Forbes: 4 Retail Trends and What They Mean for Branches

- Banks

- Branch Transformation

- Consulting

- Retail

Categories:

While some semblance of normalcy is incoming, the impact of the pandemic is still very much a reality.

As it relates to retail branching, the early days of the pandemic seemed to have three primary predictions:

1) The Branch is Dead

2) The Branch Will Come Back Stronger

3) The Branch Will Change

Like most things in life, level-headedness has prevailed. With a good bit of recent history now behind us, the right answer here seems to be point #3. The branch will change due to the pandemic. Let’s be honest, though, the branch was already changing and will continue to do so regardless.

Forbes, who does a great job of keeping the finger on the pulse of so many topics, recently published an article called “Four Trends Reshaping The Future of Retail.” They talk evolving trends greatly impacted by the pandemic. Here, we will highlight those four trends, but look at it through the lens of retail banking and what it means for your organization.

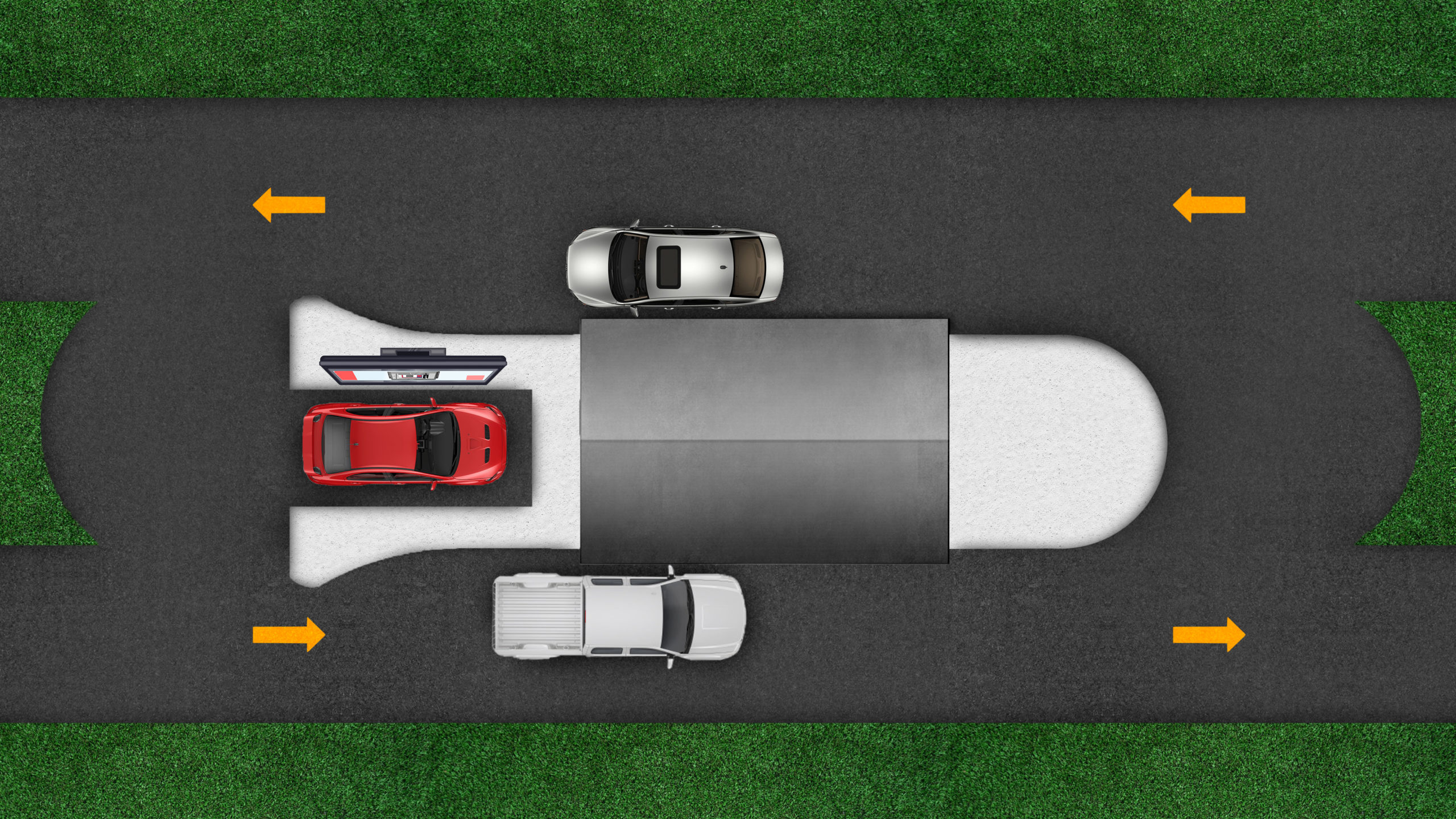

#1 – Buy Online, Pick Up In-Store & Curbside Pickup Remain Popular

In General Retail Terms – The main takeaway here from the Forbes article is the concept of “Omni-channel.” What you can begin with online has either a hand-off or direct correlation to what happens in-store (or vice-versa). This still has great relevance to any Bank or Credit Union. These services were available to most retailers prior to the pandemic, but really came into their own when many stores were closed and while customers eased their way back to “normal.”

In Retail Branching Terms – Omni-channel servicing is not a new concept to retail banking. For an industry that is hard to change its ways, however, looking at product and services in a seamless, intertwined fashion between the online and offline must become part of any strategy going forward. We predicted long ago the rise of “curbside banking” and have now seen a post-pandemic bump in the drive-through. The branch is becoming less transaction and more advisory. Blending what can be learned or discovered online, then delivered and/or advised upon in-branch is key.

#2 – Retail Stores Have Become Fulfillment Centers

In General Retail Terms – Some retail stores had to reinvent themselves as fulfillment or distribution centers when doors were shut and/or foot traffic tailed off. This is a direct result of point #1 above, especially as it relates to in-store pickup and/or curbside.

In Retail Branching Terms – The translation here for retail banks and credit unions is not so much as “fulfillment centers” to sell your widgets. You must understand that the majority of folks who come into the branch to open an account very likely began their “shopping” experience for your products and services online. They probably looked into your credit card offerings and got an understanding of the different flavors and narrowed down the choices. They might have even determined the winner. When it came time to open, though, they decided to come into the branch to open the winner. They wanted that personal touch.

