Branch Cost and Change Orders. Please, stop the Madness!

- Announcements

Categories:

The battle to lower branch costs begins earlier than you think.

There is probably no more despised phrase in all of construction than “change order”. The phrase elicits thoughts of pain and suffering beyond measure. Imagine Dante’s Inferno, Nails on a Chalkboard, or Crying Babies on an all-day flight to nowhere! Maybe I went over the edge a little there, but for an owner (who is paying the bills), change orders can be more than a little unpleasant.

What few owners know, or realize is that the battle lines against higher branch costs and change orders are NOT established after the design is produced, and the project is being bid. The fight for lower cost is won much earlier in selecting your project delivery method.

Getting Low = Change Orders

Most Banks or Credit Unions are accustomed to hiring an architect to design their branches or main office, and then bidding that project amongst qualified general contractors (GCs). Though this method is familiar, it is far from the most effective, and wrought with competing voices.

- Architects design without a clear understanding of costs.

- Furthermore, GCs only bid what they see in drawings.

In the fight to get low (to win the work), GCs are forced to forget what they know. The strategy is to win the work, and then manage change to make a profit.

Another option is available

There is an upgrade available to this methodology – hiring both the designer and GC, simultaneously (under one contract) i.e. design-build. A large study completed by Penn State University compared different methods to deliver construction across the US. Their research uncovered projects using design-build had lower cost (over 6% in savings) and were completed 33% faster. Furthermore, projects using design-build (hiring one firm to design and construct) were also much less likely to incur cost growth (5% less) and schedule growth (11% less) – FEWER CHANGE ORDERS!

Faster. Lower Costs. Fewer Surprises.

Design-build was created to deliver projects faster by overlapping phases of design and construction. So speed to market deals with opportunity cost. The other key benefit is getting constructability input on the front end to nail down costs, schedule, and reduce as many surprises as possible. When we created our company 13 years ago, we had several options available to us. However, we chose design-build because we understood how important cost, quality and schedule are to banks and credit unions.

In fact, over our last $100 million in construction projects – encompassing 25 states – our change orders average less than 2.45%.

Design-build delivery allows us to partner with our clients, not compete with them on costs. And that partnership is producing greater certainty and predictability to their business.

Banking today is very different than in the past. Risk is everywhere.

But you can quantify the ROI for Branching.

Legends Bank | New Midtown Branch Rocks Music Row

- Announcements

Categories:

Legends Bank’s New Midtown Office “Rocks” Music Row

Legends Bank, headquartered in Clarksville, TN has engaged LEVEL5 to complete its new Midtown Office located on Music Row in Nashville. The new space redefines the customer experience for the Bank and enhances the Bank’s commercial opportunities.

“We are very excited to be able to create and implement this project for the Bank,” said Michael Bryan, Regional Director for LEVEL5. “The team at Legends Bank is completely changing the way they serve their community and customers through this new office.”

The project began with the Bank’s need to expand its loan production office to a full-service branch, and overall presence in Nashville. The Bank chose the former Fender Guitar space on Music Row that was recently rebuilt as its new center-piece for the Nashville Market. The commercial lending consolidation is key to the Bank’s push in Nashville for market share. Furthermore, the new branch concept in the space is the Bank’s first move toward non-traditional banking.

“Customers have more options than ever for doing their banking, but physical locations still serve an important function, facilitating relationships and reinforcing our brand”, said Tommy Bates, President and COO of Legends Bank. “We chose LEVEL5 for our Midtown Office because they understand customer experience, new banking strategies, and are experts in bringing together all of the components in the design-build of financial facilities.”

The branch portion of the Midtown Office moves away from traditional, teller line banking in exchange for teller pods. The pods free up the Bank’s staff to engage with their Nashville customers in a personal, face-to-face environment, and enable the Bank’s front-line team to be more efficient and productive.

The design of the space is complete and construction has begun. The Midtown office will open in early fall, and the Bank is planning a grand opening once complete to unveil this new office to the Nashville community.

