new members.

MISTAKE #3: Thinking data is the same thing as insight.

Do you remember when everyone started talking about the power of big data? The conversation was all about how advances in technology would allow smaller entities to gain the same access to enormous amounts of data to better understand their companies and their customers.

Big data by itself won’t help you grow your credit union. Everyone has data these days. You don’t need more data. You need more insight.

When you can sift through the mountains of data and draw conclusions that matter, that’s insight. When you can see and take advantage of real estate opportunities when the best locations aren’t even on the market, that’s insight. Insight comes from combining data from many sources—including boots-on-the-ground research—and leveraging both experience and expertise to understand what the data means … and how it can guide your growth strategy.

If you don’t avoid these mistakes credit unions make to grow core deposits, you’ll be taking enormous risks and miss key opportunities while your competitors—including the big banks like PNC and JP Morgan Chase—gobble up the best locations and new deposits.

But if you can resist and avoid these three mistakes, you’ll be on your way to developing a predictable growth strategy that will attract new members and increase your core deposits and get a jump on the competition.

To learn more about how you can set your credit union on a predictable growth path, download LEVEL5’s latest white paper, Core Deposit Growth Trends →.

3 Reasons to LAUNCH: Alignment

- Announcements

- Banks

- Branch Transformation

- Credit Union

- Leadership

- Retail

Categories:

We Have Liftoff

LEVEL5 has officially launched our LAUNCH Program.

This program has been specifically designed for the Credit Union and Bank executive who has a clear vision for the next 3-5 years, but is struggling to execute to these goals.

In this article, we discuss the second phase of our LAUNCH Program.

Phase II: Alignment

Phase I was the Discover phase, where we got to know each other, but most importantly, discussed current and future states, with goals and objectives laid out, but also discussing what’s been getting in the way of successfully executing to these goals.

In Phase II, we discuss the Alignment of your goals to our services. You did most of the talking in Phase I, now it’s our turn.

We will take the information we discussed, and add insights. We’ll present initial data to add value to our conversations, while also laying down a firm roadmap on how to break through the roadblocks and initiate plans to help you achieve your goals.

Based on relevancy of the need, we’ll recommend paths forward relating to Market Analysis as part of our Strategy service, as well as Site Selection to ensure geographic analysis aligns with available land and buildings in your desired Trade Areas.

Technology is a key strategic component in the branch. We’ll discuss options relating to the right “Tech Fit” across your current and/or future locations.

And finally, we’ll walk you through the Design and Build phases, speaking to budgets and timelines.

When relevant, we’ll also discuss previous efforts in the form of Case Studies, or share insights into current jobs that have relevance to your scenario.

Why LAUNCH At All?

The LEVEL5 LAUNCH Program follows a methodical, yet casual approach to uncovering the critical needs of your Financial Institution. Through a series of easy discussions, our team will be able to capture your goals, but also understand what is getting in the way of you achieving them.

From there, we’ll be able to make actionable recommendations on how to execute to these goals.

To learn more about our LAUNCH Program, and to schedule your first Discover call, Contact Us today to get going.

3 Reasons to LAUNCH: Discover

- Announcements

- Banks

- Branch Transformation

- Consulting

- Credit Union

- Leadership

- Retail

- Services

Categories:

We Have Liftoff

LEVEL5 is excited to help your FI with your growth initiatives in 2023 and beyond with our LAUNCH Program.

We’ve built this phased approach to assessing and launching your growth strategy around the methodical steps aimed at uncovering the challenges getting in the way of your Credit Union or Bank achieving its objectives and goals.

Phase I: Discover

The first phase in. our LAUNCH Program is called “Discover” – when our relationship will begin with a casual conversation, no more than 30-minutes, where we simply have a chat.

In this discussion, we’ll go over our services and background – but this phase is frankly about you. We’ll want to know about your FI’s history, your place and positioning in the communities you serve, and most importantly, current state versus desired state.

Your “Current State” is where you are today – number of branches, trade areas, assets, branch type mix, and of course, your member/customer base.

Your “Desired State” is where you want to be – expansion plans, asset goals over the next 3-5 years, thoughts on branch types, hub & spoke models, as well as any M&A’s that may be in play.

