Branching: Location…Location…Which Location?

- Announcements

- Branch Transformation

Categories:

Consumers love the branch, so how do you get the one you want?

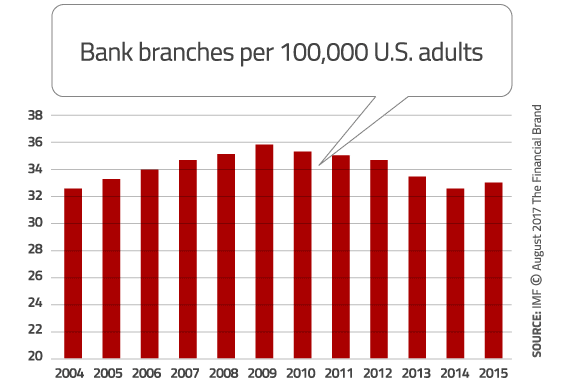

U.S. Consumers and the Branch. There is no denying that the number of branches in operation today is less than before the great recession. However, simply pointing out there are fewer branches is only part of the story. For example, when you consider a recent a IMF study, the number of branches is rising. Per their research, the peak of branches per capita was 35 branches in 2009. The low point was 33 in 2014 – the same level as 10 years earlier. But in 2015, the number of branches per 100,000 started rising again.

Let’s Talk about the S-Word. So instead of another article focusing on “if the branch is still important”, let’s talk about one of the key steps in making sure when you do branch – you get what you want. Let’s talk about Site Selection.

Good to Great: Site Selection

First Things First. The first step in site selection is not the real estate procurement, but establishing the business case. Site selection is the marriage of market analysis and real estate procurement. In a fintech and omni-channel banking world, understanding why to invest in the branch is crucial. And for banks and credit unions – that’s loans and deposits.

Begin with the End in Mind. Therefore, when it comes to site selection, the approach matters. Here’s why: If the business opportunity in a market can support the branch (solutions produce over $35 million in new deposits) then the critical component that takes the opportunity from good to great is how we procure the real estate.

Face the Brutal Facts. Selecting the best site for a branch or main office opportunity is not a matter of selecting the right broker. Brokers can serve a role in selecting a site, but brokers are not the answer. In site selection (market analysis and real estate), it is about realizing business opportunity.

A Retail Perspective. In retail development, there are two users that every owner wants – pharmacies and financial institutions. Owners of land understand the correlation of location and performance…and they understand that business opportunity is worth a hefty price.

Good is the Enemy of Great. But what if you could get the property you want, and the owner would not know it is you? You could avoid the premium and have a greater opportunity to perform. This is where LEVEL5’s real estate procurement process, during site selection, separates itself from everyone else.

Our proprietary process veils your identity to protect you from the market, the owner and yourself.

Furthermore, our approach negotiates contracts and performs all due diligence (surveys, environmental; and geotechnical test). A broker doesn’t study markets to define loans and deposits, they don’t negotiate contracts, and they do not handle due diligence. So, site selection with LEVEL5 is so much more.

Actionable Strategy

Getting what you want. For branch or main office opportunity to be realized, then the process has to move from strategy into action. Many firms speak to market opportunity or operations analysis, and even more firms design and construct financial facilities. However, it is taking action on the best location that brings branching and a new main office to life.

It’s about predictability of outcome. For the last seven years, LEVEL5 has annually procured between $20 and $25 million in property for banks and credit unions across the US. Driving predictability has allowed these banks and credit unions to outgrow their peers by 3x. Since the branch is still location driven, then selecting the best site is key to performance.

The consumer voice continues to speak loud and clear about the importance of the branch. Listen to what they have to say when banks and credit unions decide to close their branch.

Micro Branches | The Next Big Idea?

- Announcements

- Branch Transformation

Categories:

Enhancing your branch strategy with the most flexible of solutions – the micro branch.

Branch density is the goal. Space to build is the challenge. What makes a financial institution’s branching strategy successful? Many experts point to density “more locations and brand”. Agreed! However, what if the target community doesn’t have any suitably sized site options within the desired market? Or, what if there is not a lease space available in this market?