Branch and Main Office Transformation | Landmark Bank

- Announcements

Categories:

The Branch of the Future is Here, Today at Landmark Bank

LEVEL5 has completed the design-build of Landmark Bank’s Branch Transformation at their Corporate Headquarters in Columbia, MO. The project included transforming the retail lobby as well as remodeling the Bank’s private banking and commercial banking departments.

“We are very excited to be able to transform this space for the Bank,” said Mike Colvin, Executive Vice President/Principal for LEVEL5. “The team at Landmark Bank is completely changing the way they serve their community and customers through this effort. It truly has been a pleasure to work with the Bank’s team throughout this process.”

The project began in the retail lobby transforming the space from a traditional teller line to banking hubs (or teller pods). This shift allows the Bank’s employees to spend more time with their customers, further embracing the universal banker model. The entire first floor’s look and feel matches the Bank’s move toward a more engaging environment. The renovation included new essential brand elements to tell the Bank’s story through graphics, signage, digital messaging and merchandising. Furthermore, the private banking and commercial banking departments were also transformed to promote collaboration and flexibility with the ever-changing needs of the Bank’s customers.

“The Branch of the Future is here, today,” says Shon Aguero, Executive Vice President of Retail Banking at Landmark Bank. “Customers have more options than ever for doing their banking. Yet, the branch still serves an important function, facilitating relationships and presenting our brand. We chose LEVEL5 for our branch transformation because they understand the role of the universal banker, advanced retail banking strategies, and are experts in bringing together all of the components in the design-build of financial facilities.”

The Bank recently unveiled the transformed space and plans to use this model for future transformations within the Bank’s footprint.

No Shortcuts to Transformation

- Announcements

Categories:

Re-thinking the branch, re-training the banker for transformation

Change is inevitable. The world we live in and the people we know change constantly. Businesses are changing as competition intensifies, technology accelerates and information moves at the speed of light. The world has transformed into a global economy, no longer bound by walls, geography or time. We are in an age where busyness is the norm, and we dictate our own realities by the choices we make…daily.

Who needs a branch anymore? For the community-based financial institution (FI), “the times” have changed them too. No longer can FIs rely on just branches, or just service to meet consumer demands. Today, we live in a world where consumers demand an Omni-Channel approach. Consumers demand automated channels, virtual channels and physical branches to meet their needs.

Branches are no longer one-size-fits-all. Branches today are still about convenience and market density, but each branch can and does fit a different purpose. Starting with the largest of all facilities, the cornerstone branch, which includes main offices, these large format facilities play a different role than others.

Where Community meets Technology. Today’s main office sets the tone for the company’s culture and identity. Furthermore, the rapid loan growth being enjoyed by FI’s across the country is causing ripple effects throughout the main office. Call centers in these facilities are changing. With the advent of Interactive Teller Machines (ITMs), community-FIs can serve their consumers 24-7-365, which means the call center is in the midst of transformation, now staffed with Universal Bankers who can be a one-stop-shop for the customer’s needs.