#3 – Free-Standing Stores Continue to Proliferate

In General Retail Terms – Free-standing stores, compared to their mall or shopping center based brethren have seen better store-over-store sales. The reason for this is directly related to the pandemic, with consumers choosing the larger overall footprint of these given stores, and not having to deal with the confines of a crowded shopping complex.

In Retail Branching Terms – At LEVEL5, we have a robust Market Analysis division, that has a very strong reputation for running 10-year proformas on different branch types. Without fail, our models always show better sales and faster ROI with a freestanding branch. Regardless of our models, the other primary takeaway here is that you should think of your Branch Strategy in the terms of Branch Optimization. Make sure any individual branch of yours is giving you the best return. The upside to a freestanding branch will nearly always outweigh any storefront branch.

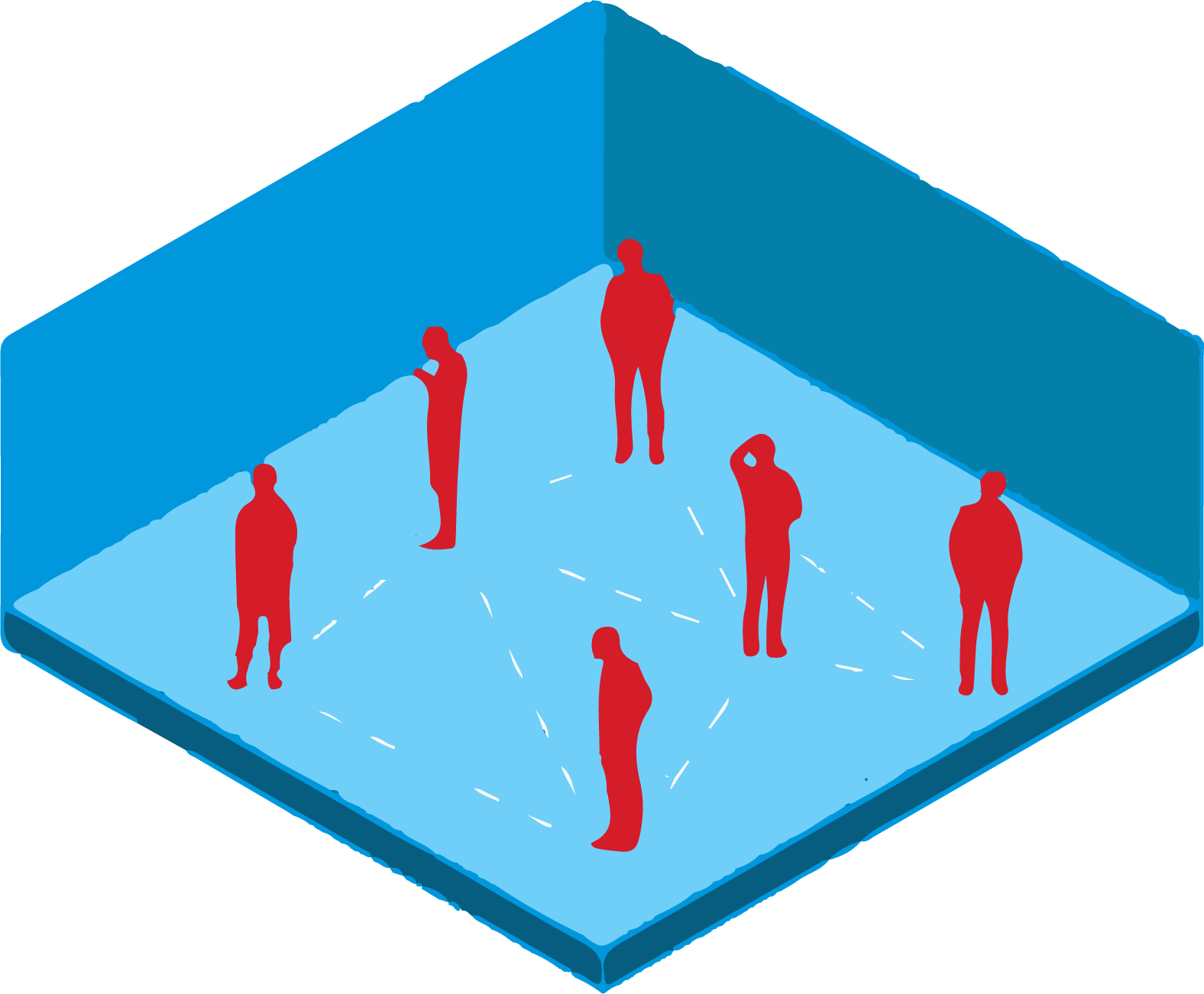

#4 – In-Store Health and Safety Measures Remain Paramount

In General Retail Terms – Retailers, through and through, want you back in the store. Health and safety are paramount. This is marketed widely, both through advertising media, but also in-store. Retailers are glad you’re back and want you to feel safe while shopping.

In Retail Branching Terms – Welcoming customers or members back to the branch is no different than any other shopper type. Branches across the country have gone through great lengths to put up plastic guards, hand sanitization stations, social distances markers, alternating chairs, and more. While masks are becoming a thing of the past, a bottle of Purell only goes so far. LEVEL5 has created the Re-FI Design Program, which was developed to specifically help Bank and Credit Unions address the issues related to the pandemic beyond simple triage measures.

So much press in our industry trades was given to Digital Transformation and Branch related obituaries. Let’s be honest, though, most are click-bait. There are kernels of truth sprinkled about, but it leaves us to sift through the noise to find the relevancy.

Yes, Digital Transformation is a real thing. If your digital platforms are at least not on par, you have some catching up to do.

No, the branch is not dead. It simply needs to continue to evolve.

The main takeaway here is Omni-Channel. The digital world and retail world can have mutually exclusive strategies. If there aren’t cross-over and intertwined components, you’ll be left behind your competition. More importantly, you won’t be delivering a modern experience for your customers or members.

Edwards FCU Flies Ahead With New Flagship Branch

- Branch Transformation

- Credit Union

- Main Office

- Retail

Categories:

With the project just completed, and the moving boxes being emptied, Edwards FCU are now the proud occupants of a new Flagship Branch and Headquarters Building.

So impressive is this project, the CUToday wrote an article and added some great photos, so we’ll let them do the bragging for us.

To learn more about this project, and to discuss your next branch or headquarters building, Contact Us today.