Are more branches an opportunity? Or a risk?

This begs a follow-up question: What about branch network density? Should a financial institution continue to invest in branch density given the advent of new technologies that may lead to a decreasing need for branches? On the other hand, what if digital and mobile channels, video tellers, and smart cash equipment don’t decrease the number of branches, but rather enhance the capability of the branch to better serve consumers? Is it possible the micro branch can be a solution for these facility questions?

What is a micro branch?

Essentially, It can be whatever you dream up! As long as it has a small footprint, is heavily branded and uses smart technology. For instance, it can be a shipping container converted into a permanent freestanding branch (see image above), equipped with an ATM and a universal banker office. Or it could be a 1,000 to 1,500 square foot freestanding branch equipped with video tellers, assisted self-service or ATMs and staffed with a few universal bankers.

[metaslider id=6389]

All kinds of possibility.

These imaginative facilities can contribute to branch density through a downsized, refined package while still offering similar services as larger branches. We have the technology; let’s use it!

The micro branching movement is putting the spotlight on a new way of thinking about service facilities…here’s how:

- Speed to market – Micro branches provide financial institutions the opportunity to enter the market quicker because design and construction durations are much shorter.

- Cost does matter – Because of the reduced branch size, these facilities require less real estate, and the cost to build and maintain is lower compared to a more conventional cornerstone (hub office) or community branch.

- Staffing – Micro branches typically have a reduced staff. The staff is focused on high-value customer interactions – while technology handles the more mundane transactional components.

- Resiliency – Micro branches provide agility in decision making for financial institutions needing to quickly adapt to the market. For example, a container facility can be converted to a cashless location, or due to a shift in market dynamics, the micro branch can be converted to a loan or mortgage facility.

- Dream big with less – Micro branches give financial institutions the opportunity to venture into markets that previously were not considered a possibility due to lack of site options. For example, in a dense retail area, where room is snug and will not accommodate a community size branch, a permanent container facility or small prefabricated facility may be a quicker and more effective solution for the market.

- Deliver the deliverables – Micro branches are outfitted to deliver the intended service solutions for targeted communities. In fact, these facilities give greater flexibility for branch density strategies by providing the financial institution greater access for entry into specific markets of interest.

- It’s on the menu – Micro branches can have full-service capabilities such as cash handling technology (ATMs or ITMs), and even drive up lanes. Furthermore, micro branches can be constructed “your way” with the same high-quality construction, and architectural brand identity, as seen with a traditional facility.

Customized for the community. The beauty of the micro branch, besides its lower cost, is that it can meet the desired financial needs of a community, creating better opportunity for consumer loyalty and satisfaction. As is the case with all branches, micro facilities are targeted for specific market and community conditions. And, having the ability to enhance the product and service offerings to a community while contributing to branch density. The micro branch is an option that gives financial institutions greater flexibility to enrich its intended branching goals and improve its presence in communities once thought to be out of reach!

The micro branch reduces the risk of branch density and rewards institutions willing to explore the possibilities.

The relevancy of branches for an FI is something to greatly consider. Maybe this article will help.

Return on Investment for Branching

- Announcements

- Branch Transformation

Categories:

Is the deck stacked against the physical branch?

Priorities, priorities. A recent study released by the Financial Brand revealed the top priorities for financial institution (FI) marketers. In order of priority: 1) Increase Wallet Share, 2) Increase Loan Growth and 3) Acquire New Customers. Given the branch has historically been a dominant tool in the FI tool belt, it would appear that these goals are challenged.