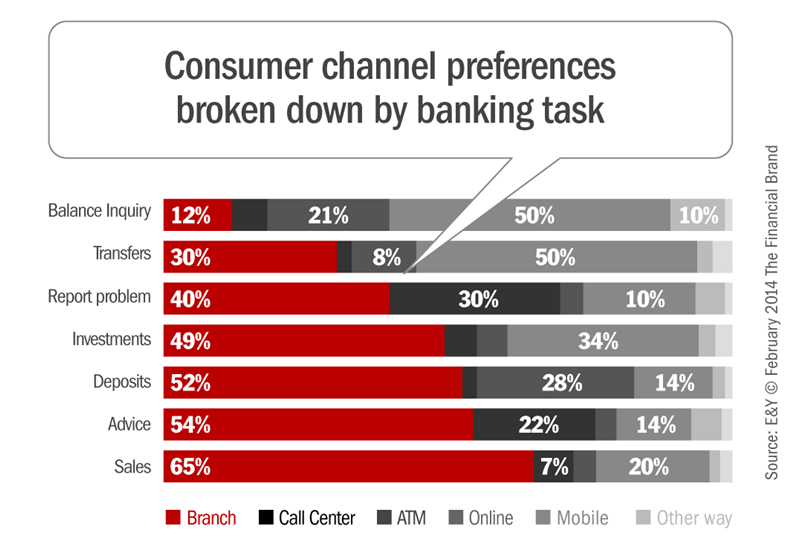

Engaging consumers. After all, building relationships are at the heartbeat of the Universal Banker model. Surveys show that 65% of sales occur in a physical branch, so the days of relying on a relationship built across three feet of mahogany are over. Today, banks are challenged with differentiating themselves and some are more aggressive than others in their use of technology, retail concepts and design to facilitate a more engaged consumer experience.

The people have spoken. Market research, customer concentrations and analytics now dictate how FIs should design their branches to relate to their markets. If the model is best supported by a teller line, then stick to that plan. If a more engaging environment, powered by technology is indicated, boldly adopt that plan. In all cases, the transformation of the branch is crucial to reach consumers.

When a big branch doesn’t make sense. The cost and time to implement branches has also given rise to the Micro Branch. Micro branches today still include storefronts and in-store branches, but can now also include mobile branches, freestanding facilities, and “pop-up” branches. The key component of Micro Branches are their size and flexibility as well as their cost.

How best to serve? In the end, banks and credit unions are faced constantly with decisions on how to serve their consumers, communities, and employees. Change is inevitable just for relevancy, but the FIs that are changing with a plan achieve specific results.

Proof that change can work. Based on FDIC data, one Southeast Bank grew organically from $1 Billion to over $3.5 Billion in the last five years by making branching decisions around a business case. Another FI grew its assets by 37% in the Carolinas over a seven-year period embracing technology and universal bankers. Still another near the Great Lakes moved its loan to deposit ratio from 88% to 92% in less than two years by implementing a more engaged branch culture.

The bottom line is the bottom line – transformation, driven by a well-devised plan and business case, succeed.

Improving your performance. In today’s ever-changing environment, financial institutions are faced with two opportunities for performance improvement:

- Their existing footprint

- Moving into new markets

The FIs that flourish, marry business planning and execution into a seamless model driven by a business case to maximize their investment and gain optimal returns for their stakeholders. Predictability, timing, risk management and engagement can all be folded together so the business, consumers and community win!

So, as you face the future, start making decisions and then take bold action. Over time, those actions lead to transformation…there are no shortcuts.

Financial institutions who do their homework are the ones best positioned to succeed in a brand new playing field.

Branch Transformation and Safety…A Great Marriage!

- Announcements

- Branch Transformation

Categories:

Could the evolving role of the branch actually lead to fewer robberies?

