Data Points the Way

- Branch Transformation

- Credit Union

- Data

- Retail

Categories:

Using data to make informed decisions is nothing new. We’ve seen (or at least heard) the stories of mega e-commerce platforms that know what and precisely when to deliver us ads on things we didn’t even know we needed. Sports leagues use data to determine the value and output of a player beyond what a scout can see with the naked eye and thirty years of industry experience.

When it comes to informing your Branch Playbook (download here), and determining the right methodologies and decision, you need to have the right access to data (and likely the right partner).

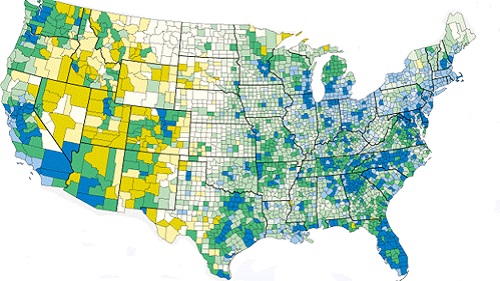

LEVEL5’s approach to Strategy and Market Analysis goes beyond the traditional “consulting” engagement of other firms. Firstly, Market Analysis and the data does not live unto itself, we pair it with Site Selection.

While traditional firms will tell you a market area is viable, we take the data and hand it off to our Site Selection department to determine actionable properties. What good is data pointing to a broad section of a map if there is nothing actionable.

To further understand how LEVEL5 does Market Analysis, we have broken out the data components into two broad categories, with four sub-sets in each.

The first four components of our Market Analysis represent the critical INPUTS that fuel our proprietary algorithms.

- Data Points – We begin by feeding the data engine with proprietary data points exclusive to LEVEL5, as well as data points exclusive to you, the Financial Institution

- Staffing Interviews – Our Strategy team conducts a series of staff interviews, both qualitative and quantitative, which are then gathered and computed into the overall input engine

- Market Segmentation Analysis – Geographic assessments are conducted over a defined area to include currently existing footprints and growth areas, which include competitive analysis, current consumer overlays, population densities and growth trajectories, demographics and product propensities

- Trade Area Analysis – The final layer is a further drill-down at the geographic level, determining a several square block radii with viable, actionable properties

The second phase of a data-rooted Market Analysis effort is the OUTPUTS.

- 10 Year Proforma – LEVEL5 delivers a 10-year proforma on a specific branch’s performance over a 10 year period with several variable factors, giving you visibility into the break-even point, loans, deposits, and Return on Investment (ROI)

- Branch Type Model – One of the key variables to the 10 Year Proforma is branch type, with the modeling allowing for plug and play entries for free standing, storefront, and micro branch types, among others

- 10 Year Staffing Model – Staffing, and their inherent costs greatly impact the model of a branch’s performance, with entries allowed for number of staff and staff types (salaries/costs)

- Technology Needs Assessment – Technology, whether it be banking equipment and/or digital signage are an important capital cost consideration into your overall branch growth decisions

If you’d like to learn more about how LEVEL5 approaches data differently, and can give you the visibility into your growth potential and help you de-risk decisions, Contact Us today.

4 Critical Things We Learned in 2021

- Announcements

- Banks

- Branch Transformation

- Consulting

- Credit Union

- Data

- Retail

Categories:

2021 was the much-anticipated light at the end of the seemingly endless tunnel of 2020. It wasn’t an easy year, as we were all still dealing with the tribulations of the pandemic, but it was laced with hope.

Before we begin to look ahead to 2022 (our annual Crystal Ball series is close), let’s revisit this year as we highlight 4 critical things and discuss what we learned.

The Branch is Not Dead

Let’s be honest here… if anything were to have killed the branch, it would have been COVID-19. A global pandemic preventing people from gathering in groups, touching surfaces, attending events in-person, or entering closed spaces without masking up first? And all of that on TOP of the already rapid rise in digital as an alternate to in-person banking?

If that didn’t get rid of all bank and credit union branches in the country, nothing will. Brick and mortar in the banking industry is simply not going to go away – it’s just time to optimize.