We’re Already Right

- Banks

- Branch Transformation

- Credit Union

- Retail

Categories:

Well, that didn’t take long.

We’re not one to gloat, but we do know what we’re talking about.

In looking at some industry publications and comparing it to our Crystal Ball series posted over the past two weeks, there are two very interesting tidbits that have hit the wires that back up and corroborate our thoughts on the year to come.

Point #1 – The Branch Matters

Throughout the past year, there has been news of PNC, Chase, and others closing branches. Despite this and the tailspin that all of retail was caught in due to the pandemic, it has been proven that the branch still matters.

In fact, according to a recently conducted Novantas survey published by American Banker, “Despite the increased adoption of digital banking, branches still matter to consumers as they select which institution they want to bank with, research has shown.”

Furthermore, a recent Forbes Article states that while the pandemic has impacted branches, they still remain important, only possibly, and likely evolving (which they were regardless).

Despite headwinds, the branch is still a critical component. Clients want to meet in person for transactions such as account openings and decisions on which institution to bank with. It is a critical component to a well-planned and executed omni-channel strategy.

So, don’t take our word for it – other independent periodicals are saying the same thing.

While digital and FinTech get all the headlines, the branch is still the anchor point for consumer FI’s.

Point #2 – Digital Only Is Not That Simple

Speaking of digital – yes, you click on the articles and yes, you are intrigued. You should not become a “digital only” brand, though.

In recent news, BBVA announced that it is Shutting Down Simple. The online-only banking app is to begin migrating all users into the standard BBVA digital ecosystem.

So, what to make of this? Digital is important, but it’s not the single answer. Similar to the point made above (and in our Crystal Ball series) a well balanced omni-channel strategy is the right approach. Investment weights in the channels can ebb and flow year over year, but, over time, they should even themselves out.

If your digital experience is lacking, it’s time to get it up to par. You will not outcompete the big banks, nor should you pivot and try to become the next FinTech darling. Simple already wore that crown and look at where it is now – a footnote.

Would you like to speak with an expert regarding your branch strategy and how to balance your customer channels? The experts at LEVEL5 are ready to speak with you today.

A great place to start is with our data driven Consulting Group, who can assess your branch network and help you make the right decisions – Contact Us today to get the conversation going.

2021 Crystal Ball: Boldly Predicting the Year to Come Pt. 2

- Banks

- Consulting

- Credit Union

- Main Office

- Retail

Categories:

In last week’s post, we gazed longingly into the Crystal Ball to look ahead at the year. Here, we’ll gaze into the future one last time, discussing a range of topics surely relevant to the way you conduct and run your business.

The Great Migration (Back to Work)

Just as giant herds of wildebeest seek greener pastures, your employees too will return from whence they came.

While the pandemic continues to steal headlines and as I continue to write this article, cases are as high as ever. Branches hours are changing daily, but there is light at the end of the tunnel. Whether it’s due to warmer temperatures, vaccination roll outs, or herd immunity, many believe the pandemic’s peak is upon us. The downward curve is fast approaching and health and business experts alike agree that the post-pandemic world is within reach.

While the pandemic continues to steal headlines and as I continue to write this article, cases are as high as ever. Branches hours are changing daily, but there is light at the end of the tunnel. Whether it’s due to warmer temperatures, vaccination roll outs, or herd immunity, many believe the pandemic’s peak is upon us. The downward curve is fast approaching and health and business experts alike agree that the post-pandemic world is within reach.

Your employees, who are still working in their home offices, kitchen tables, or closets under the stairs, will have to physically return to their places of employment. It could be on a flex schedule or full-time basis. No matter what, though, they are returning and you and your organization must be prepared for them.

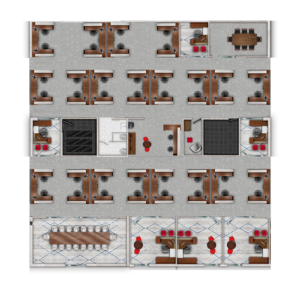

Aside from some bottles of sanitizer, chances are that your corporate offices are not prepared for a proper return. Do your current offices need to be renovated accordingly? Are you looking into the future for an entirely different office building? If so, we have created the “L5 HQ” program, which is meant to assess your corporate office needs.

The Cost of Things

The cost of doing business, specifically in the Design-Build world, has been greatly impacted by the pandemic. As we look ahead to 2021, there will be carryover from 2020 along the following fronts:

Labor

One of the ironic impacts from the pandemic has been the boom to the construction industry. If you have not done something to your home, the chances are, your neighbor has. Ever since the first wave of lockdowns commenced back in March, there was a massive rise in DIY projects. All of a sudden, desires arose to landscape yards, update kitchens, overhaul master baths, finish unfinished basements (guilty), and build out those home offices.

While on the surface, this all sounds residential and not commercial, an impact on labor is seen across sectors. You see, the crew doing your home project may also be the sub-contractor at the complex up the road.

Thus, we have a national labor shortage, with states like New York, Florida, California and Texas particularly feeling the pinch.

This is where planning ahead and having the right General Contractor for your branch or headquarters project really count.

The right GC has existing relationships with the local sub-contractors who pour the concrete, set the framing, and manage all the other elements that make up your building. Subs tend to allow themselves to be hired out by those they trust, and those who feed them continued work. A local General Contractor typically does not have the pull and project load compared to a national outfit.

Materials

So, if there is a labor shortage, that must mean that there are many projects abound and materials are in short supply. When supply is short, costs go up. Timber in particular has struggled to keep up with demand. While our projects continue to stay on budget, we are aware of the national timber shortage and have seen it impacting jobs across the country.

So, if there is a labor shortage, that must mean that there are many projects abound and materials are in short supply. When supply is short, costs go up. Timber in particular has struggled to keep up with demand. While our projects continue to stay on budget, we are aware of the national timber shortage and have seen it impacting jobs across the country.

Regardless, post-pandemic prices have not dipped, but are instead rising slightly. There will likely be a leveling off by mid-summer. Projects in the construction industry have stayed steady, however.

Q&A RE M&A

I sat down with our lead consultant, John Hyche. His reputation as a thought leader in the industry has continued throughout his nearly 30-year career. John is no stranger to Mergers and Acquisitions, having been involved in heading many consulting engagements with clients over the years.

