Core Deposit Growth Strategy: Part 2

- Branch Transformation

- Consulting

- Credit Union

- Retail

Categories:

What are the growing performance trends for Credit Unions?

Analyzing Credit Union Performance Trends: A Decade in Review

Previously in this article series, Core Deposit Growth Strategy: Part 1, we looked back over a period of 20 plus years to learn the history of what led the financial services industry to today’s environment. Now, we’ll zoom our lens further in to the past 10 years in particular, focusing on key credit union performance trends, and how recent large-scale change in the world affects your institution’s next stage of growth.

Peer Group Analysis: How Credit Union Asset Size Influences Growth

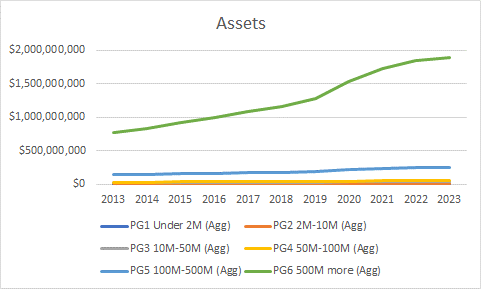

Furthermore, for a comprehensive comparison, let’s start by breaking down credit unions into six peer groups based on asset size:

Assets < $2 million

- Assets $2 million – $10 million

- Assets $10 million – $50 million

- Assets $50 million – $100 million

- Assets $100 million – $500 million

- Assets > $500 million

The Impact of the Great Recession and COVID-19 on Credit Union Assets

By 2013, the Great Recession was a fading memory, but its influence is still evident.

As of then, things are moving along pretty well, rates are low, and we’ve never heard of covid.

That’s our point of origin for this discussion.

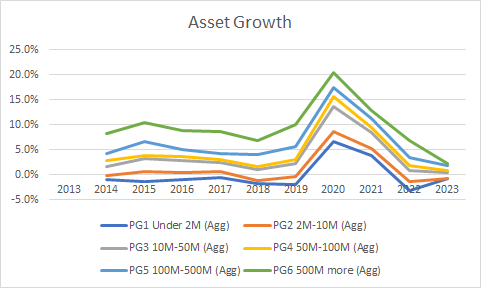

Asset growth was pretty consistent through about 2018, and then the ride got bumpy. Once the pandemic is underway, we see assets in a near-vertical climb.

Also, asset growth within a peer group correlates to the asset size of the peer group, resulting in bigger institutions growing faster.

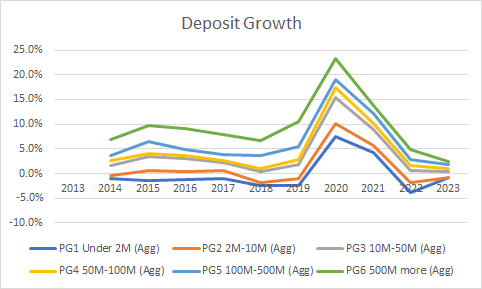

Deposit growth trends

Of course, deposit growth was the real driver of asset growth at that time, fueled by various forms of government stimulus being pumped into the economy during COVID as well consumers playing it safe by stockpiling savings as the stock market looked like a scary place to park one’s hard-earned money.

This trend peaked in 2020, and deposit growth returned to something close to normal by 2022.

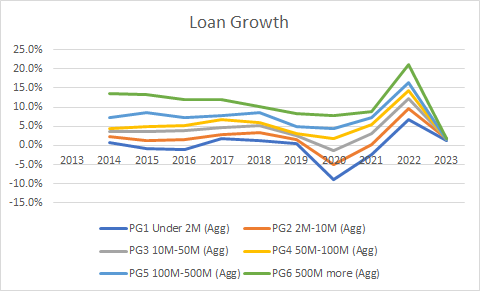

Loan growth trends

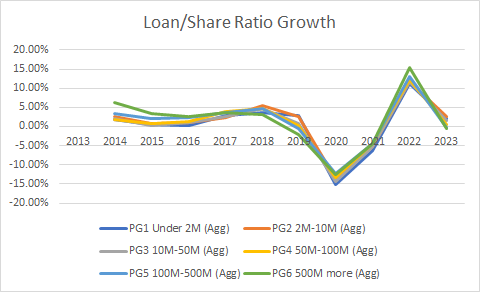

Loan growth tells a similar story with a couple of plot twists along the way. As with assets and deposits, the loan growth rates are almost perfectly correlated with asset size.

