Crystal Ball 2022: The Full Series

- Branch Transformation

- Retail

Categories:

For those who have read the entire series thus far, or for those who may have missed a week, but are looking for a consolidated version, this is the version for you.

Below, we present our combined 4-part Crystal Ball 2022 series.

Part 1 – Costs Continue to Rise

While indicators seem to be pointing to a “recovery” from the pandemic, such as employment rates, and even total cases per day/month, one of the lagging hangover effects that has not begun to ease are construction costs.

One of the impacts of the pandemic, foreseen or not, was the spike in construction across the board, both residential and commercial.

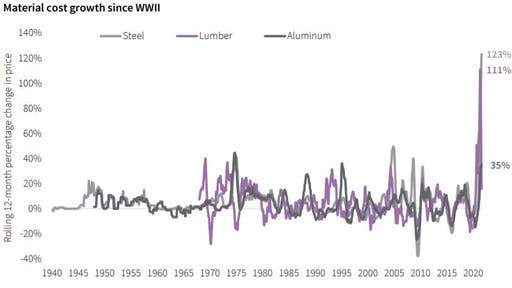

As seen with the below graph from the U.S. Bureau of Labor Statistics, costs of materials have not only spiked, but are also the highest since World War II.

Regardless of prices, this has not translated into construction projects being put on ice – quite the opposite.

Cranes are flying over downtown skylines, and residential neighborhoods are replete with both new homes, remodels and extensions.

So what does this all mean for a Bank or Credit Union who is looking to grow, and looking at the branch as a main driver of this growth?

It comes down to a matter of investment.

While it may cost “more” to build a branch compared to pre-pandemic cost structures, if it’s growth you seek, and it can only/mostly be done via new members bringing in new Loans and Deposits via a new branch in a new Trade Area, you have to ask yourself if it’s worth the investment.

Wayne Gretzky famously said, “You miss 100% of the shots you don’t take.”

In banking growth terms, this quote can be translated into the simple economic situation of needing to invest to grow, or, “you have to spend money to make money.”

Material costs are predicted to rise, or stabilize at least through the first half of 2022, but what is the trade off of NOT doing anything? How can you value being stagnant, and how do you justify to the board to sit and wait for an unknown “cost” future?

The reality is, for a Bank or Credit Union looking to grow, you act now.

So, how do you counterbalance higher material costs for optimal margins?

Economies of Scale

Typically, when LEVEL5 begins a client engagement, the discussion of a branch is never singular, it typically involves 2 or more branches, even if the schedules for the builds is over a 12-36 month period.

If the plan is to indeed design and build more than one branch, buying the raw materials in advance will yield savings, and aid the overall margin.

Labor Discounts

Deals on labor can be had when multiple projects are happening either concurrently, or successively.

As the General Contractor, LEVEL5 has existing relationships with different Trades (sub-contractors) across the country, and have had success in booking these Trades for multiple jobs. This aid the sub-contractor, who can keep their workers engaged for longer.

Real Estate/Site Selection Transactions

LEVEL5 has been acquiring land and buildings for clients for over 20 years. In doing so, we veil your identity during the negotiation phase. The reason this is important is because in doing so, we have more negotiation power, and often save our clients up to 18% on the transaction price – helping your bottom line.

Time is Money

The other benefit of working with LEVEL5 when it comes to overall cost is the savings you’ll get from working with a proven national General Contractor. In today’s economic climate, the supply chain is compromised and there are labor shortages – both of these typically mean that a standard construction job inevitably is going over on schedule – and added time is added money.

We have been successful in queuing up work well in advance, which is why we subscribe to the “Design-Build” philosophy, not Design-Bid-Build.

Design-Build forecasts materials and labor during the planning stage. When things are known and predicted up front, plans can be made, and money can be saved.

Part 2 – Supply Chains & Trades Issues

While the pandemic seems to be drifting away, at least in its economic impacts, construction materials supply chain problems and availability of Subcontractors will continue to remain a challenge to credit unions and community banks looking to open a new branch in 2022 or 2023.

A critical component to executing a Branch plan is to have the right partner on your side.