From here we’ll start to discuss next steps. Most importantly, we’ll need to uncover what is getting in the way of you executing and achieving your goals. That bridge from here to there is typically full of roadblocks, but that’s where LEVEL5 comes in.

Why LAUNCH At All?

The LEVEL5 LAUNCH Program follows a methodical, yet casual approach to uncovering the critical needs of your Financial Institution. Through a series of easy discussions, our team will be able to capture your goals, but also understand what is getting in the way of you achieving them.

From there, we’ll be able to move into the other phases of the LAUNCH Program and make actionable recommendations on how to execute to these goals.

To learn more about our LAUNCH Program, and to schedule your first “Discover” call, contact us today to get going.

3 Reasons to LAUNCH: PROPOSAL

- Announcements

- Banks

- Branch Transformation

- Credit Union

- Leadership

- Retail

Categories:

We Have Liftoff

LEVEL5 has officially launched our LAUNCH Program.

This program is perfect for the Credit Union and Bank executive struggling to execute their strategic goals.

Phase I was the Discover phase, Phase II was Alignment. In Phase III, we’ll discuss the delivery of the Proposal and what that means to getting you that much closer to Liftoff.

Phase III: Proposal

By Phase III, if we’ve done our job, we’ve listened intently, captured all of your thoughts and concerned, and have now translated them into a Proposal for your review.

In this proposal, we’ll outline the overall scope of services, whether they be singular, or reflect an integrated deal, where all of our services are reflected, to present budget considerations and proposed schedules.

In this Phase, we’ll look to set up one final call, where we’ll be able to review the proposal, but most importantly, allow you the opportunity to ask any final clarification questions because from here, this proposal is either signed, or goes to the Board for final approval and signature.

Once the proposal is signed, we are officially at LIFTOFF.

While your project has been accounted for up to this point, the execution of the Proposal allows for your project to officially be assigned. Depending on scope of services, you will be introduced to your project lead and the project will commence in earnest.

Why LAUNCH At All?

The LEVEL5 LAUNCH Program follows a methodical, yet casual approach to uncovering the critical needs of your Financial Institution. Through a series of casual conversations, our team will be able to capture your goals, but also understand what is getting in the way of you achieving them.

From there, we’ll be able to make actionable recommendations on how to execute to these goals.

To learn more about our LAUNCH Program, and to schedule your first Discover call, Contact Us today to get going.

5 Key 2022 Planning Strategies

- Banks

- Branch Transformation

- Consulting

- Credit Union

- Data

- Leadership

- Training

Categories:

As the calendar has now rolled into October, you undoubtedly have been called into the first of several meetings to discuss your strategies and goals for next year.

It’s planning and budget season.

How will you gain more members/customers and grow relationships with existing ones next year? Well, now’s the time to answer these questions.

Growth-minded credit union and community bank leaders need to make vital decisions to propel business growth in 2022 and an effective plan takes into account the changing nature of banking.

Our team, here at LEVEL5, lives and breathes financial institution growth every day, so we’re sharing our 5 key 2022 planning strategies for credit unions and community banks.

#1 Analyze Your Branch Network

Before you can begin to think about organic growth with net new customers in net new areas, you need to ensure the current branches and the customers they serve are performing.

Initially, you must to take a holistic assessment of your entire branch network.

Do you have a current and accurate understanding of loan and deposit performances per branch?

Which demographics make up your clientele at each branch and have they changed?

Do you have the right number of branches within a certain market to benefit from the network effect?

And most importantly, which branches are performing at forecast, and which ones are not?

Knowing what you’re working with is the foundation for making correct growth decisions for next year. In order to know, your finger needs to be on the heartbeat of the entire organization.

#2 Optimize Your Branch Network

Once you’ve captured a clear picture of your network, it’s time for action.

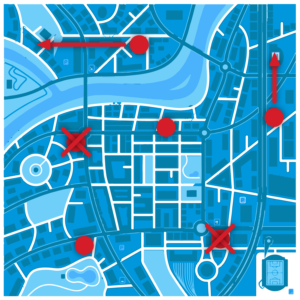

While some branches may be thriving, others may not be performing. In order to optimize, it may be crucial to consider closing or relocating them before they can take more toll on your financial health than they already have.