Prior to the pandemic, loan growth rates were stable (or declining a bit for the largest credit unions). The pandemic’s impact on loan growth is almost a mirror image of deposit growth. During the pandemic, consumer uncertainty and rising interest rates combined to quash loan demand.

Post-pandemic, pent-up demand and lower interest rates drove more loan demand, which continued even as rates began rising in mid-2021 (perhaps with some borrowers rushing to close loans before rates rose even higher).

Loan-to-Deposit Ratio: A Key Indicator of Credit Union Performance

The nature of the banking industry is a balancing act between deposit acquisition and loan dispersal. Accordingly, the loan to deposit ratio is one of the fundamental measures of any institution’s performance. The loan to deposit ratio gradually grew 2013 – 2018, and then things got interesting.

BUILD WITH CONFIDENCE

Put LEVEL5’s proven expertise to work for you. De-risk your future growth with the strategy, technology, site selection, design, and build services you need to launch the next phase of your credit union’s branch network.

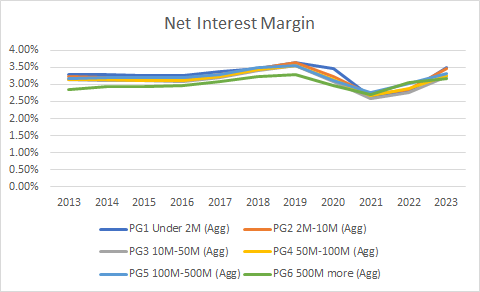

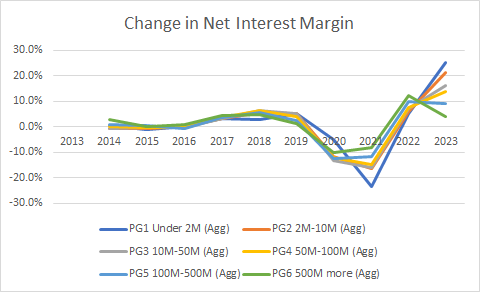

Exploring Net Interest Margin Trends in the Credit Union Sector

As you know, similar to the loan to deposit ratio, net interest margin is a key metric that tracks the combined effectiveness of the institution’s deposit-gathering and loan-granting activities.

Loan and deposit rates are both set by the individual institution but are also constrained by the Federal Reserve’s activity too as competitive response. But, as you also know, loan and deposit volumes are influenced not only by pricing, but also by an institution’s strategic day-to-day and long-term performance in marketing, reputation, member service, and convenience.

With this in mind, this is a great place to reflect and ask yourself “what can my institution do next to achieve our net interest margin goals?”

Navigating the “New Normal”: Challenges and Strategies for Credit Unions

The takeaway from of all this is that it’s too soon to tell exactly what the “new normal” will look like, but we can certainly use our experience and assessment to confidently project:

>Higher rates will raise the cost of funds, putting the spotlight on core deposits and other low-cost deposits.

>Higher rates may also dampen loan demand, at least in the short to intermediate term (sooner or later, cars have to be replaced, families need to move, and unexpected life events happen!).

Previously, some institutions have created high performance lending teams over the low-interest rate era, but diminished loan demand in the present and near future may constitute a refocusing of your strategy.

So, what can be done?

Our next and final post in this series will examine some strategies to pursue core deposits as one way of managing the “new normal” and boosting your net interest margin.

Leveraging Technology and Strategic Planning for Credit Union Success

In this dynamic landscape, credit unions must adapt to changing member expectations and leverage technology to deliver exceptional retail bank customer experiences. Embracing data-driven retail credit union consulting and strategic planning can position your credit union to thrive in the evolving market.

At LEVEL5, we understand the unique challenges faced by credit unions and offer expert guidance in credit union strategy and planning. Our 20 years of experience as pioneers in modern bank design and retail bank consulting, enables us to deliver innovative solutions tailored to your institution’s needs.

Whether you’re exploring credit union or bank branch construction, credit union or bank branch design, or branch transformation, our national design build services ensure a seamless process from start to finish. We specialize in strategic planning for credit unions, market analysis, and designing the branch of the future.

Check out the other posts in this series

Growing Core Deposits Blog Series Part 3 ➝

Growing Core Deposits Blog Series Part 1 ➝

Contact Level5 For Help with Your Core Deposit Growth Strategy

Contact us today to learn more about how LEVEL5 can help you navigate the changing landscape of the financial industry and achieve your growth objectives. Let’s build the future together.