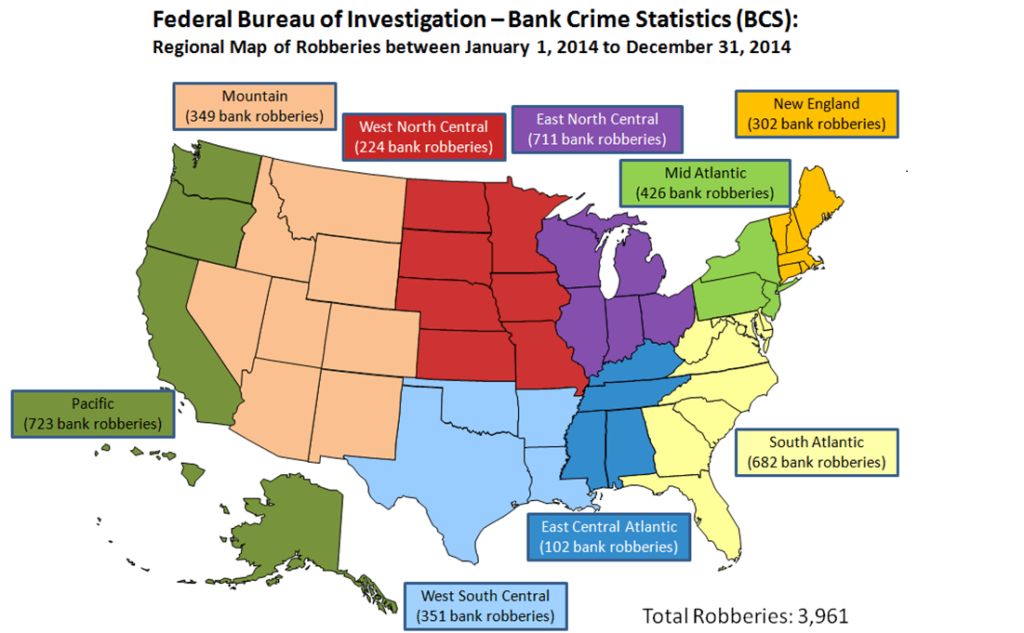

As we think about branch transformation, one of the overlooked benefits in the rush to design-build a customer or member-centric environment is safety. The 2014 Bank Crime Statistics compiled by the FBI recorded 3,879 robberies of financial institutions in the U.S. The breakdown shows 3,430 commercial banks and 312 credit unions robberies are included in the report. The overwhelming majority of the robberies occurred at a branch office. The most common approach used in the robberies was a note or oral command. Nearly 47% of reported robberies involved a firearm or handgun. Needless to say, robberies remain a significant threat for branch operations.

So how can Branch Transformation…the marriage between Design and Technology, change the branch environment to hinder potential robberies? Glad you asked! FBI data shows that premeditated robbers research their target by scoping out the institution or branch paying particular attention to where the teller line is and how money exchanges are performed. For instance, a common robbery scenario involves a note passed to a teller. Per their training, the teller hands over the money and the assailant casually slides out of the bank trying to maintain anonymity.

Fighting back by smiling back.

One key aspect of Branch Transformation involves creating a retail environment that encourages personal interaction between the staff and their customer/member. By engaging the customer as they walk into the branch, conversations take on a completely new meaning. Therefore, many Branch Transformation projects work hand-in-hand with the FBI’s new technique for avoiding robberies called “SafeCatch” tactics. The heart of the tactic is engaging the customer as they walk thru the door thereby taking away the anonymity from a potential robber disarming them with great customer service.

Phasing out the teller window.

The physical components of Branch Transformation often replace the traditional teller line with a Pod System. This change in delivery method encourages staff interaction with customers using a face-to-face posture. An integral part of the system is the cash automation i.e. cash recyclers. In a robbery scenario, the assailant now sees cash being dispensed, not from a teller drawer, but from a machine. Since the cash recyclers are UL Rated as a secure currency container or safe, the staff operating the device needs a passcode in order to interface with the system to dispense cash. This provides the branch staff more flexibility to walk away from the Pod unit to engage the customer/member verses using a teller line, and provides more security.

Path of least resistance.

Robberies and crime are probably here to stay; however, alternative ways of delivering services and technology can greatly reduce a financial institution’s branch from being a target. In yester-year, the teller line’s main purpose was to facilitate a transaction, but with the rapid decline in transaction activity in branches…the teller line is going the way of the dinosaur in favor of alternative approaches to facilitate new interactions with customers.

Vault-less banks?

The latest advancement in branch transformation utilizing interactive teller machines, may finally eliminate the physical opportunity for robberies. However, only time will tell, and history teaches us that robbers have always evolved when desire intersects with ability. Nevertheless, the goal of all financial institutions is to insure a safe and enjoyable work environment for employees, and the goals for many is an engaging environment for their customers. The good news is with the advancements in technology and design both of these goals can now be a reality.