It’s best to get ahead of loss by data-driven analysis to determine what needs to be done. Once a non-performing branch is closed, you can move those resources into a new branch that will turn positive numbers within a healthier market.

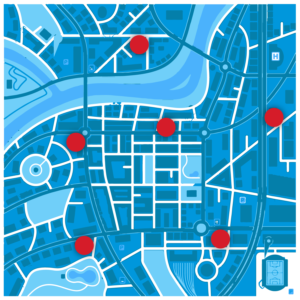

Identify geographic markets where your optimal demographic is growing. With the right branch in the right place, you’re armed to expand your network in an impactful way. Informed consulting services tell you which branches to close, keep, remodel, and/or relocate.

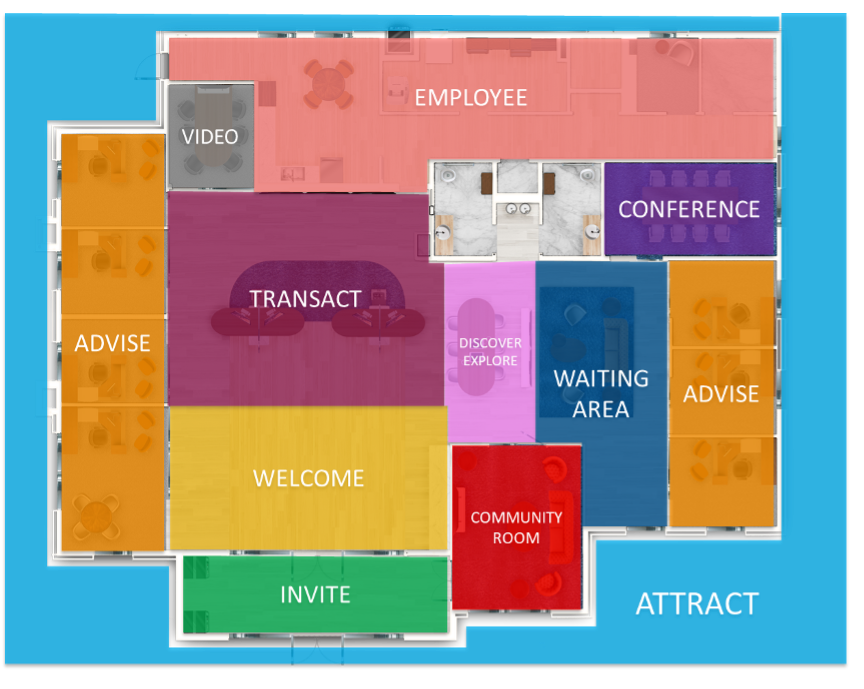

#3 Boost the Retail Experience

Branches are still at the forefront of customer engagement and retention, but due in part to digital channels, their role has become less transactional and more about onboarding and advisory sessions.

The Financial Brand publication notes that bolstering a credit union or local bank standing as a trusted advisory community institution helps to keep them competitive against mega retail banks. From our experience, we couldn’t agree more.

Therefore, the branch should be where new customers come to open accounts and clientele visit to seek advice from a real person, making the functional experience of your spaces paramount. After all, the effort you put into your environment speaks to the effort you’ll put into your banking relationships.

All great branches should include at a minimum:

- An inviting entrance, opening into a welcoming space that facilitates trust with staff

- High quality branding, amenities, and materials in line with your organization’s culture

- Informal advisory areas

- Private advisory areas

- Comfortable furniture

- Well-lighted spaces

Our ReFi program helps you assess clientele experience in your current branches with actionable ways to remodel, re-inventing an inviting and engaging branch experience.

#4 Secure Your Budget

Planning is key, but it’s all backed up by the ability to properly secure funds for future projects.

Make sure to properly communicate all future fund needs to all stakeholders and decision-makers. In addition, make them aware of the purpose behind each project so proper decisions can be made now and no surprises pop-up later on.

A well-defined plan, with actionable and attainable goals will be the projects awarded the proper funds for execution.