I asked John his thoughts regarding Mergers and Acquisitions and the below is a summary of his thoughts:

Mergers and Acquisitions will continue to be a trend within the industry. While the pandemic and post-pandemic world has its influence, the trends and reasonings behind the topic are consistent.

They can be broken down into 3 broad categories.

The first we’ll call “The Smaller Players.” These community based FI’s are typically operating a small handful of branches in their comfortable corner of a given market, with assets in the single digit millions to low double digits. They are surrounded by larger players, both in asset size, branch network and most importantly, efficiencies. The smaller players may ultimately find themselves at a precipice, where the cannot grow. Conversely, they may fill a niche for a local larger player, and so a M&A play commences.

The second scenario we’ll call “Merger of Equals.” This is when two like FI’s see complimentary components with one another. They may be similar, but also are seen as filling in gaps to one another. Whether it be geography (east side of town vs. west side), innovations, product offerings, customer base, etc. A merger of these “equals” is seen as a much faster growth route than doing it organically. This makes a lot of sense, but a critical component to the post-merger success is the personnel, with many organizations struggling to right-size their staff after the fact.

The third broad scenario we’ll call “The De Novo.” This is a new FI, from scratch. The advantage that a De Novo bank or credit union has is they can build whatever type of FI they want. They are not burdened by being branch first, tech first, on an old core system, or operating in the wrong trade areas. While De Novo FI’s may begin existence by filling a void in the market, ultimately, they may cause enough of a fuss for the bigger players in the market to begin to entertain an acquisition play. In fact, this may very well be the de novo strategy all along.

So there you have it, our Crystal Ball for 2021.

If you’d like to learn more, need to discuss your corporate office, or interested in our M&A Consulting Packages, Contact Us today.

2021 Crystal Ball: Boldly Predicting the Year to Come

- Banks

- Credit Union

- Retail

Categories:

PART 1

It’s that time of year again. This is when we look ahead to stick our necks out and make bold claims regarding the year to come.

While we don’t claim to be soothsaying, we do have the crystal ball and know how to interpret its readings. So here, in a two-part series, we outline trends and share our thoughts on what is to come. This way, you can interpret and translate accordingly for your 2021 strategic plans.

Branch Matters

While saying the branch will change is an obvious statement on the surface, as any retail setting inevitably ebbs and flows with the times, these are most unusual times. It’s no mystery that the COVID-19 has altered the course of banking, retail, and the economy as a whole.

What began to unfold in mid to late March 2020 was reactionary. It was a triage of our retail facilities (and employee facilities) as impact was still unfolding. While the impact of the pandemic is still very much at play in our daily lives, enough time has transpired to understand its effect on our businesses. 2021 retail strategies need to incorporate COVID’s legacy.

Aside from the simple and expected sanitization stations, the branch needs to evolve for a post-pandemic world. If an “open concept” branch was just a trend

previously, it is a necessity now. While there may come a day when social distancing is not mandated, it will remain a practice with a long hangover in our collective consciousness. Your branch layout needs to accommodate for it.

While some believe that traditional Teller Lines still have a place in the branch, Teller Towers are at the forefront like never before. These pods, with the right Banking Equipment, enable a more open floor plan while eliminating the old-school queuing.

Rise of the Machines

No, we’re not talking about robots inheriting the earth. The right blend of technology will modernize your branch, enhance the overall retail experience, enable social distancing naturally, and make traditional in-branch transactions that much more efficient.

The right blend of technology, both in and outside of your branch, will enhance the overall customer experience. This, in turn, will further justify the need for branch visits.

Teller Cash Recyclers work perfectly affixed to a Teller Tower. It enables Universal Tellers to man these stations while also giving them the flexibility to walk about the branch.

Interactive Teller Machines have been a much discussed and much contemplated piece of technology. Now, they have as much justification as ever before with the Renaissance seen in the drive through. ITMs in your drive-through give visitors the transactional need while also allowing for an interactive experience, albeit virtually.

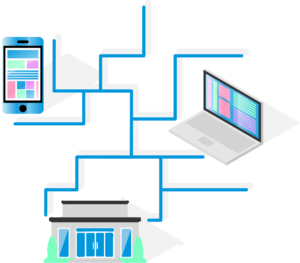

The Omni-Channel Dilemma

It is no secret that digital transactions have risen since the pandemic hit last Spring. The reliance on digital methods became the only option when branches closed. Those who were reluctant to take advantage of simple transactions and information via Online Banking portals or Apps were forced to do so out of necessity and lack of options.

What is more surprising, though, is that in-branch transactions, particularly those involving account openings, has nearly, if not entirely rebounded to pre-pandemic levels.

So the question is: Do you invest in the Branch, or do you invest in your Digital Channels?

When you come to a fork in the road… take it. By this we mean, you should be investing equally in your offline and online channels. You always should have been.

Digital products and technological marvels get all the headlines. A more balanced omni-channel approach to your clients, however, has always been the right answer.

Sure, budgets may swing in favor of digital one year, then back to the retail branch the next. This is all a balancing act in what should be an equally weighted customer touchpoint strategy that unfolds over the course of many years as part of a well-executed three, five, even ten year strategic plan.

Executing this accurately, thoughtfully, and strategically, gives you a well-executed customer experience.

Experience Good Experience

If you have any web or app developers on your team, or if you’ve ever in a development meeting, you’ve heard words like “frictionless” and “UX.”Gone are the days of bloated and cavernous digital engagements. A digital design wants as few dead ends and wrong paths as possible, providing a frictionless experience. UX, or User Experience, is king when it comes to designing a new website and smartphone application. Extensive planning happens before any code is written or deployed.

Your branch should be no different. If the idea of a good customer experience in your retail setting is news to you, it is not too late. The branch is going through an evolution the wake of the pandemic. Now, more than ever, you truly need to be thinking engagement and experience first when it comes to your branch.

The branch is important, and while digital channels should not be seen as a replacement for functions in the branch, they should be complimentary and designed equally from a UX perspective.

Give your visitors a reason to continue to come in. Whether it be traditional transactions or advisory sessions, the branch is still an important piece in your omni-channel strategy.

Allow the right technology to perform transactions. The right staff on point to answer the right questions, and, more importantly, open accounts, is where your branch should really shine.

Blending transactions and advisory services into a seamless retail experience is the right approach.

Next week, we’ll conclude this two-part Crystal Ball series.