According to a recent study completed by Raddon/Fiserv, 77% of consumers said they went to a branch at least once a month during pandemic. Pre-pandemic, only 69-70% of consumers said they went to a branch at least once a month. Although mobile usage is steadily rising, branch usage is now rising for different reasons. People like to interact with people, especially when it is regarding the things most important to them.

The branch is not dead, but the old way of banking is. In order to continue to thrive and grow, it is imperative to reevaluate and optimize your branch network. The first step in this process is to take a good look at which branches are underperforming and why, and then remove or relocate them. Then, take a look at which branches are performing well and make sure they are well-equipped to provide consumers with personalized experiences. Once your branch network is operating at the maximum efficiency, you can begin to expand.

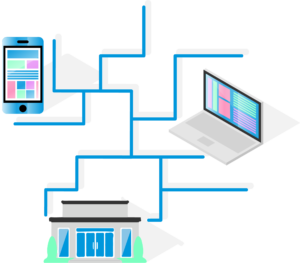

OmniChannel

Although the branch is not dead, mobile banking saw big gains during the pandemic and will only become more widespread. The rapid increase and reliance on mobile banking does not mean the end of branches, however. Caroline Vahrenkamp, a Senior Research Analyst for Raddon/Fiserv, says “People like to see other people. People like to interact with other people. The challenge is they also like to do things on mobile banking. So they like to use their phones for some things, they like to use their computers for some things, and they like to do some things face to face. And there’s a pretty clear idea of what each individual person wants to do in each of those methods.

Although it’s not consistent it’s not like everyone wants to do the same thing in each of those ways, everyone has a blend. But everyone has a blend.”

The statistics of the uptick in branch usage during the pandemic is clear proof of this.

It’s not enough to use brick and mortar, online, and mobile banking arbitrarily. Those three avenues must work seamlessly together and compliment each other. The channels working separately and under different departments forces them to work against each other instead of together. Mobile and online banking should not be the enemies of brick and mortar banking. Mobile and online banking fit the average consumer’s simple, daily needs. Your branches must fill in the gaps that mobile and online banking leave. They can provide human interaction, advisory services, and various other capabilities that require thought and trust. Something not provided by the apps.

Return to the Office

as predicted, the inevitable happened and the great migration back to the office began for much of the country this year. As the vaccines rolled out, companies slowly started opening their doors back up. While some decided that remote work was the best fit for their operations, many other institutions opted for “flex” type schedules. Others decided to go back in full-swing, pre-pandemic style.

Companies that decided on any type of in-person work had to put measures in place for the safety and comfort of people. Workplaces are now equipped with hand sanitizer stations, plexiglass dividers, and spread-out environments to accommodate those coming back to the office. Those on flex schedules go in to the office every other day and work from home the other days. They perhaps even share workspaces or common areas with others working in-office on opposite days.

LEVEL5 worked tirelessly throughout 2021 to equip our clients with the knowledge and resources they need for a safe and comfortable return to the office. We used our (Re)FI Design program to re-envision the workspace according to COVID-19 restrictions. We looked into workspace designs that allow for social distancing as well as minimizing touch points to stop the spread of germs and various other ways to allow for a safe branch.

Labor and Supply Chain

A couple of major disruptions throughout the last year that were caused by COVID-19 were the massive labor shortage and the extreme stress put on the supply chain. Although there were issues with it to begin with, the supply chain took a major hit with factories shutting down and workers losing jobs. Even when recovery seemed to be in the works, the Delta variant took some more punches – and who knows just what impact Omicron will have.

For what seemed like an eternity, the supply chain disruption happened in conjunction to a heavy decrease in demand. Factories closed and cut production while many lost jobs and couldn’t afford to spend money on anything other than the bare necessities. But not in the fun, carefree way that Baloo sings about. No one could forget about their worries and strife.