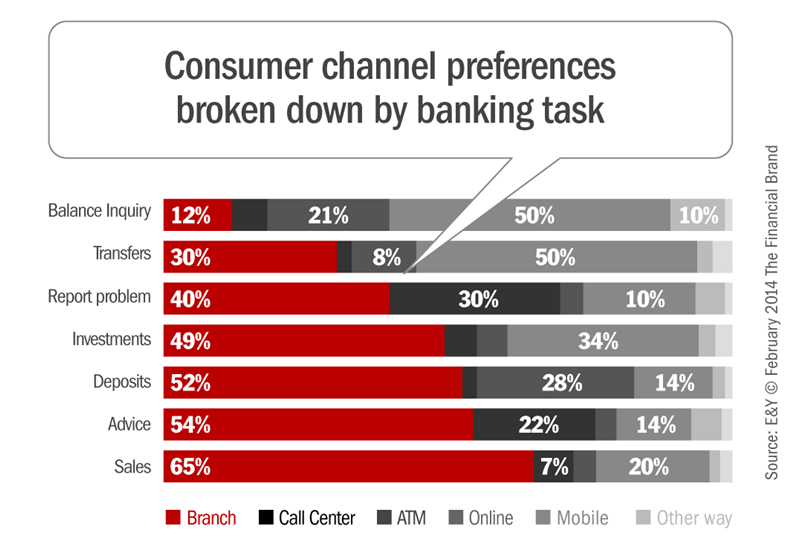

Too many branches? In an increasingly omni-channel consumer society where branch visits are down, and population per branch is low (thanks to the proliferation of branches), it would appear the deck is stacked against FIs trying to get a return on investment (ROI) from branching, while reaching its goals. This is especially true when we consider how branch use has changed. No longer is the branch the primary channel of choice for consumer transactions. Consumers today use branches for different things than they did even 10 years ago (see graph below). Branch use for depositing, withdrawing, and transferring funds is a shadow of its former self. However, when we consider what the branch IS for today…there is more than a little light at the end of the tunnel.

Survey says… According to an Ernst & Young survey, 65% of sales occur in a physical environment i.e. the branch. So for FIs looking for a ROI for branching look no further than sales and service for your key driver of success. With this shift in mindset comes the opportunity for a new result.

Great brands think alike. Marketers of brands like Apple and Disney keenly identify that brands change over time – they evolve. Furthermore, they know that the brand and the business are intertwined as they seek to make emotional connections with their customers to drive sales. A good example is Coca-Cola. Coke’s market cap is attributable not just to the commodity of soft drinks, but also to Coke’s iconic bottle, a physical embodiment of the brand. In fact, without the Coke brand, its value is half.

FIs can learn from other retailers and develop specific strategies to get a ROI for their efforts to market their company’s brand in its primary channel, the branch.

HOW TO DO IT

Is opportunity knocking? The journey begins with market research and analysis that drives to a business case for or against branch investment. Understanding the loan and deposit potential in a market can quickly start an effective narrative for branching by defining goals and expectations based on facts. Those facts frame our investment in land, building and people so we can predict with greater certainty what the future holds.

Execution is everything. Then based on these facts, we build a plan to connect with the opportunity. Our engagement begins by tailoring the interior space to the culture and desired customer experience. The focus is on enabling “bankers” to easily connect with their clients. The physical identity (architecture) and signage of the branch is an extension of the culture and makes a statement to the market at large, so the market knows we are different. This means we don’t run the same play every time and in every community. Specifically, we don’t always use teller lines, or pods, or self-service, but look at each market’s components and then tailor our connection.

Make your intentions clear. As we build the connective environment, we are intentional to communicate our brand message in graphics, colors and materials. Our value to the community and customer cannot be guesswork because these components drive action – action taken by our employees to use these materials to cross sell, and action by the customers who are now educated on what we can offer.

What we can learn from the major players. Bigger banks have taken these components to heart and are leading the way on branch experience, and getting great returns. Earlier this year, JD Power revealed that customer satisfaction at big banks is at an all time high, which is remarkable given the attitude of the marketplace toward big banks after the financial crisis. Big banks have learned that customer engagement in the branch is powerful, and they have learned how to clearly communicate value proposition.

ROI in action. The great news is we can quantify the ROI for branching using the tools mentioned above. For example, a FI in Michigan wanted to create a new customer engagement model in its community to achieve more loan opportunities. The plan included relocating a branch and remodeling a second facility with a new way of connecting, and the glue that held it together was training. The FI changed the engagement model to focus on asking questions and relationship building. They also changed their branch environment, and moved away from teller lines and used technology to automate routine activities. When the brand message became specific to the community, and the FI’s mission, then the culture changed. Within the first two years, the FI has grown its loan to deposit ratio from 88% to 92%.