In the meantime, if you would like to jump into addressing some of your glaring branch shortcomings, our Re-FI Design Program is the perfect anecdote to an outdated branch.

Contact us today for a free, no obligation assessment.

Beware The Frankenbranch

- Branch Transformation

- Retail

Categories:

We’ve all got ’em. That “branch on the hill” that just doesn’t quite fit into your overall branch network. It’s not well placed, likely in the wrong trade area, well past its prime, and looks nothing like any of your other branches.

It’s your Frankenbranch.

The design is stale, likely from a bygone era where the choices seemed fine at the time. It’s as dated as that can of Tab Clear nesting on your garage shelf next to your neatly stored sky blue tuxedo shirt with extra ruffles, cuz, just in case.

The single ATM is the lone piece of “tech.” The Brand Deployment may be a previous version of the logo design, if not definitely fading in color and importance.

In reality, this branch is not truthfully as scary as it is embarrassing.

Take solace in this: everyone’s got one.

You, as a manager and leader of a Financial Institution, make a point of assessing your organization’s talent pool, identifying the high potentials and underperforming. Why don’t you do the same for your branch?

If it’s about the economics and performance, the right analysis can aid in the tough decisions to relocate or shut down this monster.

How about if it’s an underperforming branch in the right Trade Area surrounded by high value clients? This is where a little love can turn this Frankenbranch into branch that is “ready for its close up.”

But don’t fret, there is good news.

If you want to analyze the market – LEVEL5 does that.

If you want to remodel your branch, maybe even turn it into your new flagship, if not your new prototype, well, we do that too.

Contact us today and we’ll help you give that monster of a branch a makeover that’ll make you, your board, and especially your clients happy.

Micro Branch Strategy – The Full Series

- Branch Transformation

- Retail

Categories:

Previously, we released our take on Curbside Banking, a supplement to the previously released “Branch Design After COVID-19” Guide Book. Both have been incredibly well-received and we’re grateful for all who have read it and reached out to us to learn more.

Within the Curbside Banking supplement, we introduced a new Micro Branch concept. While we have done previous posts on Micro Branches, we thought we would return to this topic. This time we’ll focus on 3 underlying strategies that are often overlooked when considering going small.

First, in Part 1, we are going to begin with the “Network Effect.” What is the Network Effect? Funny you should ask, that’s what we’re here to talk about.

The traditional economist states that the more people use something, the more valuable that it becomes.

In the retail banking world, Bancography states the following:

“The network effect is the phenomenon by which large branch networks capture a disproportionate share of market deposits. For example, a four-branch network captures more than twice the deposit volume of a two-branch network; an eight-branch network captures more than twice the deposit volume of a four-branch network. Viewed another way, average deposit size per branch increases as a function of the number of branches, as each incremental branch a financial institution adds provides a lift to – and derives benefit from – all its preexisting branches in the market.” – Bancography, April 2017

In other retail terms, it answers the question of why there is always Starbucks across the street from every Starbucks. When you see one on every corner, you start to want Starbucks. Saturating a market with brick and mortar has an exponential growth metric attributed to that strategy.

So, let’s now bring this back to your Retail Branch growth strategy and how the Micro Branch plays a role.

When you operate a network of branches in a given market, there is an assumed volume of Loans and Deposits that are up for grabs. When we run our consulting engagements, we estimate a Market or Trade Area’s total forecastable Loans and Deposits volume. From here, we estimate what your “fair share” is and what is also available. This availability is where your branch expansion plans come in.

While building several full-scale, standalone branches is ideal, this is not always feasible. Do you lack the available capital for a series of additional free standing branches, but want to capitalize on the Network Effect? A Micro Branch may very well be the perfect answer.

A Micro Branch can often cost 1/3rd the price of a free standing branch, yet allows you to further penetrate and saturate a market. This addition of low-cost brick and mortar locations allows you to expand your brand, serve your customers/members, and grab available Loans and Deposits in that market. A compounding effect will take place with each additional location because of the Network Effect. This will aid the percent increase of those Loans and Deposits at the locations already in existence.

Now onto Part 2, where we’ll go beyond the single market notion of the “Network Effect” and discuss an expanded concept. We’ll debate whether or not it makes sense to enter a new market and how the Micro Branch plays a role in this decision. Since this new, expanded version of the Network Effect doesn’t really have a name, we’ll call it the “Out of Network Effect.”

Many times, when we’re engaged in a Multi-Site Branch Growth Plan consulting engagement, we discuss geographic expansion strategies. A scenario always arises that proves to be a bit of a conundrum.

When we assess large, county-wide, or even state-wide geographies in an effort to find the best Trade Areas for branch expansion, there are some markets where the data implies a branch makes a lot of sense. Then, there are other Trade Areas that do not justify a fully staffed standalone branch.

This is where the Micro Branch comes into play – especially when considering the Out of Network Effect.