Then, as financial assistance was provided, vaccines were produced, and people returned to work, the demand grew back rapidly. This, however, put the supply chain under immense pressure. The pressure continues now as materials and resources are low along with a shortage of essential workers. In addition, the countries of the world “opening back up” is not happening in parallel. The US, for example, is opening at a much faster pace than some other countries, leaving an imbalance in the flow. The supply chain continues on the path of recovery, though. It’s making a comeback.

Although the pandemic permanently altered society, the changes that happened in banking were going to happen regardless of COVID-19. It merely kicked the evolution into overdrive. We have been preaching about the transition of branches from transactional to advisory for years now, but 2021 proved what we’ve been saying since the beginning.

Now, 2022, we’re ready for you. Bring it on.

If you’d like to know more about how you can help your bank or credit union grow in 2022, CONTACT US.

5 Key 2022 Planning Strategies

- Banks

- Branch Transformation

- Consulting

- Credit Union

- Data

- Leadership

- Training

Categories:

As the calendar has now rolled into October, you undoubtedly have been called into the first of several meetings to discuss your strategies and goals for next year.

It’s planning and budget season.

How will you gain more members/customers and grow relationships with existing ones next year? Well, now’s the time to answer these questions.

Growth-minded credit union and community bank leaders need to make vital decisions to propel business growth in 2022 and an effective plan takes into account the changing nature of banking.

Our team, here at LEVEL5, lives and breathes financial institution growth every day, so we’re sharing our 5 key 2022 planning strategies for credit unions and community banks.

#1 Analyze Your Branch Network

Before you can begin to think about organic growth with net new customers in net new areas, you need to ensure the current branches and the customers they serve are performing.

Initially, you must to take a holistic assessment of your entire branch network.

Do you have a current and accurate understanding of loan and deposit performances per branch?

Which demographics make up your clientele at each branch and have they changed?

Do you have the right number of branches within a certain market to benefit from the network effect?

And most importantly, which branches are performing at forecast, and which ones are not?

Knowing what you’re working with is the foundation for making correct growth decisions for next year. In order to know, your finger needs to be on the heartbeat of the entire organization.

#2 Optimize Your Branch Network

Once you’ve captured a clear picture of your network, it’s time for action.

While some branches may be thriving, others may not be performing. In order to optimize, it may be crucial to consider closing or relocating them before they can take more toll on your financial health than they already have.

It’s best to get ahead of loss by data-driven analysis to determine what needs to be done. Once a non-performing branch is closed, you can move those resources into a new branch that will turn positive numbers within a healthier market.

Identify geographic markets where your optimal demographic is growing. With the right branch in the right place, you’re armed to expand your network in an impactful way. Informed consulting services tell you which branches to close, keep, remodel, and/or relocate.