More proof. Furthermore, a FI in the Southwest grew from $1.0 Billion to $3.5 Billion in 5 years through a similar shift. The shift included a new engagement model in the branch, and messaging throughout the customer experience. The exterior also changed, which was important; it helped the community identify with the change. By the way, the bank quantified the business case through research before each move.

To recap. In review, FIs can reach their goals of increased wallet share, loans, and customer growth in the branch. Here are the steps:

- We are clear on what we want and whom we serve. Our customers are diverse and changing, so our channels must appeal to all generations.

- We tailor the message of the branch to the market. This includes doing our research and quantifying the loan and deposit opportunity – upfront. Then we focus the branch experience on the opportunity.

- Our goal is to establish an emotional connection with our customers and community to drive results. Our focus is on engagement and inviting the community in, so we listen more and talk less.

ROI for branches can be justified by clearly defining the role of the bank and its value to customers.

Engagement in the branch takes a new kind of banker…welcome to the age of the universal banker!

Financial Resources FCU | Micro Branch of the Future

- Announcements

Categories:

Financial Resources FCU “Micro” Branch of the Future

Much is written about the “Branch of Future”, but a version of it may be in operation, today in New Jersey. LEVEL5 is proud to announce Financial Resources FCU’s new micro branch in Jersey City, NJ. This start-of-the-art branch focuses on automation and brand to serve its consumers and community.

The 1,100-square foot facility is located in the Newport Tower on Washington Boulevard near the subway. The branch is powered by NCR’s Interactive Teller technology, which allows the Credit Union to operate the facility 24-hours a day. NCR’s Interactive Teller machines (ITMs) provide the normal operation of an ATM, but with a video option that allows consumers to interact with a live representative.

“Advancements in retail technology, like ITMs, are allowing the community-based financial institution (FI) to compete, at scale with much larger FIs,” said Mike Colvin, Executive Vice President of LEVEL5. “Financial Resources has taken the next leap in consumer experience with this new branch allowing convenience, service and brand in a much smaller footprint.”

The branch’s two ITMs are connected via video back to the Credit Union’s call center. This allows the physical branch to operate with fewer staff, while consumers, using the ITMs, interact with live Financial Resources’ member reps in the call center. The in-branch staff, no longer encumbered by teller fixtures and balancing cash, are focused on service and sales to meet the needs of its consumers. In summary, routine transactions are handled more efficiently through technology, allowing for more complex interactions with branch staff.

Frank Almeida, COO of Financial Resources added, “Though routine banking needs are now being automated, we have found the human component to still be a primary need of our members.” Mr. Almeida continued, “The value of the branch and our use of ITMs is not to replace the importance of the human interaction, but to enhance convenience outside normal hours, and have the ability to provide depth for all their financial needs.”

The branch’s focus on convenience is also evidenced by the use of two-way video in the conference room allowing consumer-access to Credit Union specialist at other locations. Furthermore, the Financial Resource FCU brand is on full display throughout the space inclusive of video displays to educate consumers on how the Credit Union can integrate with their daily lives.

Mr. Almeida offered, “We chose LEVEL5 for our newest branch because they understand consumer experience, new branch technologies, and are experts in bringing together all of the components in the design-build of financial facilities.”

Smaller branches are not just a trend they are a new reality. Check out this new freestanding branch that is heavy on automation in a small footprint.

Branch Cost and Change Orders. Please, stop the Madness!

- Announcements

Categories:

The battle to lower branch costs begins earlier than you think.

There is probably no more despised phrase in all of construction than “change order”. The phrase elicits thoughts of pain and suffering beyond measure. Imagine Dante’s Inferno, Nails on a Chalkboard, or Crying Babies on an all-day flight to nowhere! Maybe I went over the edge a little there, but for an owner (who is paying the bills), change orders can be more than a little unpleasant.

What few owners know, or realize is that the battle lines against higher branch costs and change orders are NOT established after the design is produced, and the project is being bid. The fight for lower cost is won much earlier in selecting your project delivery method.

