Technology and Consumer Behaviors Have Changed Banking

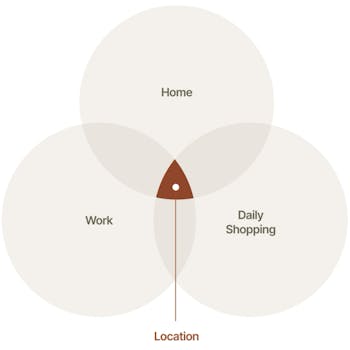

Technology and consumer behaviors have revolutionized everything from shopping to dating. As people redefine convenience on their own terms, they expect to easily and quickly be able to visit their local credit union or community bank branch. As a matter of fact, when it comes to picking a financial institution, the biggest deciding factor for modern consumers is branch location.

Branches are Back and Convenience is King

With 60% of individuals preferring to bank close to home and 40% wanting to handle their banking near work, it’s no wonder that in 2023, U.S. banks added more net new branches for the first time in a decade. U.S. financial institutions have planned or opened more branches in the last few years than over the entire previous decade combined—with plans to continue that pace into 2028 and beyond.

An Evidence-Based Approach to Site Selection & Acquisition

The importance of investing in physical branches can’t be overstated. But there are a myriad of things to consider during the complex and time-consuming process—traffic patterns, customer dispersion, accessibility, visibility, hidden costs, CC&Rs, site due-diligence, and so much more. So how do you find the right branch location to minimize risk and maximize return?