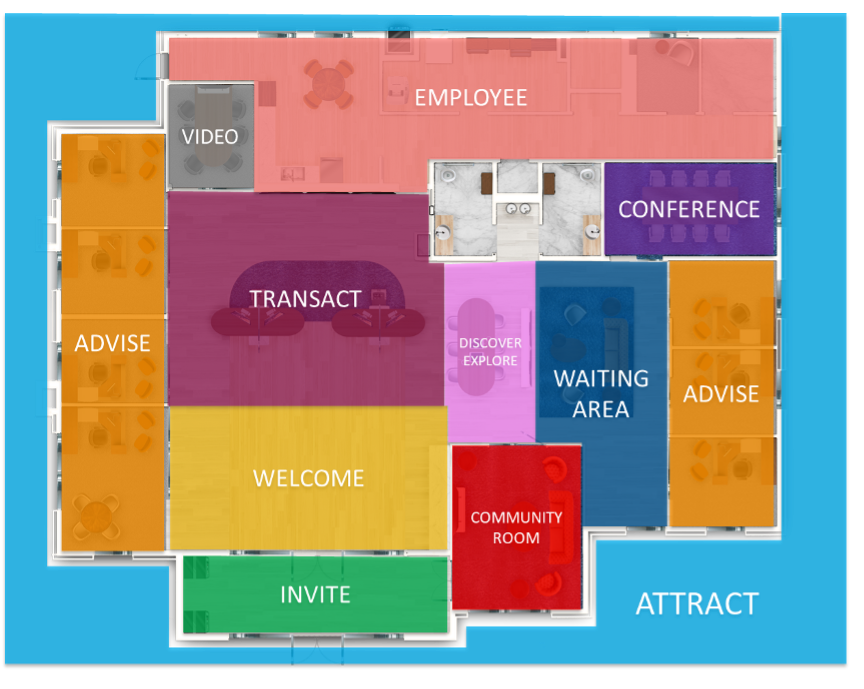

#3 Boost the Retail Experience

Branches are still at the forefront of customer engagement and retention, but due in part to digital channels, their role has become less transactional and more about onboarding and advisory sessions.

The Financial Brand publication notes that bolstering a credit union or local bank standing as a trusted advisory community institution helps to keep them competitive against mega retail banks. From our experience, we couldn’t agree more.

Therefore, the branch should be where new customers come to open accounts and clientele visit to seek advice from a real person, making the functional experience of your spaces paramount. After all, the effort you put into your environment speaks to the effort you’ll put into your banking relationships.

All great branches should include at a minimum:

- An inviting entrance, opening into a welcoming space that facilitates trust with staff

- High quality branding, amenities, and materials in line with your organization’s culture

- Informal advisory areas

- Private advisory areas

- Comfortable furniture

- Well-lighted spaces

Our ReFi program helps you assess clientele experience in your current branches with actionable ways to remodel, re-inventing an inviting and engaging branch experience.

#4 Secure Your Budget

Planning is key, but it’s all backed up by the ability to properly secure funds for future projects.

Make sure to properly communicate all future fund needs to all stakeholders and decision-makers. In addition, make them aware of the purpose behind each project so proper decisions can be made now and no surprises pop-up later on.

A well-defined plan, with actionable and attainable goals will be the projects awarded the proper funds for execution.

#5 Prepare An Employee Training Plan

Ensure your tellers and bankers on the ground are up-to-speed on the ultimate purpose of the branch. They need to know that they’re on the front lines of fostering relationships and growth.

While critical functions such as onboarding, executing transactions and product cross-selling are key to any in-branch function, there is always a gap in the training where a newly built (or remodeled) branch and its core strategic function are lost on the staff that occupy it.

Ensure that your branch staff not only know how to perform the duties defined in their job descriptions, but also how to do it in the space you’ve planned and built.

To learn more about the 5 key strategies outlined above and how LEVEL5 can assist you with your strategic assessments and branch build projects, Contact Us today. We’re ready to help you meet your 2022 goals.

2020 Crystal Ball: Big Data Will Get Bigger (and Smarter)

- Consulting

- Data

Categories:

[fusion_builder_container hundred_percent=”no” equal_height_columns=”no” menu_anchor=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=”” background_color=”” background_image=”” background_position=”center center” background_repeat=”no-repeat” fade=”no” background_parallax=”none” parallax_speed=”0.3″ video_mp4=”” video_webm=”” video_ogv=”” video_url=”” video_aspect_ratio=”16:9″ video_loop=”yes” video_mute=”yes” overlay_color=”” video_preview_image=”” border_size=”” border_color=”” border_style=”solid” padding_top=”” padding_bottom=”” padding_left=”” padding_right=””][fusion_builder_row][fusion_builder_column type=”1_1″ layout=”1_1″ background_position=”left top” background_color=”” border_size=”” border_color=”” border_style=”solid” border_position=”all” spacing=”yes” background_image=”” background_repeat=”no-repeat” padding_top=”” padding_right=”” padding_bottom=”” padding_left=”” margin_top=”0px” margin_bottom=”0px” class=”” id=”” animation_type=”” animation_speed=”0.3″ animation_direction=”left” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” center_content=”no” last=”no” min_height=”” hover_type=”none” link=””][fusion_text]Big Data will continue to grow in size and usefulness. With the rise of AI and Machine Learning, it’s your decision whether to find it intimidating or useful. But let’s face it, it’s probably both.