Getting Low = Change Orders

Most Banks or Credit Unions are accustomed to hiring an architect to design their branches or main office, and then bidding that project amongst qualified general contractors (GCs). Though this method is familiar, it is far from the most effective, and wrought with competing voices.

- Architects design without a clear understanding of costs.

- Furthermore, GCs only bid what they see in drawings.

In the fight to get low (to win the work), GCs are forced to forget what they know. The strategy is to win the work, and then manage change to make a profit.

Another option is available

There is an upgrade available to this methodology – hiring both the designer and GC, simultaneously (under one contract) i.e. design-build. A large study completed by Penn State University compared different methods to deliver construction across the US. Their research uncovered projects using design-build had lower cost (over 6% in savings) and were completed 33% faster. Furthermore, projects using design-build (hiring one firm to design and construct) were also much less likely to incur cost growth (5% less) and schedule growth (11% less) – FEWER CHANGE ORDERS!

Faster. Lower Costs. Fewer Surprises.

Design-build was created to deliver projects faster by overlapping phases of design and construction. So speed to market deals with opportunity cost. The other key benefit is getting constructability input on the front end to nail down costs, schedule, and reduce as many surprises as possible. When we created our company 13 years ago, we had several options available to us. However, we chose design-build because we understood how important cost, quality and schedule are to banks and credit unions.

In fact, over our last $100 million in construction projects – encompassing 25 states – our change orders average less than 2.45%.

Design-build delivery allows us to partner with our clients, not compete with them on costs. And that partnership is producing greater certainty and predictability to their business.

Banking today is very different than in the past. Risk is everywhere.

But you can quantify the ROI for Branching.

Legends Bank | New Midtown Branch Rocks Music Row

- Announcements

Categories:

Legends Bank’s New Midtown Office “Rocks” Music Row

Legends Bank, headquartered in Clarksville, TN has engaged LEVEL5 to complete its new Midtown Office located on Music Row in Nashville. The new space redefines the customer experience for the Bank and enhances the Bank’s commercial opportunities.

“We are very excited to be able to create and implement this project for the Bank,” said Michael Bryan, Regional Director for LEVEL5. “The team at Legends Bank is completely changing the way they serve their community and customers through this new office.”

The project began with the Bank’s need to expand its loan production office to a full-service branch, and overall presence in Nashville. The Bank chose the former Fender Guitar space on Music Row that was recently rebuilt as its new center-piece for the Nashville Market. The commercial lending consolidation is key to the Bank’s push in Nashville for market share. Furthermore, the new branch concept in the space is the Bank’s first move toward non-traditional banking.

“Customers have more options than ever for doing their banking, but physical locations still serve an important function, facilitating relationships and reinforcing our brand”, said Tommy Bates, President and COO of Legends Bank. “We chose LEVEL5 for our Midtown Office because they understand customer experience, new banking strategies, and are experts in bringing together all of the components in the design-build of financial facilities.”

The branch portion of the Midtown Office moves away from traditional, teller line banking in exchange for teller pods. The pods free up the Bank’s staff to engage with their Nashville customers in a personal, face-to-face environment, and enable the Bank’s front-line team to be more efficient and productive.

The design of the space is complete and construction has begun. The Midtown office will open in early fall, and the Bank is planning a grand opening once complete to unveil this new office to the Nashville community.

Millennials and the Branch: Strange Bedfellows

- Announcements

- Branch Transformation

Categories:

How do financial institutions connect with Millennials? Answer: A marriage of Science and Art

Earlier this year, shock waves were sent through the financial industry as study after study echoed the same message – Millennials highly value the branch. Though millennials and all consumers look digital-first for connection from their bank and credit union of choice, the branch is equally as important to consumers.

Human Connection. The research by Bain and Fiserv point to an inherently human response during the banking process, establishing trust and demonstrating value through relationship. Relationship is the heartbeat of the financial services industry and relationships are established over time.