Advance Planning, Advance Savings

During the past 2 years, more and more of LEVEL5’s clients have been opting for advance design and planning of multi-year, multi-branch rollout strategies for their prototype branches. We believe this is happening largely because the antidote to such an unpredictable construction landscape is predictability that translates into advanced planning with the benefit of cost savings.

So how does working with our team help you plan for the future and reduce your spending?

Establishing a supply chain means that you have a defined product to execute upon. Let’s use a branch prototype as example. Once you’ve worked with LEVEL5 to design and finalize your prototype, this means that you’ve already specified materials needed for the majority of your branches. At this point, our team can work proactively with different manufacturers, subcontractors, suppliers for furniture, equipment, fixtures and so forth.

This advanced heads-up will give our sourcing partners an upfront and predictable way of understanding allocation needs. It will in turn helps to bring down prices for you.

The Design-Build construction method allows you to make material selections based on current availabilities. We factor this in with you in the design process.

Conversely, in the Design-Bid-Build process, a stand-alone architect designer may not be as privy to current materials costs in the design stages. Not being able to account for fluctuations here can result in unexpected costs once bids are turned in.

Think of the saying “knowledge is power.” In this context, we’re talking about the knowledge of future needs. It is a power that keeps costs down for your financial institution.

As you can see, advanced design and planning of rollouts can certainly drive down cost.

Knowing Costs Now Helps You Make Better Business Planning Decisions

To your advantage, you have an annual business planning cycle that needs to be built on sturdy information.

Once your professional credit union and bank consulting is complete, you’ve decided on the prototype and strategy. Then, we supply you with an accurate price estimate on your new branch or branches.

Having an accurate estimate now takes a huge unknown out of your organization’s plans, giving you more assurance and a realistic scope of your budget. It also allows you to make effective projections and preparations for changes in personnel at varying locations.

Secure Necessary Subcontractors Amid Shortage & Strain

Subcontractor labor shortages have been an issue even before the pandemic. Think all the way back to the great recession in 2008. But now, it’s become even more strained due to the aftermath (or continued impact) of COVID-19.

Because of these circumstances, the ability of your General Contractor to secure the right kind of Subcontractors for your project will only become more difficult the longer you wait to get things started. Less time to plan ahead and communicate properly with Subcontractors on their availability can cause obvious hurdles for your goals.

This goes for both singular branch builds and multi-branch rollouts. However, we want to note that Subcontractors will be more aggressive sometimes. For example, bidding and staffing for projects that are part of an integrated/multi-location rollout will be aggressive. A one-off branch project will be much less so.

Regardless of the branch rollout volume, you can see how moving forward with long-term action now will put you in a preferable spot. It will minimize unknowns in both project staffing and pricing.

Don’t linger too long when making growth decisions – it could cost you greatly in finances, stress, and timeline goals for your bank or credit union.

Part 3 – The Branch Lives

Gone are the days of industry commentators preaching “the branch is dead!” and gone are the talks of moving to solely digital platforms (we hope, we think, but probably not).

Long live the branch!

Let me explain:

The Surprising Aftermath of an ongoing Pandemic

Long ago, in the ancient days of 2018 and 2019, the percentage of people using branches was declining. In 2010, 83% of people surveyed said that they visited bank or credit union branches at least once a month. That number steadily declined to 70% and 69% as mobile and online banking steadily increased.

Everything changed when the pandemic hit. For a brief time, branch use obviously hit an all time low as the whole world shut down. Then, the strangest thing happened. As the world hesitantly began to open back up, as stimulus checks were sent out, as FDA-approved vaccines rolled out, people stepped back out into the sunlight. People not only started visiting branches again, but they started visiting them even MORE than before. In 2020, it was reported by the Fiserv company, Raddon, that 77% of consumers went to a branch at least once during the pandemic.

Despite the health risks of going in public, despite business shutting down, and despite the convenience and rise of mobile and online banking on top of all of that, the branch prevailed. People WANTED to leave the house and go interact with other people. People craved that human interaction.

The New Branch

Now, don’t get me wrong, digital banking is still rising and will continue to rise. But the rise of digital does not have to mean the death of the branch. They are not mutually exclusive. In fact, for either of them to work to their fullest potential, they must support each other. While mobile banking rises, brick and mortar will also rise. It might not be the traditional physical building that you’re used to, but it’s a physical building nonetheless. There’s a new branch in town.

