HOW TO DO IT

Is opportunity knocking?

The journey begins with market research and analysis that drives to a business case for or against branch investment. Understanding the loan and deposit potential in a market can quickly start an effective narrative for branching by defining goals and expectations based on facts. Those facts frame our investment in land, building and people so we can predict with greater certainty what the future holds.

Execution is everything.

Then based on these facts, we build a plan to connect with the opportunity. Our engagement begins by tailoring the interior space to the culture and desired customer experience. The focus is on enabling “bankers” to easily connect with their clients. The physical identity (architecture) and signage of the branch is an extension of the culture and makes a statement to the market at large, so the market knows we are different. This means we don’t run the same play every time and in every community. Specifically, we don’t always use teller lines, or pods, or self-service, but look at each market’s components and then tailor our connection.

Make your intentions clear.

As we build the connective environment, we are intentional to communicate our brand message in graphics, colors and materials. Our value to the community and customer cannot be guesswork because these components drive action – action taken by our employees to use these materials to cross sell, and action by the customers who are now educated on what we can offer.

What we can learn from the major players.

Bigger banks have taken these components to heart and are leading the way on branch experience, and getting great returns. Earlier this year, JD Power revealed that customer satisfaction at big banks is at an all time high, which is remarkable given the attitude of the marketplace toward big banks after the financial crisis. Big banks have learned that customer engagement in the branch is powerful, and they have learned how to clearly communicate value proposition.

ROI in action.

The great news is we can quantify the ROI for branching using the tools mentioned above. For example, a FI in Michigan wanted to create a new customer engagement model in its community to achieve more loan opportunities. The plan included relocating a branch and remodeling a second facility with a new way of connecting, and the glue that held it together was training. The FI changed the engagement model to focus on asking questions and relationship building. They also changed their branch environment, and moved away from teller lines and used technology to automate routine activities. When the brand message became specific to the community, and the FI’s mission, then the culture changed. Within the first two years, the FI has grown its loan to deposit ratio from 88% to 92%.

More proof.

Furthermore, a FI in the Southwest grew from $1.0 Billion to $3.5 Billion in 5 years through a similar shift. The shift included a new engagement model in the branch, and messaging throughout the customer experience. The exterior also changed, which was important; it helped the community identify with the change. By the way, the bank quantified the business case through research before each move.

To recap.

In review, FIs can reach their goals of increased wallet share, loans, and customer growth in the branch. Here are the steps:

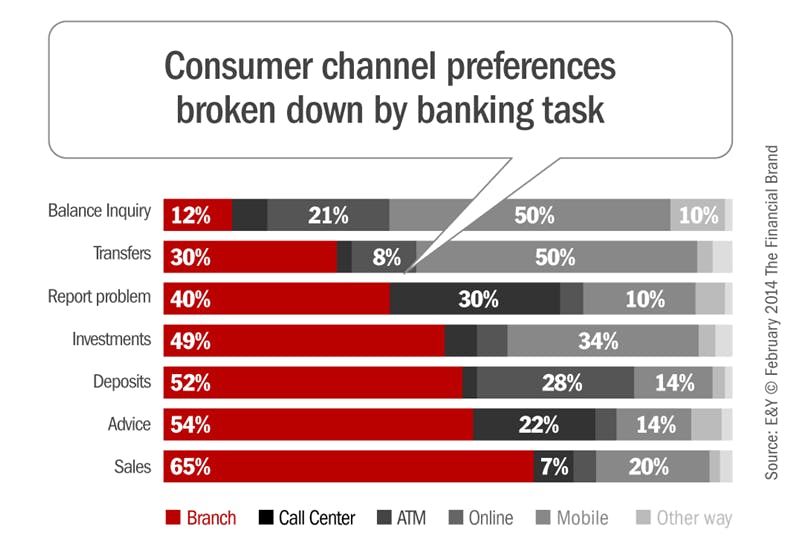

- We are clear on what we want and whom we serve. Our customers are diverse and changing, so our channels must appeal to all generations.

- We tailor the message of the branch to the market. This includes doing our research and quantifying the loan and deposit opportunity – upfront. Then we focus the branch experience on the opportunity.

- Our goal is to establish an emotional connection with our customers and community to drive results. Our focus is on engagement and inviting the community in, so we listen more and talk less.