#5 Prepare An Employee Training Plan

Ensure your tellers and bankers on the ground are up-to-speed on the ultimate purpose of the branch. They need to know that they’re on the front lines of fostering relationships and growth.

While critical functions such as onboarding, executing transactions and product cross-selling are key to any in-branch function, there is always a gap in the training where a newly built (or remodeled) branch and its core strategic function are lost on the staff that occupy it.

Ensure that your branch staff not only know how to perform the duties defined in their job descriptions, but also how to do it in the space you’ve planned and built.

To learn more about the 5 key strategies outlined above and how LEVEL5 can assist you with your strategic assessments and branch build projects, Contact Us today. We’re ready to help you meet your 2022 goals.

The #1 Hidden Key to Your Reopening

- Banks

- Branch Transformation

- Credit Union

- Leadership

- Training

Categories:

The phrase “New Normal” is getting thrown around a lot today. In the wake of the pandemic, things are undeniably different, even though we are all collectively pining for things to go back to the way they were.

For Retail Bankers who have now opened branches back up, things are inevitably different. The branch may look the same. The people may be the same smiling faces that were there before the shutdown. But we can’t ignore that there has been a major change.

Sanitization stations are readily available, shields are acting as a transparent barrier to our conversations, and policies are different.

Back during the shutdown, many meetings were had as to what “New Normal” branching will look like. While this is still unfolding in front of us, new policies have been in place to ensure the safest environments possible.

Policy documents were drawn up, bank managers were briefed, who in turn had team huddle ups – then, boom, the gates were lifted and we were back in business.

Yet, it’s not really that easy, is it?

To properly enact your new policies, you must train the staff. This is not as easy as mandating policies in a pre-opening huddle-up, or distributing a flyer. It would be nice if it was – it’s just not.

We talk quite a bit about training when it comes to Branch Transformation. In our “PLACES!” training, the key to a successful branch opening is ensuring that the frontline staff understand the space in which they are now working. This includes the flow, the procedures, and the customer service objectives.

While re-opening your branch likely has not seen structural changes just yet, policies and procedures are different. They must be exercised, repeated, and coached.

Think about the training that is needed to reinforce these new policies. Speak to them, quiz them, and most importantly, make them act it all out. Repeat this until you feel the branch staff knows exactly how and what to do.

So, among the many things on your plate, you must ensure that proper training is enacted as we are now operating branches in this “New Normal.”

Peter Pan Was A Bad CEO

- Banks

- Branch Transformation

- Credit Union

- Leadership

- Retail

Categories:

In the 1953 Disney movie, Peter Pan instructs the Lost Boys to follow John as they go exploring Neverland. Off they go, singing “Following the Leader.” John puts on a brave face and the Lost Boys follow. Peter Pan had instructed them to do so, but his advice was short-sighted. John didn’t necessarily know how to lead, and he definitely didn’t know where he was going. Peter Pan is a bad CEO.

Some of us suffer from “Peter Pan Syndrome” in life (we do not want to grow up). There is, however, another kind of “Peter Pan Syndrome” in the Corporate world. It is one where too many company leaders are content to “follow the leader” instead of blazing their own path forward.

Some of us suffer from “Peter Pan Syndrome” in life (we do not want to grow up). There is, however, another kind of “Peter Pan Syndrome” in the Corporate world. It is one where too many company leaders are content to “follow the leader” instead of blazing their own path forward.

Why would you follow someone if you’re not entirely sure that they know what they’re doing in the first place?

And now, in a post COVID19 world, the dangers of “following the leader” are never more present. Retail Banks or Credit Unions are still trying to figure out the next step to right the ship and see what will become of their institution. Observing and sharing ideas may very well be a good idea for us all to band together and get through this, but when it comes time to grow again (and that time is coming), you must do this on your own.

When we at LEVEL5 begin a relationship with a client, we aim to uncover three key elements by asking:

- Can you succinctly describe your organization and what makes you different?

- Do you have an approved 5-year plan?

- What are your branch (and headquarters) level strategies?

When looking to rebuild your 5 year strategic plan for your Branch Network, below are 3 classic traps many leaders become ensnared:

“I Want That!”