Your branch locations must be used to fill the gaps that mobile leaves. This means the human element to branching is imperative. When a modern-day consumer walks in the branch, their first touchpoint should be a human one inquiring about their needs. After that, they can move either to the transactional zones of the branch or the advisory.

We’re finding more and more that people are coming in less for the teller lines and more to sit down in a private office to talk to someone about their finances. Now, they want to walk in the branch, tell an advisor about their financial goals, and plan a strategy to meet those goals. They want to learn about the different types of credit card programs you offer and discuss which one would best fit their needs. They want to learn about your high-yield savings account and how to properly invest their money. Some of them are buying houses and want to know about their mortgage options.

Even if they do want a transactional process done, many times, they’ll head straight to the ATM’s or ITM’s. As popular as mobile has and will continue to become, you’ll never be able to withdraw cash from your phone. At a tech table, a consumer might want to use a tablet to go through the steps of opening an account. You might ask yourself, “Why would they do this at a branch when they could go through the same steps on their phones?” Well, it might seem the same, but again, that lacks the human component. if they wanted to open an account quickly on a tablet inside the branch, they would also be able to ask questions to the nearest teller about the different types of accounts and which of them best suits their needs.

Your consumers cannot have the same level of security in informed decision making from their couches.

Whatever reason the modern consumer has for needing brick and mortar branches, there’s no denying the existence of that need. The people have spoken and the branch is here to stay.

Part 4 – The Branch Strategy Shift from Transactional to Advisory

Last week, we predicted the importance and need for the branch in the year to come. This week, let’s talk about the why and how of it all.

The Shift is Happening

While it is true that the branch is indeed alive and well, it is also true that the branch we used to know and love has irreparably changed. A study done by Raddon right before the pandemic surveyed consumers on their branch preferences. The results showed that when it came to the older generations, they did prefer those traditional branch layouts with the teller lines and transactional components. It’s what they were used to and knew how to use. When it came to Millennials, however, the results told a different story. The study showed that Millennials preferred very technology-oriented branches, and/or the “coffee bar” model of branch.

The technology focused branch is the branch that you walk into to see digital screens around, displaying local news, the weather, the stock market trends, advertisements about products that the financial institution is offering, and events in the area. It holds interactive teller machines and a tech table with tablets for consumers to use for transactional needs. The rest of the branch, then, is for advisory offices and maybe a teller pod or two.

A Cup o’ Coffee for Your Thoughts

The “coffee bar” branch is the branch with an attachment of a Starbucks, a Peet’s coffee (if you’re Capital One Café), or a local café that the financial institution is partnered with. That’s the branch that you, as a consumer, can visit to enjoy a coffee and dessert while you take out a car loan or open a new account. It can be a convenient place for students to go to for financial advice or to begin the learning process for the upcoming adult responsibility of money. Then, they can stay for the coffee and snacks with peace and quiet while studying.

The existing Capital One Café is the perfect example of this. In order to be successful, these branches are conveniently located and strictly advisory.

Both branch types represent solutions to needs that mobile banking does not and cannot fill. Millennials are no longer those kids that can’t get off their phones. They are now financially independent adults with careers, families, and homes. They are now thinking about how they can move up in the world and this means investing their money, taking out car loans and mortgages, creating financial strategies, and even planning early for retirement. Properly designed advisory branches are the perfect (and only) fit for those needs.

A Strategic Plan First

Now, that’s not to say that every single traditional branch must be shut down immediately. You must root every decision in strategy. You must take a look at your branch network, target markets, and consumer demographics before making the decision of what type of branch you need in each area. The market surrounding a college campus would benefit a lot more from the “new” branch than the market surrounding a retirement community, for example.

Lucky for you, LEVEL5 has the leading Market Analysis team for Financial Institutions in the country. Our experts will evaluate the relevant data to draw conclusions and then align them with your strategies and goals. After that, we can come up with a game plan together and begin the execution.

Whew, that was a lot. But good stuff, right?

Contact Us today to discuss any items herein. We’ve been future-proofing growth plans for Credit Unions and Banks for twenty years, helping our clients grow at twice the national average. It’s time you work with LEVEL5.