Big Data, Big Intimidation

Think of it this way. Big Data is a seismic, confusing and useful asset. No different than the thoughts around the water cooler back when the Internet dawned and later, online banking, then mobile banking. It was daunting, scary and intimidating with the only way to conquer it was to just begin to tackle it. Now, these critical pieces are just second nature and the fears they presented seem silly in retrospect.

Now just when you thought you had a grasp of Big Data and thought it was safe to go back in the ocean, here comes AI and Machine Learning to get you confused all over again.

Rise of the Machines

The introduction of AI and Machine Learning is the next evolutionary step with Big Data. Before, where there was huge swaths of data, somebody had to interpret it. But it was not only the interpretation, it was actually really more about what to do with it. These Data Scientists would crunch, tabulate, then make recommendation based on the results.

Now, Artificial Intelligence and Machine Learning take the human element out of the equation (to a degree), making way for tabulation and particularly recommendations, in real-time. You are likely familiar with this in your personal life in the likes of LinkedIn making job recommendations and Facebook making friend recommendations. These systems are not guessing here. There are algorithms at work based on many data sets to ultimately deliver you that recommendation.

Help Wanted

So here’s the good news: you don’t need to master Big Data, AI or Machine Learning. You just need to master the art of a partnership, and work with a company who lives and breathes this stuff everyday so it can help you grow, not stall you with indecision.

These elements need to be run, managed and interpreted by those who know what they’re doing. You have a bank to run. You don’t necessarily need to know how, but you should know who. We at LEVEL5 have a team of Data Scientists/Statisticians who have been using a multitude of data points to deliver actionable results for many years, we just didn’t call it “Big Data” until that became a thing.

In fact, Big Data in the hands of the right Retail Banking Consultants can help you get out of the vicious “analysis paralysis” phase, interpret the data and give you the actionable results you so desperately seek.

The likes of making a decision on where to put your next branch or main office is daunting. For many community bank and credit union C-level folks, the right decision will make a career. The wrong decision will stop a career in its tracks.

So embrace Big Data. Or, at least embrace a partner who embraces Big Data.

If you’d like to learn more about how LEVEL5 uses Big Data to deliver actionable results, Contact Us today.[/fusion_text][/fusion_builder_column][/fusion_builder_row][/fusion_builder_container]

When “X” Marks The Spot

- Branch Transformation

- Consulting

- Data

Categories:

Finding Your Next Branch Site With A Data-Driven Approach

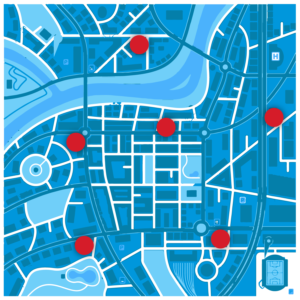

Forget the fact that Halloween is just around the corner and dressing up like a Pirate is fun (and timeless), as a Retail Banker eyeing (insert pun here) your next branch location, “X” will always mark the spot.

Treasure Hunting

In the old days, heck, even now, most approach a new branch’s site selection with a little intuition and a couple phone calls. The classic scenario unfolds like this: Boss says we need to grow and growing means a new branch. Bankers talk to one another and decide there’s a nice pocket in town, or in the next county over, that is begging for a new branch. After all, you don’t have a branch within at least a 10 mile radius.

You pull out a map (or Google) and pick the street corner that you’d like to be on. A couple phone calls later, you’re in luck because a site just happens to be available.

Now, if you had applied a data-driven approach to this methodology, you’d soon learn (instead of the hard way) that your new-found location is not only on the wrong street corner, but it may very well be in the wrong part of town entirely.

In this magical universe, where data is applied to your branch endeavor, the data will ultimately point you to where the branch should be located.

By combining up to 12 data points and mixing them into our custom and proprietary algorithms, the LEVEL5 Consulting Pirates (lead by Captain John Hyche) have been helping our clients find where the treasure is by locating the ideal address in the ideal market suited to fit your strategic goals and objectives.