While we’re not going to dive into the details of our Discover phase (the first step in our Blueprint process), we should still talk about where things must start. When we begin to get to know a client, one of the main questions we always ask is: “What do you want?” But what we’re really asking is “What are your strategic initiatives and goals?”

This probing question often gets misinterpreted. It will perhaps cause a client to jump right past the strategy, goals, and objectives, and right into the Design of the branch. There is always the inevitable reference of a nearby branch from a known competitor, or a flagship branch from one of the big boys, with a CEO proclaiming, “I want that!”

Flattery is nice, and mimicry does have its place. The issue with this proclamation, however, is that it completely skips over the critical early stages of the process. First, you must identify what you want a given branch to do for you in the community and your clients. Strategy will yield Design, not the inverse.

An example of the right way to implement an “I want that” strategy is perhaps how the Hooksett, NH branch came to be for Northeast Credit Union. Once the strategy was identified, Trade Area chosen, and branch type chosen via sound data, it was time for the Design conversation. CEO, Tim Collia, worked with our Design team to identify a new, modern aesthetic for the branch that was reflective of the natural elements in New Hampshire. It would also set the foundation of a new branch prototype design not only for that branch, but for all future branches yet to come.

The Design for NECU did not “follow the leader” – rather, they set the tone that was right for them. It began with strategy.

The Mysterious Case of the Missing Five-Year Plan

Another fundamental question we ask in our Discover phase is “What is your five-year plan?”

While this question is perhaps more directed at the macro Retail level, it helps us understand what is happening at the corporate level so our Consulting Team can run the best analysis possible.

While this question is perhaps more directed at the macro Retail level, it helps us understand what is happening at the corporate level so our Consulting Team can run the best analysis possible.

The issue here is often times, the answer to this question is that there isn’t one. Many Community Retail Banks and Credit Unions may very well not have a five-year plan. They instead only plan things out along a 12-month or at most, an 18-month time horizon. This may be the reality, as things are fluid and ever changing (especially now), but it brings up a fundamental challenge in this space.

Creating a 5-year plan is critical. A 5-year road map (even with change) lays the foundation for a strong corporate vision. An 18-month road map can set you down the right path, but, at worst, it can make you more reactionary instead of proactive.

When we began working with Canvas CU (Denver, CO) they outlined a very specific and well-defined multi-year plan that included aggressive growth plans up and down the Colorado front range, into deeper bedroom communities in Denver, then up and down the I-25 corridor. We are now several years into that execution, with Canvas still eyeing a multi-year strategic growth horizon.

Think Like A Golfer

There may very well be 144 or so golfers at any given (pre cut) golf event. That’s a lot of competition, but each golfer is really just focusing on themselves.

At least, they should be.

Sure, they’ll take a peek at the leaderboard, but in reality, any other golfer’s actions do not influence whether they hit the fairway off the tee or sink that birdie putt.

Sure, they’ll take a peek at the leaderboard, but in reality, any other golfer’s actions do not influence whether they hit the fairway off the tee or sink that birdie putt.

The same can be said about running a Retail Bank or Credit Union. Yes, you want to be aware of what your competition is up to, and yes, you want to peek at the leaderboard, but are you really going to switch clubs or shoes if someone else hits a great shot? You shouldn’t.

The point here is this: Don’t follow the leader. Be your own leader. Set your path forward. Have a game plan. Not for the 18-holes, but for all 72 holes over the four day tournament – this is your 5-year plan.

Keep an eye on what the competition is doing, take a cue from it and even learn from it. But you must be true to who you are and your strategy will be born from that. After all, if you see a competitor go heavy on tech, but your customers are a bit more traditional, don’t chase that shiny object and implement something that won’t be well received.

So, Peter Pan was a bad CEO. Don’t follow the leader. Follow your own path.

I hope your childhood has not now been compromised.

But here’s the good news.

LEVEL5 can help you get there. Our Business Development managers and Consulting Team are experts at helping you craft, evolve and mold your vision into a solid 5-year plan that is yours and only your. Contact Us today to learn more and get going today.

