Branching: Location…Location…Which Location?

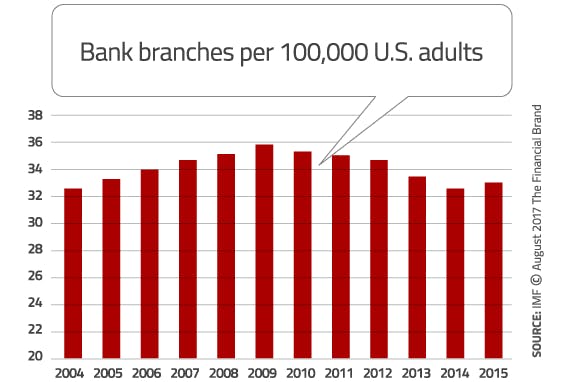

U.S. Consumers and the Branch. There is no denying that the number of branches in operation today is less than before the great recession. However, simply pointing out there are fewer branches is only part of the story. For example, when you consider a recent a IMF study, the number of branches is rising. Per their research, the peak of branches per capita was 35 branches in 2009. The low point was 33 in 2014 – the same level as 10 years earlier. But in 2015, the number of branches per 100,000 started rising again.

Let’s Talk about the S-Word. So instead of another article focusing on “if the branch is still important”, let’s talk about one of the key steps in making sure when you do branch – you get what you want. Let’s talk about Site Selection.

Good to Great: Site Selection

First Things First. The first step in site selection is not the real estate procurement, but establishing the business case. Site selection is the marriage of market analysis and real estate procurement. In a fintech and omni-channel banking world, understanding why to invest in the branch is crucial. And for community banks and credit unions – that’s loans and deposits.

Begin with the End in Mind. Therefore, when it comes to site selection, the approach matters. Here’s why: If the business opportunity in a market can support the branch (solutions produce over $35 million in new deposits) then the critical component that takes the opportunity from good to great is how we procure the real estate.

Face the Brutal Facts. Selecting the best site for a branch or main office opportunity is not a matter of selecting the right broker. Brokers can serve a role in selecting a site, but brokers are not the answer. In site selection (market analysis and real estate), it is about realizing business opportunity.

A Retail Perspective. In retail development, there are two users that every owner wants – pharmacies and financial institutions. Owners of land understand the correlation of location and performance…and they understand that business opportunity is worth a hefty price.

Good is the Enemy of Great. But what if you could get the property you want, and the owner would not know it is you? You could avoid the premium and have a greater opportunity to perform. This is where LEVEL5’s real estate procurement process, during site selection, separates itself from everyone else.

Our proprietary process veils your identity to protect you from the market, the owner and yourself.

Furthermore, our approach negotiates contracts and performs all due diligence (surveys, environmental; and geotechnical test). A broker doesn’t study markets to define loans and deposits, they don’t negotiate contracts, and they do not handle due diligence. So, site selection with LEVEL5 is so much more.

Actionable Strategy

Getting what you want. For branch or main office opportunity to be realized, then the process has to move from strategy into action. Many firms speak to market opportunity or operations analysis, and even more firms design and construct financial facilities. However, it is taking action on the best location that brings branching and a new main office to life.

It’s about predictability of outcome. For the last seven years, LEVEL5 has annually procured between $20 and $25 million in property for community banks and credit unions across the US. Driving predictability has allowed these community banks and credit unions to outgrow their peers by 3x. Since the branch is still location driven, then selecting the best site is key to performance.