Branching is about relationship. Banks and credit unions all offer similar products and services (perhaps at slightly different rates), but the motivation to buy (a loan) from one company over the other comes down to relationships. And consumers of all demographies are coming to the branch for that connection. In fact, the Fiserv study found that Millennials are the most likely demographic segment to visit the branch, and they are the most-likely to apply for and receive a loan through the branch.

Therefore, a key question for all banks and credit unions should ask is: How can we better connect with a demographic that wants what we have?

Science and Art. When it comes to branching there are no silver bullets or secret sauces to success. However, there are guiding principles, call them natural laws that govern victory, and it’s a marriage of Science and Art.

Science of branching. If there is one step we witness financial institutions (FIs) skip over in their pursuit of connection with consumers through the branch is developing a business case. In our industry, we have data at our fingertips and its plentiful. But, the science of branching is not about the data, it is the interpretation of the data for a specific outcome.

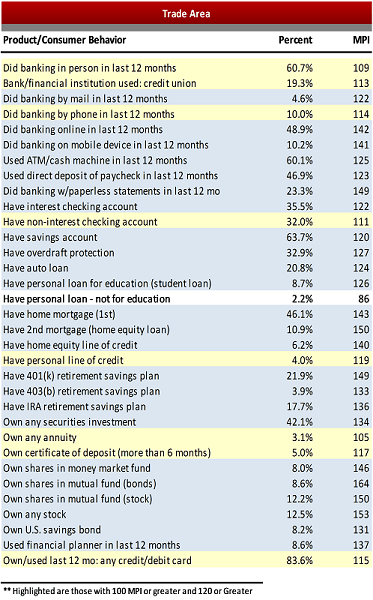

Market conditions. Collecting specific data about the local market conditions around your existing branches, or proposed new ones reveals more than you could imagine. It reveals the preponderance of consumers who desire what you have – loans. It shows how they want to connect with you (mobile, automated, and the branch), and it reveals the specific products and services we should offer in branches.

The index data above is much more than good local information about product and service demand. With this data in-hand we can go to the next level to establish the total headcount, and the function of the branch. So instead of staffing branches “how we always do” we can staff for a specific outcome based on what local consumers want today, and what they will need, tomorrow.

Loans and Deposits. Furthermore, all data collection for branching should result in a specific loan & deposit forecast for that opportunity. Only with this information can we build a business case that will allow for measurements of return on investment. Historical experience has proven that a freestanding branch’s profitability comes into focus at $25 Million (deposits & loans). Nevertheless, as branches get smaller and more flexible perhaps lower opportunity can be feasible. In any case, understanding opportunity and starting to develop a detailed plan – if it’s a 70% one – will create a greater likelihood for a predictable outcome.

Art of branching. Certainly, much of the business case for the branch is art as we interpret the data; however, the art also flows into design. The function and headcount of the facility are finite components so that is science, but how we integrate those into our consumer experience is unique to the local community we serve, and your business, and that is an art.

A unique consumer experience. Connecting with the local demography, the community and your consumers is unique to your business. The experience should be well planned and purposeful, always remembering your personality and value proposition are unique to you. A consumer experience that begins before the consumer walks through the door, and continues through the branch environment. And the beauty is though again we have guiding principles that govern victory, we have freedom of creativity to build connection, so the branch experience it takes on different personalities in each community we serve.

[metaslider id=6198]

Training drives performance. And the glue that holds all of it together is your human capital – your people. Nothing in branching drives success better than training your staff to learn how to connect with people and opportunities. For many FIs, this means adopting the Universal Banker model for their business. This means we combine skills training to optimize each opportunity our staff has to connect with consumers. To shift the employee mindset and branch purpose from order-taker to advisor, teacher, council and guide through the consumer’s financial journey. Every consumer is at a different stage, and they look to their bank or credit union for help. Your success depends on your ability to capitalize on those opportunities.

So, what’s next? That’s really up to you. The process outlined above is but an overview, a 30,000-foot glimpse into a portion of the process of connecting with consumers who want what you have in the branch. So, a good question follow-up question might be:

What is the Business Case for the Branch in a Fintech World?