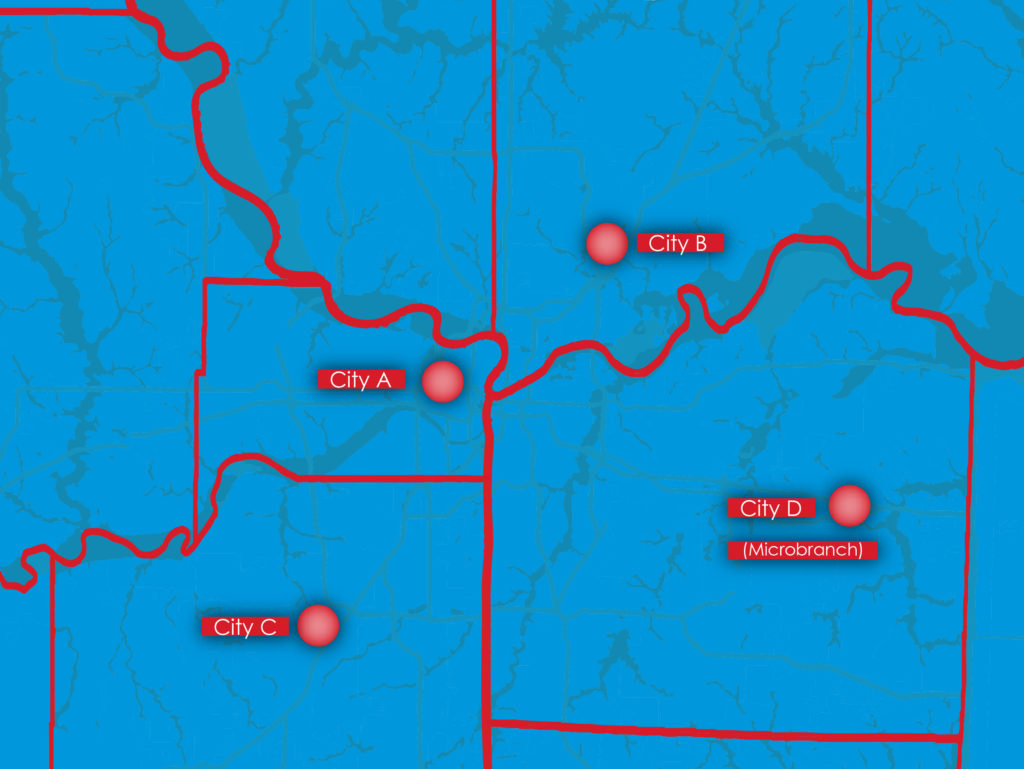

To further explain, I’ll use a recent example from a current client where this played out. I’ll be as specific as I can while maintaining our client’s privacy.

We recently executed a Multi-Site Branch Growth Plan where we looked at 4 cities across 4 counties. Each city represented the county seat, with one of these cities being a large metropolitan area. The remaining 3 cities were rural outposts with residents either working locally or commuting into the “big city.”

City A represents the large metropolitan area, where our study indicated the optimal number for the Network Effect at 6 branches. City B is their Headquarters branch, with a total Network Effect need at 3 branches. City C is a net new market, with a total Network Effect also at 3.

This is where the conundrum arose with City D. The data show that many employees and customers of this company live in City D. Yet, based on our Loans and Deposits forecasting, the data does not support a full standalone branch in City D.

But – the data does support a Micro Branch.

Executing a Micro Branch in City D is a win on several levels:

- It takes a cost-effective approach to branching, thanks to the smaller footprint and lower overhead costs of a Micro Branch

- It serves the needs of local customers, regardless of reduced loans and deposits compared to larger, neighboring towns

- It will aid in the Network Effect, but in this case, benefiting from the Out of Network Effect

Here’s why a Micro Branch makes sense in this smaller town. If you think about it, the Network Effect states that there will be a total lift in sales (Loans & Deposits) in a given market by adding locations and aiding total saturation. This economic philosophy typically works for a confined market.

When you expand this to a rural, multi-county setting in addition to a dense metro market, the theory still holds. People who live in a tightly packed metro market need not venture more than a couple miles beyond their home’s radius. When you live in the country, however, you’re often driving across county lines. Wether it’s for a job, to see family, to get groceries, or visit specialty shops, it’s always a journey.

That’s why we did not recommend a standalone branch in City D, despite the client stating they wanted one. The data did not support it. Since we ran a proforma on a Micro Branch, however, the client got the branch they desired. Not only that, but all other branches in the quad-county analysis benefited from this single Micro Branch. Thus, the Out of Network Effect took hold.

Now here in Part 3, we’re going to revisit the concept of Hub & Spoke. This time, we’ll discuss how the Micro Branch can play an important role in executing this concept.

For visual purposes, we’re going to use a generic Market Area for Anytown, USA. These strategies can not only work for any given metro market, but can also be applied across a more rural, multi-county geography.

First, let’s revisit the concept of Hub & Spoke.

On the surface, the Hub & Spoke retail branch model implies you have your bigger branch as a central anchor (hub) to smaller, scattered satellite branches (spoke) across a given geography. Implying that Hub & Spoke is only about branch size, however, is missing the point.

When thought of strategically, the right Hub & Spoke model is about efficiencies while considering:

- Serving Your Clients – Having locations where your clients live and work provides the convenience they require of you, even if some are digital first. Beyond location convenience, you can further serve your clients by understanding demographies of given neighborhoods. More specifically, know their propensities for products and services so that you can offer what your clients need and make adjustments across different spokes.

- Network Effect – To reiterate from our previous posts, saturated markets and/or trade areas may allow the addition of more spokes. This would complete your Network Effect strategy and, in effect, elevate all other locations along the way.

- Budget Considerations – Factor in these elements and the cost considerations of a Micro Branch compared to a freestanding branch. You’ll find that you get a lot of lift out of a Micro Branch. It is a much more effective notion especially if you’re unable to afford a traditional branch at a specific site.

All of this is where having a Micro Branch as your wild card really comes into play.

When looking at the Hub & Spoke model across your branch network, your Hub is the flagship; the crowning achievement. It is the branch with the best design. It offers the most services, has best employees, and is either located in the optimal neighborhood or in the neighborhood with the best bragging rights (many traditional retailers put their flagship stores in Times Square (New York City), Union Square (San Francisco) or Magnificent Mile (Chicago)).

Your spokes are the soldier locations spread across the field. When the data doesn’t support a full branch in the outposts of your empire, the Micro Branch is ready to swoop in and fill the void.

The last point we’ll make here to close out this article and the series is this: the Hub & Spoke model actually has two sides.

- Side #1 is your entire branch network, anchored by your Hub Flagship branch and bespoked across your geography. If you are a Community Bank or Credit Union, this is your strategy. You operate a fleet of branches typically in one larger geographic market.

- Side #2 is is more cluster based, allowing for multiple instances of a Hub & Spoke model. You will have multiple Hubs and their aligned spokes across different geographies. If you are a larger FI, one that spans across different metropolitan areas or state lines, deploying this type of Hub & Spoke model may make sense. For example, you may have a Hub and several spokes in Dallas, and another wave of Hub/Spoke branches in Houston.

To learn more about how Micro Branches can help you complete a well-rounded Hub & Spoke strategy, Contact Us today to learn about our Data Driven Consulting division and how the right branch strategy can help you double in size.

Micro Branch Strategy – Part 1

- Branch Transformation

- Retail

Categories:

Last week, we released our take on Curbside Banking, a supplement to the previously released “Branch Design After COVID-19” Guide Book. Both have been incredibly well-received and we’re grateful for all who have read it and reached out to us to learn more.

Within the Curbside Banking supplement, we introduced a new Micro Branch concept. While we have done previous posts on Micro Branches, we thought we would return to this topic. This time we’ll focus on 3 underlying strategies that are often overlooked when considering going small.