5 Levels of Branch Preparedness in a COVID-19 World

- Banks

- Branch Transformation

- Credit Union

- Leadership

- Retail

Categories:

In last week’s White Paper, we looked at what has transpired and what is to come for Retail Banks and Credit Unions regarding COVID-19. There, we identified 5 distinct levels of preparedness. As you’ll see below, we are currently in a bridge period between LEVEL 2 and LEVEL 3. Here, we’ll dive deeper into each of these levels. More importantly, though, we’ll discuss what you can be doing to prepare for whichever level you’re in, and for which level is approaching.

LEVEL 1 – Close/Limit Branch Operations

Description – This level has now past, and you are already beginning to look ahead. You are likely finding yourself in LEVEL 2 or even LEVEL 3.

Timeline – March & April 2020

Action – Branches were completely closed. Of those that stayed open, hours were altered and traffic was directed to drive-thru’s, digital channels, and customer service lines.

LEVEL 2 – Identify The Quick Fixes

Description – Your internal teams at the Executive, Retail, Operational, and Marketing levels have met and begun to look beyond the closures and limited hours. They are now discussing what permanent or semi-permanent measures need to be taken in preparation for an eventual re-opening. These conversations have likely already taken place, but whether they are completed, or need to be revisited is different.

Aside from branch/staffing operations and client communication measures, the “quick fixes” looking to be implemented include Sanitization Stations and protective shields, also known as “sneeze guards.”

Timeline – April & May 2020

Action – If you are looking for assistance in sourcing these in-branch materials, contact us for guidance.

LEVEL 3 – Open & Optimize Branch Network

Description – At this point in time, you are probably at this level. Branches are just beginning to open again or they’re opening imminently. Now that procedures are in place, staff has been (re)trained in operating the branch in this new normal. There is an interesting duality here that needs to be addressed.

In one regard, you need to pay close attention to how the early stages of your reopening are going. Not only from a benchmark and performance perspective, but from a health perspective.

How is your staff managing the new procedures? Do they feel safe and do they feel capable of doing their job under new guidelines and restrictions? What about your clients – of those that have returned? Do they feel comfortable in your branch? Are they distancing appropriately? Are they able to conduct simple transactions and receive counsel on financial questions while masked, 6 feet apart, and perhaps from the other side of a protective shield? These new scenarios are the new normal, at least until they are no longer relevant or needed.

The second consideration here is to begin looking at your overall branch network holistically. Now is the time to begin assessing a longer term analysis on how branches were prior to COVID-19. With those benchmarks, assessments will need to be made if those performance trends continue, flip, or possibly become greater.

Regardless of the direction of branch performance, you will likely need to do a branch assessment to build a business case on what to do with these assets.

Timeline – May & June 2020

Action – You can look at the trends of your branches in this new normal, but LEVEL5 can help you assess your branches. Our “Current Branch Network Plan” is the perfect path forward to look at your overall branch network and assess both past and current performances. Most importantly, however, we will use our custom and proprietary algorithms to run a 10-year proforma for each of your branches. We will give definitive recommendations on next steps as a result

LEVEL 4 – Establish New Prototype Branch

Description – Now that the assessments have begun, it’s time to begin to look ahead at establishing a new Design for your branch network. The notion of a consistent branch design with essential branded elements and iconic features has always been a necessity. This is more about the remodeling of existing branch layouts to accommodate the branch going forward. While reactionary measures have likely taken place by this stage (distance markers, protective shields, sanitization stations), a more permanent remodeling can begin to take shape.

The LEVEL5 design team can look at your current branch network and provide you actionable drawings that can speak to an overall better client flow through the branch. This includes permanently placed sanitization stations and the possible removal of some fixtures to allow for more natural spacing. It also includes the introduction of the right technology to make your branch as “contactless” as it needs to be.

Timeline – July – December 2020

Action – Contact LEVEL5 today to begin your Branch Design Assessment, a holistic Design review of each branch in your fleet, what will need to be changed or introduced, and ultimately, what this would look like, both visually through professional renderings, and budget to act upon the concepts.

