Core Deposit Growth Strategy: Part 1

Understanding Historic Trends is Critical for developing & executing strategy for core deposits growth

This is part 1 of a 3-part series to help financial institutions develop effective, long-term strategies to grow core deposits.

What Was the Financial Industry seeing in historic trends for core deposits in January 2000 and How Has it Affected Today?

Let’s set the stage by thinking back to January 1, 2000. We all awoke with a wary eye. Had our efforts to ensure all our electronics were Y2K compliant succeeded? Or had civilization imploded at the stroke of midnight due to a glitch that the earliest programmers never envisioned? The glow from our bedside alarm clocks gave us a glimmer of hope. When our trusty coffee makers bubbled to life, we began to rest assured that life would go on indeed.

When we were in our “just glad to be alive” moment, we couldn’t imagine the changes that the next twenty-plus years held for our economy and the financial services industry.

Strategies for the Future of Financial Services Should be Informed by the Past

Although the economic shifts in the last 2-3 years have appropriately created a growing level of concern for credit unions and community banks, additionally considering the past two decades puts today’s financial landscape in clearer perspective.

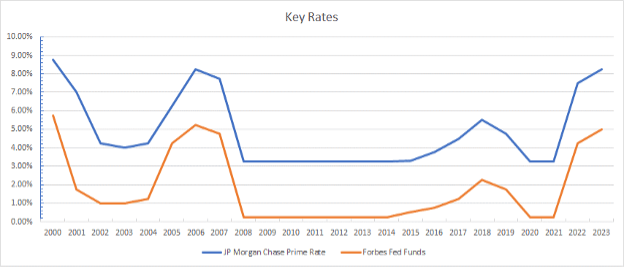

A review of the prime and Fed Funds rates will give us insight into the challenges we’re facing today.

Following the dotcom boom and Y2K was the dotcom bust. Then the horror of 9/11 weighed in and rates headed for the cellar.

The economy regained its strength, largely led by a housing boom, and rates went up.

Then, like a lightning strike, the housing bubble burst, and we found ourselves in the “Great Recession.”

This resulted in a protracted period of unbelievably low rates. Again (and predictably) home prices started to rise, and rates were adjusted upward. Then came COVID, and the rates were pushed back down to their historic lows.

Eventually and thankfully, the pandemic subsided, but we were faced with “new normal” conditions—just to name a few examples, remote work became more of the norm, retirement/resignations spiked, and a blistering housing market ensued. In response to this “new normal” the Federal Reserve instituted fast-paced, significant rate hikes to the point that nothing about our economy seems certain.

How Did We Get Here?

It’s clear that the season of very low rates resulted in a readjustment in personal and corporate budgets. Low rates made everything more affordable and we adjusted our sails to take advantage of the favorable breeze.

For the financial services industry, there is a renewed focus on core deposits. Why? The low-interest rate days are gone and unlikely to return. Borrowing to fund lending is significantly more expensive.

Further, borrowing of any sort is more expensive, which threatens loan demand. Highly-driven lending teams are constrained by the institution’s ability to fund loans and maintain adequate spreads.

This is all brought up to make this point…There are banking professionals in the industry who have 15 years of experience on their resumes but have never experienced a “normal” rate environment. It’s not their fault—they couldn’t choose the year they were born!

Build with Confidence

Put LEVEL5’s proven expertise to work for you. De-risk your future growth with the strategy, technology, site selection, design, and build services you need to launch the next phase of your financial institution’s branch network.

Our Team Helps You with Core Deposit Growth Strategy in Today’s Market

Given the current economic landscape, now is certainly the time to reexamine your financial institution’s strategic planning for the long-term. In many ways, the conditions that threaten the industry are more of a “return to normal” adjustment than a doomsday scenario.

To find solutions to guide us into the future, we need to understand more of the industry’s historic response to similar conditions and return to some tried-and-true long-term strategies for sustainable growth.

What are those strategies? That’s what we’ve covered in the next parts of this series.

Have questions today? Please contact us! For over 2 decades, LEVEL5 has developed winning credit union and community bank growth strategies through every ebb and flow of the economic landscape, so you can certainly say we know a thing or two about charting a course for a healthy future.