For this week’s post, we are going to begin with the “Network Effect.” What is the Network Effect? Funny you should ask, that’s what we’re here to talk about.

The traditional economist states that the more people use something, the more valuable that it becomes.

In the retail banking world, Bancography states the following:

“The network effect is the phenomenon by which large branch networks capture a disproportionate share of market deposits. For example, a four-branch network captures more than twice the deposit volume of a two-branch network; an eight-branch network captures more than twice the deposit volume of a four-branch network. Viewed another way, average deposit size per branch increases as a function of the number of branches, as each incremental branch a financial institution adds provides a lift to – and derives benefit from – all its preexisting branches in the market.” – Bancography, April 2017

In other retail terms, it answers the question of why there is always Starbucks across the street from every Starbucks. When you see one on every corner, you start to want Starbucks. Saturating a market with brick and mortar has an exponential growth metric attributed to that strategy.

So, let’s now bring this back to your Retail Branch growth strategy and how the Micro Branch plays a role.

When you operate a network of branches in a given market, there is an assumed volume of Loans and Deposits that are up for grabs. When we run our consulting engagements, we estimate a Market or Trade Area’s total forecastable Loans and Deposits volume. From here, we estimate what your “fair share” is and what is also available. This availability is where your branch expansion plans come in.

While building several full-scale, standalone branches is ideal, this is not always feasible. Do you lack the available capital for a series of additional free standing branches, but want to capitalize on the Network Effect? A Micro Branch may very well be the perfect answer.

A Micro Branch can often cost 1/3rd the price of a free standing branch, yet allows you to further penetrate and saturate a market. This addition of low-cost brick and mortar locations allows you to expand your brand, serve your customers/members, and grab available Loans and Deposits in that market. A compounding effect will take place with each additional location because of the Network Effect. This will aid the percent increase of those Loans and Deposits at the locations already in existence.

To learn more about the Network Effect, and how Micro Branches may be the missing key to your retail strategy, Contact Us today.

Peter Pan Was A Bad CEO

- Banks

- Branch Transformation

- Credit Union

- Leadership

- Retail

Categories:

In the 1953 Disney movie, Peter Pan instructs the Lost Boys to follow John as they go exploring Neverland. Off they go, singing “Following the Leader.” John puts on a brave face and the Lost Boys follow. Peter Pan had instructed them to do so, but his advice was short-sighted. John didn’t necessarily know how to lead, and he definitely didn’t know where he was going. Peter Pan is a bad CEO.

Some of us suffer from “Peter Pan Syndrome” in life (we do not want to grow up). There is, however, another kind of “Peter Pan Syndrome” in the Corporate world. It is one where too many company leaders are content to “follow the leader” instead of blazing their own path forward.

Some of us suffer from “Peter Pan Syndrome” in life (we do not want to grow up). There is, however, another kind of “Peter Pan Syndrome” in the Corporate world. It is one where too many company leaders are content to “follow the leader” instead of blazing their own path forward.

Why would you follow someone if you’re not entirely sure that they know what they’re doing in the first place?

And now, in a post COVID19 world, the dangers of “following the leader” are never more present. Retail Banks or Credit Unions are still trying to figure out the next step to right the ship and see what will become of their institution. Observing and sharing ideas may very well be a good idea for us all to band together and get through this, but when it comes time to grow again (and that time is coming), you must do this on your own.

When we at LEVEL5 begin a relationship with a client, we aim to uncover three key elements by asking:

- Can you succinctly describe your organization and what makes you different?

- Do you have an approved 5-year plan?

- What are your branch (and headquarters) level strategies?

When looking to rebuild your 5 year strategic plan for your Branch Network, below are 3 classic traps many leaders become ensnared:

“I Want That!”

While we’re not going to dive into the details of our Discover phase (the first step in our Blueprint process), we should still talk about where things must start. When we begin to get to know a client, one of the main questions we always ask is: “What do you want?” But what we’re really asking is “What are your strategic initiatives and goals?”

This probing question often gets misinterpreted. It will perhaps cause a client to jump right past the strategy, goals, and objectives, and right into the Design of the branch. There is always the inevitable reference of a nearby branch from a known competitor, or a flagship branch from one of the big boys, with a CEO proclaiming, “I want that!”

Flattery is nice, and mimicry does have its place. The issue with this proclamation, however, is that it completely skips over the critical early stages of the process. First, you must identify what you want a given branch to do for you in the community and your clients. Strategy will yield Design, not the inverse.

An example of the right way to implement an “I want that” strategy is perhaps how the Hooksett, NH branch came to be for Northeast Credit Union. Once the strategy was identified, Trade Area chosen, and branch type chosen via sound data, it was time for the Design conversation. CEO, Tim Collia, worked with our Design team to identify a new, modern aesthetic for the branch that was reflective of the natural elements in New Hampshire. It would also set the foundation of a new branch prototype design not only for that branch, but for all future branches yet to come.

The Design for NECU did not “follow the leader” – rather, they set the tone that was right for them. It began with strategy.

The Mysterious Case of the Missing Five-Year Plan

Another fundamental question we ask in our Discover phase is “What is your five-year plan?”

While this question is perhaps more directed at the macro Retail level, it helps us understand what is happening at the corporate level so our Consulting Team can run the best analysis possible.

While this question is perhaps more directed at the macro Retail level, it helps us understand what is happening at the corporate level so our Consulting Team can run the best analysis possible.

The issue here is often times, the answer to this question is that there isn’t one. Many Community Retail Banks and Credit Unions may very well not have a five-year plan. They instead only plan things out along a 12-month or at most, an 18-month time horizon. This may be the reality, as things are fluid and ever changing (especially now), but it brings up a fundamental challenge in this space.

Creating a 5-year plan is critical. A 5-year road map (even with change) lays the foundation for a strong corporate vision. An 18-month road map can set you down the right path, but, at worst, it can make you more reactionary instead of proactive.

When we began working with Canvas CU (Denver, CO) they outlined a very specific and well-defined multi-year plan that included aggressive growth plans up and down the Colorado front range, into deeper bedroom communities in Denver, then up and down the I-25 corridor. We are now several years into that execution, with Canvas still eyeing a multi-year strategic growth horizon.

Think Like A Golfer

There may very well be 144 or so golfers at any given (pre cut) golf event. That’s a lot of competition, but each golfer is really just focusing on themselves.

At least, they should be.