LEVEL 5 – Begin Branch Expansion

Description – The final level of branch preparedness will begin to take action in 2021, but should begin to be planned in mid to late 2020. By now, you have course corrected your current retail network from an optimization and functional perspective. It is now time to begin turning your attention to growth once again. The road to economic recovery may still be protracted, but it doesn’t mean that there aren’t new accounts to win, new geographies to expand into, and new branches to plan. Land and construction costs will be cheaper than they have been in many years. Real estate availability will be better than ever. The costs for Design and Build will be lowered due to less overall demand.

Timeline – January 2021 & Onward

Action – The LEVEL5 Branch Growth Plans is the perfect consultative approach. This data driven package looks at your overall expansion plans, both in current and net new geographies. It will supply you with an ROI, 10 year branch Proforma, staffing modeling, and branch type modeling. This will all help you de-risk your overall decisions.

Regardless of how you are approaching your branch operations, we hope our White Paper and this 5-stage guide helps you formulate a path forward to compartmentalize key strategic considerations as these months unfold.

Continue to stay safe and good luck.

Crisis is Danger and Opportunity

- Branch Transformation

- Leadership

- Retail

Categories:

Much has been written and discussed when it comes to the Chinese word for “Crisis.”

We’re not experts on Chinese characters, its different dialects, or whether the Western interpretation is right or wrong.

The fact of the matter is that it has been used so much the definition is now accepted regardless.

We’re not going to go down the interpretive rabbit hole. Instead we’ll turn the lens on how this modern interpretation is relevant for our current economic state. Specifically, we’ll look at the situation currently facing Retail Banks and Credit Unions.

With COVID-19, we are very much in a crisis.

There are health risks so severe that they have burdened our hospitals unlike anything seen before. It has had the entire country housebound as a way to limit the spread of this highly contagious disease. Only just now are states beginning to either open or discuss opening back up, but to an unknown immediate future.

Now, the crisis presented by COVID-19 to our economy and the very industry in which we exist has left us scrambling to triage our business and contemplate the future.

Slowly, the shock of the suddenness has worn off and the proverbial light at the end of the tunnel is upon us.

It may be time to look beyond the danger and find the opportunity in this crisis.

When thinking about Branch Transformation and really Retail Banking in general, the big question is; will it all change?

This is a valid question. When you take a deep breath and apply reason, however, the trends in the industry may be magnified by this crisis, but do not spell the end of the Retail Branch. Digital will continue to grow and have an important play, but the branch and the physical interaction it provides will not go away.

They said the Retail store was doomed when the Internet matured and eCommerce became truly viable both in function and customer adoption. Yet, here we are. Yes, the retail landscape has changed, but it really just evolved. Now, even Amazon, the very company that is perceived as the death knell for many retailers, actually operates its own brick and mortar stores.

This is Omnichannel and no different for Retail Banks.

The opportunity in this crisis is to not panic, but to bring critical strategies to the forefront and set your organization up for a strong, healthy future.

Any future stage is uncertain. But you still must plan and execute just the same.

4 Areas of Opportunity

Innovation

Now is the time to be innovative. The only thing constant in life is change. Now, perhaps more than any time in our professional lives, is the right time to implement change.

Change can be made in operational models, digital investments, technology, branding, and the branch itself.

Omnichannel has been and will continue to be critical. While the idea of digital has gotten a lot of press lately, your customers will still want the choice and option of a digital or in-person interaction (even if it means wearing a mask).

Now may very well be the time to invest in the right technology. While machinery like Recyclers and Interactive Teller Machines (ITM’s) are not new, these technologies will come to the forefront as a way to offer transactional services in a near-contactless scenario. With the right technology deployment, comes the branch.

Branch Network

If you’re like most and have one, if not many, social media handles for you to catch up with friends, family, and cat videos, you most likely have seen the Internet crawling with posts of what people have been doing with themselves since self-quarantining. Many people have found this as an opportunity to take up a hobby, finish a project, or even take on a project from scratch entirely.

When looking at your Branch Network, perhaps this is not all that different. Use this Crisis as an opportunity to:

Optimize – Almost any Retail FI with a fleet of branches has a couple that are underperforming. These ones can prove to be a burden on the books. Whether you know it indefinitely or need to run some additional analysis, now may be the time to close those that underperform and refresh your fleet.