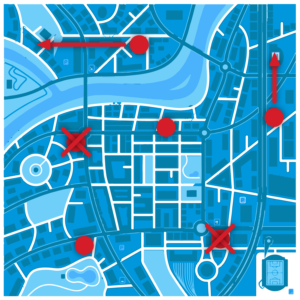

Multiple and Variable “X’s”

When it’s all said and done, and the data has been run, we actually deliver you several “X’s” as viable options. The “X” represents the site, but there is a lot of data science behind that recommendation. All you need to know at this point is that the recommendation is showing a very complicated output of growth, budget needed and return on investment.

Different parts of town, different zip codes, and even different street corners have different outputs. These “X’s” will show the sliding scale of these critical elements in your decision:

Growth – Is that address rooted in a stable, declining, or growing part of town? Do people live in and/or frequent the area? Is trade moving up or downtown?

Budget – What is it going to cost you to put a location there? Do you have a fixed budget? Are you willing to spend what it takes to be at that site (at least for the right reasons)?

ROI – Does the forecasting and expense calculate to a percent that you and others are comfortable with?

Be A Pirate

So, the next time you are tasked with growing your branch network, get out your treasure map, put on your eyepatch, and hoist the sails – but don’t forget your shipmates. The good folks at LEVEL5 have been helping others just like you find the “X” on the map for years. Contact Us now to get your treasure hunt started today.

One Thing To Know About Millennials

- Branch Transformation

- Data

- Retail

Categories:

If you are still one of the many Bankers whose head still spins when trying to unravel the enigma that is the Millennial, you’re not alone. This group, among all customer types, comes up the most when discussing Branch Transformation projects, who to target, how to appeal, and who to attract.

These successors to Gen X, (who are also called Gen Y), and are now the precursor to Gen Z, are still mostly and universally referred to as Millennials, and are still just as misunderstood and continue to mystify marketers, bankers, and heck, even their parents to this day.

When you actually break this cohort down, depending on the varying timelines that are considered legitimate, Millennials tend to occupy about a 15+/- year time horizon. That alone is confounding when you think about it. The first Millennials born in the early 80’s have likely been parents for a while now, and the “youngest” of this group may very well be parents in their own right by now.

We’re not going to sit here and tell you we’ve figured it out. What we will tell you is that nobody has really figured it out, and maybe that’s just the point. There are simply too many variables based on age ranges, socio-economic classes and cultural influences for anyone to tell you Millennials are just one thing.

BUT – if there was one commonality among this group, especially when it comes to shopping (and banking), it is the need for an experience.

Afterall, this group’s formative years were developed during the digital age. Gen Xers still remember the days of rabbit ears on TV’s, writing letters (and mailing them) to friends across the country (girlfriends in the Niagara Falls area) and going to the library to research something.

With Millennials, video games were omni-present and the Internet Age matured to a point where friends were just a click away and research papers were started and finished on a couch in the Living Room.

What is missing in all this is the human experience.

Millennials want a company they can believe in and a company that gives them a good experience. It may actually be this simple.

In Banking terms, the “belief” part can be solved by running an organization with morals, a strong philanthropic arm and deep roots in the community. You likely already have that in spades. The “experience” part – maybe not so much.

Experience for bankers needs to be thought of in terms of Omni-Channel: online banking, mobile banking and in-branch banking. Many bankers have focused much over the past years to stand up best in class online and mobile banking experiences, but the retail banking component is now starting to catch up.

Afterall, the data still supports the fact that customers choose the branch as their primary vehicle when opening an account, applying for a loan, seeking financial advice and making a deposit.

So, this begs the question, if the branch is not in fact dead, and customers are still choosing to come into the branch – make their trip worthwhile and provide a great experience.

This is easier said than done.

If you’d like to discuss ways to improve your overall customer experience in the branch, LEVEL5’s team of experts will be more than happy to discuss ways others have executed strategies and how we can customize a way for you to implement best-in-class customer experience, Contact Us today.