Sure, they’ll take a peek at the leaderboard, but in reality, any other golfer’s actions do not influence whether they hit the fairway off the tee or sink that birdie putt.

Sure, they’ll take a peek at the leaderboard, but in reality, any other golfer’s actions do not influence whether they hit the fairway off the tee or sink that birdie putt.

The same can be said about running a Retail Bank or Credit Union. Yes, you want to be aware of what your competition is up to, and yes, you want to peek at the leaderboard, but are you really going to switch clubs or shoes if someone else hits a great shot? You shouldn’t.

The point here is this: Don’t follow the leader. Be your own leader. Set your path forward. Have a game plan. Not for the 18-holes, but for all 72 holes over the four day tournament – this is your 5-year plan.

Keep an eye on what the competition is doing, take a cue from it and even learn from it. But you must be true to who you are and your strategy will be born from that. After all, if you see a competitor go heavy on tech, but your customers are a bit more traditional, don’t chase that shiny object and implement something that won’t be well received.

So, Peter Pan was a bad CEO. Don’t follow the leader. Follow your own path.

I hope your childhood has not now been compromised.

But here’s the good news.

LEVEL5 can help you get there. Our Business Development managers and Consulting Team are experts at helping you craft, evolve and mold your vision into a solid 5-year plan that is yours and only your. Contact Us today to learn more and get going today.

5 Levels of Branch Preparedness in a COVID-19 World

- Banks

- Branch Transformation

- Credit Union

- Leadership

- Retail

Categories:

In last week’s White Paper, we looked at what has transpired and what is to come for Retail Banks and Credit Unions regarding COVID-19. There, we identified 5 distinct levels of preparedness. As you’ll see below, we are currently in a bridge period between LEVEL 2 and LEVEL 3. Here, we’ll dive deeper into each of these levels. More importantly, though, we’ll discuss what you can be doing to prepare for whichever level you’re in, and for which level is approaching.

LEVEL 1 – Close/Limit Branch Operations

Description – This level has now past, and you are already beginning to look ahead. You are likely finding yourself in LEVEL 2 or even LEVEL 3.

Timeline – March & April 2020

Action – Branches were completely closed. Of those that stayed open, hours were altered and traffic was directed to drive-thru’s, digital channels, and customer service lines.

LEVEL 2 – Identify The Quick Fixes

Description – Your internal teams at the Executive, Retail, Operational, and Marketing levels have met and begun to look beyond the closures and limited hours. They are now discussing what permanent or semi-permanent measures need to be taken in preparation for an eventual re-opening. These conversations have likely already taken place, but whether they are completed, or need to be revisited is different.

Aside from branch/staffing operations and client communication measures, the “quick fixes” looking to be implemented include Sanitization Stations and protective shields, also known as “sneeze guards.”

Timeline – April & May 2020

Action – If you are looking for assistance in sourcing these in-branch materials, contact us for guidance.

LEVEL 3 – Open & Optimize Branch Network

Description – At this point in time, you are probably at this level. Branches are just beginning to open again or they’re opening imminently. Now that procedures are in place, staff has been (re)trained in operating the branch in this new normal. There is an interesting duality here that needs to be addressed.

In one regard, you need to pay close attention to how the early stages of your reopening are going. Not only from a benchmark and performance perspective, but from a health perspective.

How is your staff managing the new procedures? Do they feel safe and do they feel capable of doing their job under new guidelines and restrictions? What about your clients – of those that have returned? Do they feel comfortable in your branch? Are they distancing appropriately? Are they able to conduct simple transactions and receive counsel on financial questions while masked, 6 feet apart, and perhaps from the other side of a protective shield? These new scenarios are the new normal, at least until they are no longer relevant or needed.

The second consideration here is to begin looking at your overall branch network holistically. Now is the time to begin assessing a longer term analysis on how branches were prior to COVID-19. With those benchmarks, assessments will need to be made if those performance trends continue, flip, or possibly become greater.

Regardless of the direction of branch performance, you will likely need to do a branch assessment to build a business case on what to do with these assets.

Timeline – May & June 2020

Action – You can look at the trends of your branches in this new normal, but LEVEL5 can help you assess your branches. Our “Current Branch Network Plan” is the perfect path forward to look at your overall branch network and assess both past and current performances. Most importantly, however, we will use our custom and proprietary algorithms to run a 10-year proforma for each of your branches. We will give definitive recommendations on next steps as a result

LEVEL 4 – Establish New Prototype Branch

Description – Now that the assessments have begun, it’s time to begin to look ahead at establishing a new Design for your branch network. The notion of a consistent branch design with essential branded elements and iconic features has always been a necessity. This is more about the remodeling of existing branch layouts to accommodate the branch going forward. While reactionary measures have likely taken place by this stage (distance markers, protective shields, sanitization stations), a more permanent remodeling can begin to take shape.

The LEVEL5 design team can look at your current branch network and provide you actionable drawings that can speak to an overall better client flow through the branch. This includes permanently placed sanitization stations and the possible removal of some fixtures to allow for more natural spacing. It also includes the introduction of the right technology to make your branch as “contactless” as it needs to be.

Timeline – July – December 2020

Action – Contact LEVEL5 today to begin your Branch Design Assessment, a holistic Design review of each branch in your fleet, what will need to be changed or introduced, and ultimately, what this would look like, both visually through professional renderings, and budget to act upon the concepts.

LEVEL 5 – Begin Branch Expansion

Description – The final level of branch preparedness will begin to take action in 2021, but should begin to be planned in mid to late 2020. By now, you have course corrected your current retail network from an optimization and functional perspective. It is now time to begin turning your attention to growth once again. The road to economic recovery may still be protracted, but it doesn’t mean that there aren’t new accounts to win, new geographies to expand into, and new branches to plan. Land and construction costs will be cheaper than they have been in many years. Real estate availability will be better than ever. The costs for Design and Build will be lowered due to less overall demand.

Timeline – January 2021 & Onward

Action – The LEVEL5 Branch Growth Plans is the perfect consultative approach. This data driven package looks at your overall expansion plans, both in current and net new geographies. It will supply you with an ROI, 10 year branch Proforma, staffing modeling, and branch type modeling. This will all help you de-risk your overall decisions.

Regardless of how you are approaching your branch operations, we hope our White Paper and this 5-stage guide helps you formulate a path forward to compartmentalize key strategic considerations as these months unfold.

Continue to stay safe and good luck.