Refresh – Like most FI’s that we deal with, there is great inconsistency in the retail fleet. This can be a combination of when they came on line or the host of technology and design styles. Set yourself up for the future with a consistent fleet of branches. Institute a true Hub & Spoke model so your customers have a consistent experience no matter where they are.

Expand – Growth may be a daunting concept, particularly in this crisis, but some of the more notable and respected FI’s in the space saw the opportunity back in the 2008 Great Recession. Many of your competitors will go stagnant. This will provide you with an opportunity to gain traction in new markets with new customers. Ultimately, you’ll be able to grow your assets.

Real Estate

The opportunity to grow in markets and on the optimal street corner will become more present. In a financial and economic crisis, business will fail. Financial Institutions will fail. Land to build and buildings to occupy will be there for the taking and at much better prices than just a couple of months ago.

Build Costs

Costs of goods will go down. From raw materials to labor, including Design and Construction, services will be driven downward due to supply chain impacts and fewer overall projects. If you’ve ever wanted to build, the cost to do so may never be as effective as the period we’re entering.

How your company responds in this time is up to you. Yes, there are inevitably forces beyond your control and sometimes wishes and tactics are only as good as the tools to do something about it.

If you’re in a position to do something about it, and need a partner to help you form and realize your vision, contact us today to begin the conversation.

From the desk of: Leadership Lesson from our CEO | Goal Setting

- Announcements

- Leadership

Categories:

Goal Setting Equals Happiness?

Much has been written about people wanting more from their job (goal setting and achievement). Happiness equates to (not surprisingly) bonuses, raises, promotions and recognition. These goals are universal, and young workers put pressure on themselves to achieve them. But without a clear understanding of what your organization is expecting of you, that happiness is much harder to achieve.

These expectations, coming in the form of annual goals or objectives, are essential to career building. Furthermore, when you align your performance to the expectations of the organization, then you will be amazed at the degree to which you separate yourself from others. That means more opportunity and more money.

However, goal setting is often moved to the bottom of the list due to the everyday demands of your position. It’s completely normal. Still, it’s on you to overcome those demands and get a meeting with your superiors. Setting clear goals keeps your hard work from being overlooked.

True Goal Setting – A Frame Work

I encourage young talent to set no less than four goals, and no more than six. Here’s how you should frame them:

- They should be set annually.

- Each goal should be measurable, so they can be scaled and the subsequent performance evaluated either as exceptional or poor.

- Employees are responsible for gathering verified data.

- Results matter. The ability to be disciplined in your time management can’t be stated enough.

Breaking Down the Goals

Two goals should be achieved individually. Just doing your job doesn’t count – that’s already expected of you. Goals should be to increase your effectiveness, whether in terms of (1) quality of your work or (2) ability to get things done quicker, so you can be more productive. These goals are objective, but it’s up to you to keep track of them.

One goal should be set with you as a team member. Teamwork is essential to any organization and you should strive for more effectiveness in this regard. It is not a popularity contest, but how well you work with others. Peer evaluations can give you wonderful feedback.

At least one goal should be set with you as a team leader. It’s a difficult goal, requiring you to look at your current job description and brainstorm ideas that should be explored to develop best practices. Leadership is not about being given a title; it is about proactively looking for ways to be a leader, then effectively leading the team to results.

Stretch Goals – Benefit the Organization

That’s four goals so far, the minimum you should strive to achieve. Any goal beyond these should benefit the organization directly. This is what’s known as a stretch goal. A stretch goal tests your range and flexibility. You may have a firm grasp on your current job function and now it is time to reach and grab something else. A stretch goal is not about asking for a promotion. It is not about asking for more responsibility. It is about you taking on an increased workload or a chance to improve the business. A stretch goal is about showing that you can make something happen faster, cheaper and with better quality. This demonstrates that you are ready for more responsibility, more opportunity and more money.

Careers are earned and not given; don’t be a bystander who wishes for more. Seize the opportunity through achievement.

This has been the last article in our “From the desk of” series, special content created just for you, from our CEO Brad Eller. Share it as you wish, in the form of a link, or informally. The intent is to help your people align their career goals with the everyday needs of the organization, creating value.