4 Critical Things We Learned in 2021

- Announcements

- Banks

- Branch Transformation

- Consulting

- Credit Union

- Data

- Retail

Categories:

2021 was the much-anticipated light at the end of the seemingly endless tunnel of 2020. It wasn’t an easy year, as we were all still dealing with the tribulations of the pandemic, but it was laced with hope.

Before we begin to look ahead to 2022 (our annual Crystal Ball series is close), let’s revisit this year as we highlight 4 critical things and discuss what we learned.

The Branch is Not Dead

Let’s be honest here… if anything were to have killed the branch, it would have been COVID-19. A global pandemic preventing people from gathering in groups, touching surfaces, attending events in-person, or entering closed spaces without masking up first? And all of that on TOP of the already rapid rise in digital as an alternate to in-person banking?

If that didn’t get rid of all bank and credit union branches in the country, nothing will. Brick and mortar in the banking industry is simply not going to go away – it’s just time to optimize.

According to a recent study completed by Raddon/Fiserv, 77% of consumers said they went to a branch at least once a month during pandemic. Pre-pandemic, only 69-70% of consumers said they went to a branch at least once a month. Although mobile usage is steadily rising, branch usage is now rising for different reasons. People like to interact with people, especially when it is regarding the things most important to them.

The branch is not dead, but the old way of banking is. In order to continue to thrive and grow, it is imperative to reevaluate and optimize your branch network. The first step in this process is to take a good look at which branches are underperforming and why, and then remove or relocate them. Then, take a look at which branches are performing well and make sure they are well-equipped to provide consumers with personalized experiences. Once your branch network is operating at the maximum efficiency, you can begin to expand.

OmniChannel

Although the branch is not dead, mobile banking saw big gains during the pandemic and will only become more widespread. The rapid increase and reliance on mobile banking does not mean the end of branches, however. Caroline Vahrenkamp, a Senior Research Analyst for Raddon/Fiserv, says “People like to see other people. People like to interact with other people. The challenge is they also like to do things on mobile banking. So they like to use their phones for some things, they like to use their computers for some things, and they like to do some things face to face. And there’s a pretty clear idea of what each individual person wants to do in each of those methods.

Although it’s not consistent it’s not like everyone wants to do the same thing in each of those ways, everyone has a blend. But everyone has a blend.”

The statistics of the uptick in branch usage during the pandemic is clear proof of this.

It’s not enough to use brick and mortar, online, and mobile banking arbitrarily. Those three avenues must work seamlessly together and compliment each other. The channels working separately and under different departments forces them to work against each other instead of together. Mobile and online banking should not be the enemies of brick and mortar banking. Mobile and online banking fit the average consumer’s simple, daily needs. Your branches must fill in the gaps that mobile and online banking leave. They can provide human interaction, advisory services, and various other capabilities that require thought and trust. Something not provided by the apps.

Return to the Office

as predicted, the inevitable happened and the great migration back to the office began for much of the country this year. As the vaccines rolled out, companies slowly started opening their doors back up. While some decided that remote work was the best fit for their operations, many other institutions opted for “flex” type schedules. Others decided to go back in full-swing, pre-pandemic style.

Companies that decided on any type of in-person work had to put measures in place for the safety and comfort of people. Workplaces are now equipped with hand sanitizer stations, plexiglass dividers, and spread-out environments to accommodate those coming back to the office. Those on flex schedules go in to the office every other day and work from home the other days. They perhaps even share workspaces or common areas with others working in-office on opposite days.

LEVEL5 worked tirelessly throughout 2021 to equip our clients with the knowledge and resources they need for a safe and comfortable return to the office. We used our (Re)FI Design program to re-envision the workspace according to COVID-19 restrictions. We looked into workspace designs that allow for social distancing as well as minimizing touch points to stop the spread of germs and various other ways to allow for a safe branch.

Labor and Supply Chain

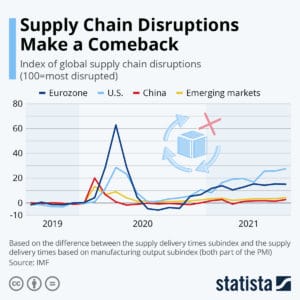

A couple of major disruptions throughout the last year that were caused by COVID-19 were the massive labor shortage and the extreme stress put on the supply chain. Although there were issues with it to begin with, the supply chain took a major hit with factories shutting down and workers losing jobs. Even when recovery seemed to be in the works, the Delta variant took some more punches – and who knows just what impact Omicron will have.

For what seemed like an eternity, the supply chain disruption happened in conjunction to a heavy decrease in demand. Factories closed and cut production while many lost jobs and couldn’t afford to spend money on anything other than the bare necessities. But not in the fun, carefree way that Baloo sings about. No one could forget about their worries and strife.

Then, as financial assistance was provided, vaccines were produced, and people returned to work, the demand grew back rapidly. This, however, put the supply chain under immense pressure. The pressure continues now as materials and resources are low along with a shortage of essential workers. In addition, the countries of the world “opening back up” is not happening in parallel. The US, for example, is opening at a much faster pace than some other countries, leaving an imbalance in the flow. The supply chain continues on the path of recovery, though. It’s making a comeback.

Although the pandemic permanently altered society, the changes that happened in banking were going to happen regardless of COVID-19. It merely kicked the evolution into overdrive. We have been preaching about the transition of branches from transactional to advisory for years now, but 2021 proved what we’ve been saying since the beginning.

Now, 2022, we’re ready for you. Bring it on.

If you’d like to know more about how you can help your bank or credit union grow in 2022, CONTACT US.