Peoples Trust | Main Office – Houston, TX

- Announcements

Categories:

Peoples Trust New Main Office in Downtown Houston Positions the Credit Union for the Future

Peoples Trust Federal Credit Union is a $500 Million credit union in Houston, TX. The Credit Union’s beginnings are with Shell Oil. However, they expanded their charter to the City of Houston over a decade ago. As the oil and gas industry continues to change, and the Credit Union continued to flourish its lease was coming due. With the proposed rate increases and need for more space, the Credit Union faced large operating cost increases well above their current costs. The Credit Union’s headcount growth, and the rate increases required they seek the best long-term solution for the Credit Union. Ultimately, the Credit Union chose to relocate their main office to a new site in Downtown Houston.

[metaslider id=6148]

The selected site for the freestanding building is in an underserved area of the city, and required environmental site work to make it suitable for the building requirement. The LEVEL5 team worked through the permitting and containment of those materials to develop the new main office. The move to this facility not only gives the Credit Union a giant billboard, but also allows the Credit Union to substantially lower cost from rising rental rates and provide better community access. Furthermore, through our proven design-build process we were able to shorten the construction duration by over a month from the contract date!

The facility focuses on efficiency and embracing the Credit Union’s legacy to its membership and community. But, there is so much more to this design-build story, so listen to what their team had to say how this new facility took shape!

Southern Bank | New Main Office

- Announcements

Categories:

Southern Bank Looks to the Future in its New Main Office

Only 15 years ago, Southern Bank was a small community bank with less than $150 million in assets. Today, the Poplar Bluff, MO bank is approaching $1.5 billion via 35 branches across two states. Growth puts pressure on the main office, as discussed in previous articles. And that pressure calls for leadership to decide how they will position the Bank as it moves into the future.

For Southern Bank, it became clear that they were outgrowing their current main office operations. Additional space was needed that not only met their needs today, but also tomorrow. Our team has partnered with the Bank for nearly seven years on the design-build of freestanding branches, micro branches and renovations, so when the opportunity arose to develop the Bank’s new 40,000 square foot main office, the team was already in place.

A team that understood and resonated with the Bank’s brand message and skew toward technology and relationship building. A team that understood the Bank’s bias toward cost and schedule. The design-build of a main office is not a frequent event for most financial institutions, so having our LEVEL5 experts partnering with the Bank throughout the process truly resonated with the management team.

The video story below tells the entire journey from the lips of the two bankers driving the process – Greg Steffens (President and CEO) and Kim Capps (COO).

Branch and Main Office Transformation | Landmark Bank

- Announcements

Categories:

The Branch of the Future is Here, Today at Landmark Bank

LEVEL5 has completed the design-build of Landmark Bank’s Branch Transformation at their Corporate Headquarters in Columbia, MO. The project included transforming the retail lobby as well as remodeling the Bank’s private banking and commercial banking departments.

“We are very excited to be able to transform this space for the Bank,” said Mike Colvin, Executive Vice President/Principal for LEVEL5. “The team at Landmark Bank is completely changing the way they serve their community and customers through this effort. It truly has been a pleasure to work with the Bank’s team throughout this process.”

The project began in the retail lobby transforming the space from a traditional teller line to banking hubs (or teller pods). This shift allows the Bank’s employees to spend more time with their customers, further embracing the universal banker model. The entire first floor’s look and feel matches the Bank’s move toward a more engaging environment. The renovation included new essential brand elements to tell the Bank’s story through graphics, signage, digital messaging and merchandising. Furthermore, the private banking and commercial banking departments were also transformed to promote collaboration and flexibility with the ever-changing needs of the Bank’s customers.

“The Branch of the Future is here, today,” says Shon Aguero, Executive Vice President of Retail Banking at Landmark Bank. “Customers have more options than ever for doing their banking. Yet, the branch still serves an important function, facilitating relationships and presenting our brand. We chose LEVEL5 for our branch transformation because they understand the role of the universal banker, advanced retail banking strategies, and are experts in bringing together all of the components in the design-build of financial facilities.”

The Bank recently unveiled the transformed space and plans to use this model for future transformations within the Bank’s footprint.